Industrial rents keep climbing, as vacancies drop in South Florida

Inflation? Recession? Pfft. South Florida’s industrial market hasn’t slowed down, as super low vacancy rates continue driving rents to new heights. In the second quarter, industrial landlords in Miami-Dade County increased asking rents by more than $1, compared to the same period last year, while Broward and Palm Beach industrial property owners jacked up the rate…

Ken Griffin’s Citadel leases at 830 Brickell office tower in Miami

Billionaire Ken Griffin inked a major lease for Citadel’s offices at 830 Brickell, less than two months after he announced moving the hedge fund to Miami from Chicago, with plans to build a new headquarters. Citadel took roughly 95,000 square feet in a long-term lease at the 55-story tower at 830 Brickell Plaza that is under construction, according to sources…

Jimmy’s Eastside Diner, featured in “Moonlight,” has a new owner

Italian restaurateur, real estate investor and soccer club owner Tonino Doino bought Jimmy’s Eastside Diner, which was featured in the 2016 film “Moonlight.” Doino, who owns the Lincoln Road restaurant Rosinella Italian Trattoria, paid about $4.3 million for the property at 7201 Biscayne Boulevard, according to the brokers involved in the deal and the…

Miami vs NYC: A developer’s guide

Don Peebles, in partnership with former Miami Beach Mayor Philip Levine and developer Scott Robins, wants to build a six-story office and apartment building on a city-owned parking lot: Ian Bruce Eichner took on two condominium projects last year. In Manhattan’s Murray Hill, he struck a deal to buy the Community Church of New York’s home. And in Bay…

Judge awards $5M to Israeli mogul in HFZ lawsuit over failed Shore Club project in Miami Beach

A judge awarded Israeli investor Benny Shabtai a $4.6 million judgment in his lawsuit against HFZ Capital Group over the failed Shore Club Miami Beach redevelopment. New York-based HFZ, led by Ziel Feldman, lost its ownership of the historic Shore Club when Monroe Capital foreclosed on the property. Monroe brought on Witkoff as its partner…

Hyatt Regency redevelopment to net $25 million for affordable housing

In November, voters in the City of Miami will determine the fate of a new plan to revive a crucial city-owned property in the heart of downtown. If approved, the sweeping development would bring three new towers to the riverfront, including a new hotel and an improved public walkway along the Miami River. Near the end of an exhaustive daylong meeting July 28…

Miami gives leaseholder 18 years to build on Coconut Grove bayfront

A formal restaurant that voters approved nine years ago for city-owned waterfront land got another nine years for completion in a unanimous Miami City Commission vote last week. The unnamed restaurant is to replace the Charthouse at 51 Charthouse Drive near city hall. The commission vote gave operators an OK to set up “temporary food…”

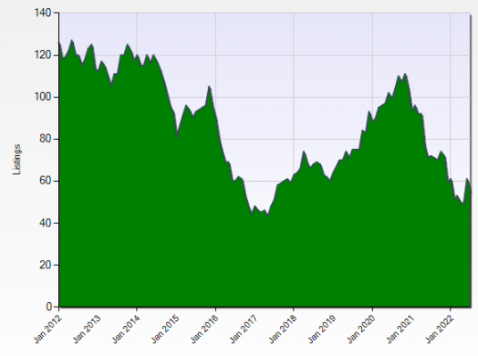

Chart Reflects Dearth of Industrial for Sale Listings in Miami-Dade

About any active commercial broker in Miami-Dade will tell you that there is all kinds of demand for industrial property, but none to buy. I can personally attest to this. This chart of properties noted as “industrial” in the Miami-Dade MLS and with an asking price of $1 to 5 million (mid-market industrial) illustrates this. The number of such active listings has only…

PortMiami Tunnel blazes trail to future

Some 120 feet below sea level the 42-foot-diameter PortMiami tunnel connects the mainland to Miami-Dade County’s second-greatest economic engine, supporting more than 334,000 jobs and contributing $42 billion annually. Since opening to traffic in 2014 after over four years in construction, it has become a gold standard for tunnels in Florida…

Golden Glades hub adding transit passengers

Most of the Metrobus routes serving the new Golden Glades Multimodal Transportation Facility that opened Jan. 24 have gained riders at a hub that also serves an express bus route and links in Tri-Rail and bus transit from Broward County. “This new transit facility is helping to bring more equity, accessibility, and innovation into our public transit system,” said…

Chart of Net Migration by State Shows Florida’s Population Growth at expense of California, New York

The map above shows each states net domestic migration from April 2020 to July of 2021. Florida and Texas had the most new residents, gaining around 200,000 each. New York and California suffered the largest losses. It appears that Arizona is benefiting from the exodus of people leaving California, as are Tennessee and the Carolinas form people leaving…

Citadel grabs Miami office space ahead of building its own tower

Ken Griffin’s Citadel is tying up deals for office space as it prepares to expand in Miami, where the firm is establishing its headquarters. Citadel has taken a floor at 200 South Biscayne Blvd., where it already has temporary offices, and leased roughly 90,000 square feet at 830 Brickell, an under-construction tower where Thoma Bravo and Microsoft Corp…

Z Capital loses attempt to assess Carillon condo owners in Miami Beach nearly $8M

Z Capital Group lost its attempt to levy a $7.7 million assessment on condominium unit owners at the Carillon Miami Wellness Resort. The outcome is the latest in the drawn out and still-ongoing legal battle, pitting the associations for the North, South and Central towers against Z Capital’s affiliate, Carillon Hotel. The oceanfront complex is at 6801 Collins Avenue…

All Florida Paper Signs 226,698 SF Industrial Lease in Metro Miami

All Florida Paper, a Hispanic-owned paper and sanitation products wholesaler, has signed a full-building, 226,698-square-foot industrial lease at Building D in Beacon Logistics Park in the Miami suburb of Hialeah. Jose Juncadella and Sebastian Juncadella of Fairchild Partners represented the landlord, Codina Partners, in the lease deal. Wayne Ramoski and…

Report: Apartments In Sun Belt Markets Set Up For ‘Significant Collapse Of Demand’

Rent growth is slowing considerably around the country, especially in some of the Sun Belt markets that were once scorching-hot, a new report shows. For the first time since 2020, 12 markets experienced a drop in asking rents over the course of a month, according to a report released Wednesday by CoStar-owned Apartments.com. The markets that…

Miami’s Office Pipeline Expands in Q2

By the end of the second quarter, Miami’s office pipeline reached 5.6 million square feet, according to CommercialEdge data. The metro’s under-construction stock represented 7.4 percent of its total office supply—the third largest rate in the country. Most gateway cities saw boosts to their pipelines during the second quarter, except Los Angeles and San…

Macken scores $16.5M construction loan for Koya Bay townhome development in North Miami Beach

Macken Companies scored a $16.5 million construction loan to complete a waterfront luxury townhouse development in its own backyard. The North Miami Beach-based developer secured the financing from LV Lending, according to a press release. The funds will go toward finishing Koya Bay, a collection of 10 four-story townhomes on the Intracoastal Waterway…

Ari Pearl JV pays $32M for Bay Harbor Islands condo complex

Developer Ari Pearl and investor Jonathan Leifer paid $32 million to acquire all of the units in an older Bay Harbor Islands condo complex on a waterfront property that they could redevelop. Nearly 30 individual owners at Bay Harbor Towers, at 10141 and 10143 East Bay Harbor Drive, sold their units to Pearl and Leifer, records show. Pearl’s PPG BHT Owner LLC…

Lease roundup: Cargo Management Group expands in Doral, All Florida Paper leases in Doral

Freight forwarding company Cargo Management Group opened additional operations in an industrial building in Doral. Cargo Management, based in Sweetwater, leased 49,986 square feet at 1325 Northwest 78th Avenue, according to a news release from the tenant’s broker. Andrew Fernandez of CBRE represented Cargo Management. Ana Rivera of JLL represented…

Hyatt, Gencom score Miami commission approval for James L. Knight Center referendum

Hyatt CEO Mark Hoplamazian and Gencom Founder and Principal Karim Alibhai with a rendering of the proposed three-tower development at 400 Southeast Second Avenue: Hyatt avoided a third strike at possible redevelopment of the James L. Knight Center site in downtown Miami. The Miami City Commission by a 4-1 margin on Thursday approved a…

Two major Miami projects – David Beckham’s soccer stadium, as well as Swire Properties and Stephen Ross’ One Brickell City Centre office tower – are a step closer to fruition. The Miami City Commission on Thursday gave preliminary approval to the Major League Soccer project’s designation as a Special Area Plan, as well as to items related to…

Crunch Fitness founder beefs up retail portfolio with $18M purchase in Little Haiti

Crunch Fitness and Big Move Properties’ Douglas Levine with 8200 Northeast Second Avenue and 201 Northeast 82nd Street: Douglas Levine, founder of Crunch Fitness, is pumping up his retail real estate holdings with a two-building, $17.8 million purchase in Miami’s Little Haiti. An entity managed by Levine, a real estate investor who also founded Miami-based…

NR Investments wants to build mixed-use complex in Miami’s Allapattah

NR Investments wants to develop a massive mixed-use complex on Miami’s General Services Administration site in Allapattah. Ron Gottesmann and Nir Shoshani’s development company filed a proposal for a 99-year lease and redevelopment of the city-owned 18-acre property at 1970 Northwest 13th Avenue and 1950 Northwest 12th Avenue, according to…

Madrid-Miami JV buys WeWork leased office building in South Beach for $37M

Azora Exan is jumping into Miami Beach’s office market with a $37 million purchase of a five-story building fully leased to WeWork. An affiliate of Azora Exan, a joint venture of Madrid-based Azora and Miami-based Exan Capital, bought the property at 429 Lenox Avenue in the city’s South of Fifth neighborhood, according to records. The partnership paid $461 per…

Related, partner pay $51M for Aventura mixed-use dev site

Related Group and a partner scooped up an Aventura office property for $51 million, with plans to develop a mixed-use project on the site’s parking lot. Coconut Grove-based Related and Aventura-based BH Group bought the 4.5-acre property at 2999 Northeast 191st Street that includes the Aventura View office building, according to the buyers’ news release. The seller…

Damac closes on acquisition of Surfside collapse site for $120M

Dubai developer Damac Properties closed on its $120 million acquisition of the site of the deadly Surfside condo collapse, The Real Deal has learned. The sale was recorded on Wednesday, according to the receiver’s notice, filed with Miami-Dade Circuit Court. The transfer of ownership marks a key milestone in litigation tied to the collapse…

Former low-income South Beach apartments hit market as possible hotel conversion

Jamestown is looking to cut off a slice of its Collins Avenue portfolio by listing a historic South Beach apartment building for sale. The Atlanta-based real estate investment firm, led by CEO and principal Matt Bronfman, retained Marcus & Millichap to market 727 Collins Apartments at 727 Collins Avenue in Miami Beach, according to an online listing. Jamestown…

Aimco adds to Flagler Village dev site set for 3M sf mixed-use project

845 Northeast Fifth Terrace and two other unaddressed lots in Fort Lauderdale with Aimco’s CEO Wes Powell: Aimco added another parcel to its Flagler Village development site slated for a 3 million-square-foot project. Denver-based Aimco, through an affiliate, scooped up 1.7 acres of parking lots on the southeast corner of Northeast Ninth Street…

Duncan Hillsley fattens up rental portfolio with $25M bulk condo purchase in Sunrise

Duncan Hillsley Capital bulked up its South Florida rental portfolio with a $25.1 million acquisition of 143 units at a Sunrise condominium complex. An affiliate of the Boca Raton-based real estate investment firm now owns a majority of Sunrise on the Green, a 238-unit garden-style condo complex at 4001 North University Drive, according to records. The…

Keiser University sells pair of Fort Lauderdale office properties for $58M

Keiser University sold a pair of Fort Lauderdale office properties to its owner, Everglades College, in two deals for a combined $57.6 million. In the bigger of the two deals, an affiliate of Keiser University sold the 111,542-square-foot office complex at 1900 West Commercial Boulevard for $30.4 million, according to records. Everglades College assumed an existing…

AvalonBay pays $295M for two Miramar complexes

From left: Rockpoint’s Bill Walton, AvalonBay Communities’ Benjamin W. Schall and Timothy J. Naughton, and The Altman Companies’ Seth Wise with 11385 SW 30th Ct and 2750 SW 113th Ln: AvalonBay Communities bought two Miramar apartment complexes for a combined $295 million. AvalonBay purchased Altís Miramar at 11385 Southwest 30th Court for…

Bridge Industrial nabs $28M construction loan for facility near Ft Lauderdale airport

Bridge Industrial is moving quickly on its project on the former Park ‘N Fly property in Dania Beach. It scored a $28 million construction loan less than two months after scooping up the site Windsor, Connecticut-based Talcott Resolution Life Insurance provided the financing for Bridge’s planned logistics facility at 2200 Northeast Seventh Avenue between Fort…

JV scores $87M construction loan for West Palm Beach office projects

Seven months after unveiling plans to develop a new office building and renovate an existing one in downtown West Palm Beach, a joint venture secured an $87 million construction loan for both projects. New York-based Acore Capital provided the financing to Brand Atlantic Real Estate Partners and Wheelock Street Capital, according to records. The funds will go…

Gatsby picks up Palm Beach Gardens mixed-use dev site for $17.5M

The Florida arm of Gatsby Enterprises is taking over a proposed office and retail project in Palm Beach Gardens after paying $17.5 million for a development site. Miami-based Gatsby FL, an affiliate of the New York-based real estate investment firm, bought a 7-acre site at 11200 RCA Center Drive from an entity managed by Palm Beach Gardens…

Developers of troubled West Palm resort project facing $61M foreclosure

The Banyan Cay Resort & Golf Club development is in deeper trouble, as a lender seeks to foreclose on the property after the alleged nonpayment of a $61 million construction loan. Dogged by four years of construction delays, the 150-room luxury hotel development’s partners allegedly failed to repay the loan by its July 1 maturity date, according to a July 16 lawsuit filed…