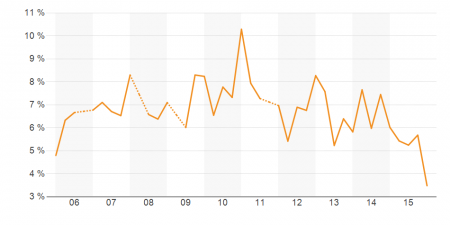

Cap Rate for Retail Properties from 5,000 to 15,000 square feet in Miami-Dade County for the 10 Years Ending 2015

The capitalization rate (cap rate) for mid-market retail properties in Miami-Dade County (5,000 to 15,000 square feet) drifted to under 4% in the most recent period reported by Costar. As can be seen in the attached chart, cap rates have been relatively consistent over the years, generally moving up and down around a 6.5% or so midpoint. The precipitous drop of late likely has to do with embedded rent increases, i.e. rents lower than the market as rent levels have increased in the area.

In recent years, increases in rent and declines in vacancy, combined with stable cap rates, have led to considerably higher prices on many area retail properties. However, changes in retail, evidenced by mass store closured by Wal-Mart, Sears, Best Buy, and others, continue to give investors pause. Smaller properties, however, may be less affected as their tenant mix is more specialized and local, and thus less affected by competition from only retailers.

Top buyers of retail properties (listings) in Miami-Dade County from 5,000 to 15,000 square feet, per Costar as of February 11, 2016, include: Ponte Gadea USA, Inc.; RedSky Capital LLC; Tristar Capital; Safra National Bank of New York; JC Capital Partners; Jamestown U.S. Immoblien GmbH; RFR Realty LLC; Thor Equities; Centurion Realty LLC; Danny Levy. Top sellers of such properties in the past year include: Fryd Properties; Michael Comras; Thor Equities; Atlas Associates Realty, Inc.; ADR Partners, Inc.; Gadinsky Real Estate, LLC; Phillip Buhler; Ronald Felton; 818 Lincon Corp.

Chart courtesy of Costar.