Miami Market Update: Investor Interest Drives Pipeline Growth

As of September, Miami’s office development pipeline reached 2.9 million square feet, up 6.9 percent month-over-month, according to CommercialEdge data. The under-construction supply represented 4.3 percent of the metro’s total stock, significantly exceeding the the national average of 2.4 percent. The national under construction pipeline has…

Construction on hold at Vlad Doronin’s Una Residences in Miami following water table breaches

Construction is on hold at the construction site of Una Residences luxury condo tower in Miami’s Brickell, after a series of breaches of the water table. Two groundwater breaches have occurred at the site at 175 Southeast 25th Road since October, and residents of neighboring properties have voiced their concerns about the impact the breaches could have on their…

The Eighty Seven Park development team ignored warnings about the damage the tower’s construction was causing to the Champlain Towers South feet away, leading to the deadly Surfside condominium collapse, a new lawsuit alleges. The complaint alleges that Eighty Seven Park developer Terra, led by David Martin, and its team of contractors and engineers…

Kushner brings on PTM Partners for Opportunity Zone rental towers in Miami

PTM Partners joined Kushner Companies as a joint venture partner in a major multifamily development in Miami’s Edgewater neighborhood. PTM, an Opportunity Zone-focused real estate development firm based in Miami, is now a 50-50 partner in the three-tower planned development at 2000 Biscayne Boulevard, where Kushner has been…

Crypto-talk: How Blockchain Technology and Smart Contracts Are Transforming the Real Estate Industry

The advent of blockchain technology is projected to have a big impact on real estate, the largest asset class by value, which is predicted to expand from $2687.35 billion in 2020 to $3717.03 billion in 2025. Blockchain is the core technology that enables the whole cryptocurrency ecosystem’s value proposition. It’s the technology behind Bitcoin’s security and the reason…

Major Food Group to open Sadelle’s in Coconut Grove

Major Food Group will open its popular brunch restaurant Sadelle’s in Miami’s Coconut Grove neighborhood, The Real Deal has learned. The New York restaurant group, which has expanded rapidly in the Miami area, inked a lease with the new owner of the former Tigertail + Mary restaurant building at the Park Grove development, according to sources.

A record-shattering quarter for industrial real estate

Industrial real estate made history in the third quarter as e-commerce and other tenants grappled for limited U.S. warehouse space. The segment logged 159 million square feet of net absorption — the amount of space newly occupied minus the amount vacated. It was the highest quarterly total since 2008, Transwestern said in a…

I-395 Underdeck, Miami Heritage Trail designs march ahead

Progress on an I-395 Underdeck Greenway is accelerating as the City of Miami has submitted a final design concept and deals with the Florida Department of Transportation (FDOT) to adjust between the formal budget proposal and the redesigned operating plan the city presented in August 2019. But funding to do the project, due to open in 2024, is still needed.

Miami Market Update: Investment Sales Pick Up the Pace

As of September, roughly 280,000 square feet of office space traded in Miami, with sales prices amounting to nearly $50 million, according to CommercialEdge. Most of the properties that changed hands were class C assets. Year-to-date through September, Miami has seen $1.66 billion in office transactions, significantly higher than last year’s figure at this…

A-Rod, ex-brother-in-law skip trial, settle dispute over multifamily empire

Former baseball slugger Alexander Rodriguez and his ex-brother-in-law, Constantine Scurtis, settled their remaining claims in their seven-year dispute over a once-burgeoning real estate empire, avoiding a trial that was set to begin on Monday. Scurtis, whose sister Cynthia Scurtis was married to Rodriguez, had sued A-Rod, claiming he had cut him out of their…

Witkoff and Monroe Capital unveil major redevelopment plan for the Shore Club in Miami Beach

After acquiring ownership of the Shore Club in Miami Beach, Witkoff and Monroe Capital are planning a massive makeover for the historic property. The joint venture is seeking to tear down a 20-story tower and two-story cabanas built in 1998 on the east side of the property at 1901 Collins Avenue, according to plans submitted to the city of Miami Beach.

Shore Club getting a Miami Beach makeover and sleek new residential tower

The Shore Club, one of Miami Beach’s iconic hotels that has been closed since 2020, is set to be redeveloped by New York-based developers Witkoff Group and asset management firm Monroe Capital, with famed architects Robert Stern and Kobi Karp, after previous plans for renovation failed. Developers submitted plans to Miami Beach’s Historic…

CMBS delinquencies plunge, but still above pre-pandemic levels

Bad commercial debt is getting harder to find. Since peaking at 10 percent last June, the delinquency rate for CMBS loans has fallen for 16 consecutive months, but remains above pre-pandemic levels. Industrial, hotel, retail and multifamily delinquency rates have all improved significantly in the past year, according to a report from Morningstar. In October, the overall…

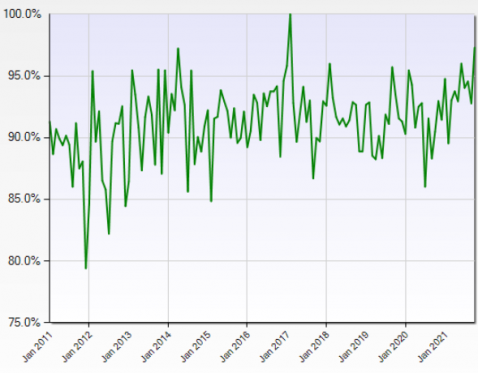

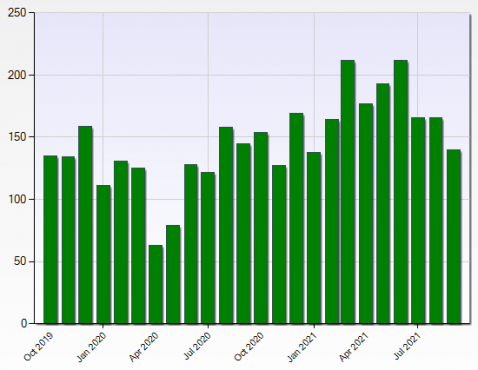

Chart: Miami Commercial Real Estate Sales to List Price Ratio October 2021

The chart above displays the sales price to listing price ratio as reported in the Miami Commercial MLS for improved commercial real estate (MLS classification: commercial/industrial) that lies within the county of Miami-Dade, including cities within, that were priced from $1 million to $10 million and that closed from January 2011 to October 2021. This ratio hit…

To get an idea of how much commercial property tends to trade in the area, see our post where we chart estimated turnover for Miami-Dade commercial property from 2016 to 2020.

Jorge Pérez’s Related Group buys Princeton apartment dev site for $8M

As part of the development wave overtaking south Miami-Dade County, Jorge Pérez’s Related Group wants to build a mixed-income apartment project in Princeton. An affiliate of Related paid $7.8 million for 10 acres on the west side of Southwest 127th Avenue and less than a quarter mile north of 248th Street, according to records. Seller…

Miami-based CGI Merchant Group to pay $375M for Trump’s DC hotel

Donald Trump is set for his second exit from Washington, D.C., as CGI Merchant Group is reportedly in contract to buy the Trump International Hotel lease. The Miami-based investment firm, helmed by Raoul Thomas is in contract to buy the hotel lease for $375 million, according to the Wall Street Journal. Under its new ownership, the 263-key hotel will…

National developers Witkoff, Kushner, PMG, Crescent Heights talk betting big on South Florida

The Real Deal’s Erin Hudson with Property Markets Group’s Kevin Maloney, Crescent Heights’ Russell Galbut, Kushner Companies’ Nikki Kushner Meyer and Witkoff Group’s Steve Witkoff The panel topic at The Real Deal’s South Florida Real Estate Showcase and Forum on Wednesday was national development, but the panelists wanted to talk about South Florida.

State attorneys general call for eviction ban on subsidized renters

Attorney General of New York Letitia James and United States Secretary of Housing and Urban Development Marcia Fudge (Getty) Tenants in New York may have two more months of eviction protections, but most renters nationwide have been exposed since August. Eviction filings have risen steadily since the Supreme Court tossed President Biden’s eviction ban…

JV Lands $55M Refi for Miami Beach Luxury Community

A partnership between Turnberry Associates, Elion Partners and Privee Capital has taken a $55 million loan to refinance 17 West, a 27-unit luxury property in Miami Beach, Fla. Newmark arranged the loan through Ladder Capital. The community, which spans a full block along 17th Street, offers a mix of one- to three-bedroom floorplans. The loft-style units feature…

Trammell Crow Residential wraps up $10M deal for Miramar multifamily dev site

Two months after securing rezoning approvals for a 250-unit apartment complex, Trammell Crow Residential closed on its nearly $10 million purchase of the development site in Miramar. An affiliate of the Dallas-based commercial real estate development firm paid $9.8 million for a vacant 9-acre property on the northwest corner of Southwest 145th Ave…

Two Miami Gardens churches could be demolished for multifamily

Two church-owned sites in Miami Gardens could be rezoned for multifamily development. The City Council will hear both applications Nov. 10. Specific site plans would be required at a later date. The bigger site is the 4.89-acre parcel at 3311-3341 N.W. 189th St. It’s owned by the Gospel Tabernacle Faith Deliverance Church and currently has two religious…

$47M Sale of Two-Property Retail Portfolio in Miami Gardens, Florida

The properties in the portfolio include Las Villas Market Square and Miami Gardens Shopping Plaza. Located on seven acres at 4705-4895 NW 183rd St., Las Villas Market Square is an 84,543-square-foot retail and service center anchored… Built in 1960, Miami Gardens Shopping Plaza is a 114,342-square-foot retail center… on 11 acres at 4500-4698 NW 183rd St…

Canadian firm buys Pompano Beach apartments as part of $3.6B Greystar sale

When Canadian real estate company Ivanhoé Cambridge struck a deal to buy $3.6 billion of apartments in the U.S., it honed in on growth markets like the Sun Belt and coastal suburbs. It is no surprise then that the Avana Bayview complex in Pompano Beach was one of the 30 properties. Ivanhoé Cambridge bought the community at 1631 South Federal Highway, as…

Broward warehouses trade for combined $47M in three separate deals

In a trio of separate deals, real estate investors from Miami, Orlando and New York picked up Broward County industrial properties for a combined $46.7 million. The purchases show South Florida’s industrial market is not slowing down, even as warehouse properties become harder to come by. Three entities managed by Midtown…

$180M refinancing secured for Miami Beach Edition Hotel

JLL’s Hotels & Hospitality Group has secured $180 million in financing for the Miami Beach Edition hotel, a 294-room hotel located at 2901 Collins Ave. on the beach. Kevin Davis and Barnett Wu of JLL Hotels & Hospitality arranged the financing on behalf of the undisclosed borrower. Redesigned in 2014, Miami Beach Edition offers traditional guest rooms and suites…

Brookfield pays $8M for office building in Boca’s Park at Broken Sound

Brookfield Properties paid $8.3 million for a fully leased office building at the Park at Broken Sound in Boca Raton. Records show that the New York-based real estate investment behemoth bought the 38,195-square-foot building at 6300 Park of Commerce Boulevard. The seller is FirstService Residential, a property manager…

Menin Development makes $10M play for Delray Beach hotel

Three months after opening its first hotel in Delray Beach, Menin Development picked up another hospitality property in its own backyard. The Delray Beach-based commercial real estate developer bought the Crane’s Beach House Boutique Hotel & Luxury Villas at 82 Gleason Street for $10 million…

West Palm shopping center foreclosure suit leads to CMBS drama

The owners of the Cross County Plaza shopping center in West Palm Beach are learning the drawbacks of taking on cheap debt, as it fights back against a foreclosure action. Cross County Owner LLC, led by Bernardo Kohn and Paul Pollak, took on a $32 million commercial mortgage-backed securities loan in 2014 to finance the shopping center at 4340 Okeechobee…

In a modern-meets-classic project, Stephen Ross’ latest downtown West Palm Beach office tower will rise next to a nearly 100-year-old church that will be preserved. Ross’ Related Companies embarked on the 25-story One Flagler, where two financial firms and a Greek restaurant signed leases. It will be on the western portion of a 2.5-acre site at the foot of the Royal…