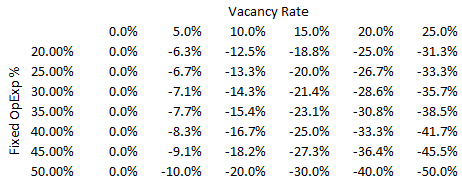

Drop in Net Operating Income as Vacancy Rate Increases from 0% Given Fixed Operating Expense Ratios

In a prior post, I discussed the potential effects on values as interest rates change, assuming capitalization rates changing in tandem at some ratio. Capitalization rates, however, are not the entire story, not at all. In particular, given that net operating income (NOI) is the numerator in the NOI/price cap rate calculation, as NOI changes, cap rates change. The general concept is that a lower cap rate means a higher price, but to the extent the lower cap rate is from a drop in NOI this is, of course, not the case.

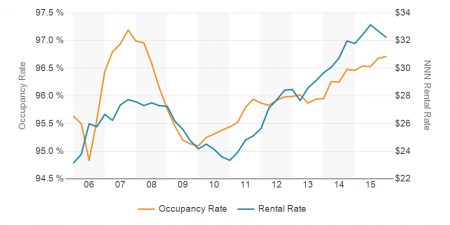

Consider further that higher interest rates have a negative effect on economic activity. Borrowing costs are increased. Interest payments on credit cards and loans are more expensive. Mortgage payments increase, reducing discretionary income. There is an increased incentive to save rather than spend, as higher interest rates make it more attractive to save . Rising interest rates affect both individuals and businesses. Thus, the economy is likely to experience a pullback in consumption and investment. In turn, commercial real estate may experience increased vacancy (decreased occupancy) and a softer rental rate environment. Variability in occupancy and rental rates, and the correlation of them, is evident in the accompanying “Occupancy and Rental Rate for Retail Properties in Miami-Dade County for the 10 Years Ending 2015” chart.

NOI itself is most affected by vacancy rates (or occupancy rates, for the glass half full crowd). To be sure, other expenses may vary, but vacancy/occupancy is the one to watch out for. Further, since most operating expenses are largely fixed, as income drops with decreased occupancy, it decreases NOI almost dollar for dollar. Since NOI is less than 100% of income, this has a leveraging affect, i.e. an increase in vacancy of some percentage causes a drop in NOI that is a greater percentage. This is represented in the chart above which lists drops in NOI as a percentage as vacancy increases from 0% given various fixed operating expense ratios.

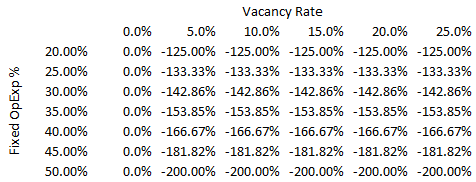

Ration of Drop in Net Operating Income to Vacancy Rate Increases from 0% Given Fixed Operating Expense Ratios

In this second chart (above), the ratio of the drop in NOI as a percentage of the increased vacancy is displayed. As can be seen, a property with a 35% fixed expense ratio will experience a drop in income that 154% of the increase in vacancy. It should be noted, however, that this assumes all rents were equal, which of course is never the case.

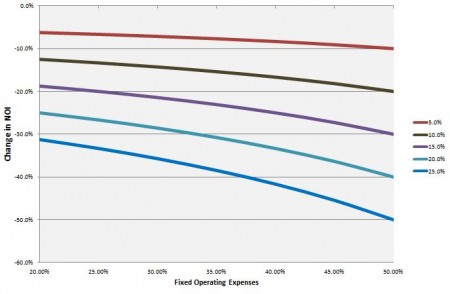

Affect on NOI Given Fixed Operating Experience Percentage at Various Vacancy Rates vs. Zero Vacancy ~ Assuming Rental Income Change Proportionate to Vacancy

This is all fairly straightforward math, surely highly accessible to anyone involved in commercial real estate, and is nothing new for most. In discourse about commercial property, however, this leverage affect is often overlooked.