We previously posted an article comparing holding vacant land vs. selling and reinvesting the proceeds. A similar situation that we often run into is that of underdeveloped property. Such property is generating income, but as a percentage of market value income well under market rates. This happens as the land value becomes greater than the value of the income from an existing improvements, i.e. when the highest and best use is clearly something different than the current one.

Vacant land for development has value relative to what income it could generate if it was developed. Similarly underdeveloped land has value relative to what income it could generate if it was fully developed. Given that, though it may outperform or underperform in the near term, development land, including undeveloped land, broadly speaking over time tends to move in line with growth in NOI (net operating income). Thus, one can compare holding underdeveloped land versus selling and reinvesting at prevailing cap rates, making assumptions for NOI growth rates with values then increasing in proportion to this rate.

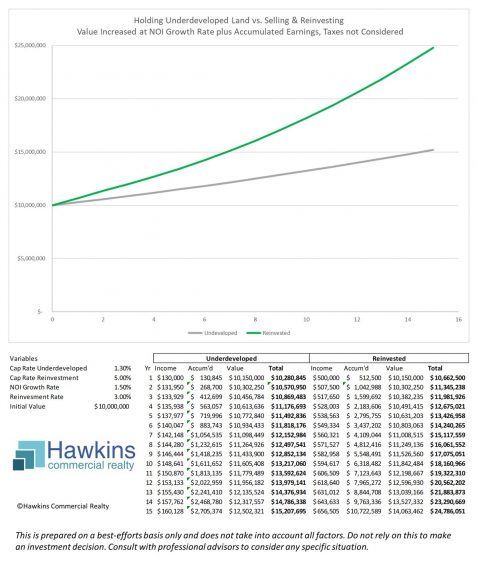

In the chart and table above, holding versus selling and reinvesting is compared for a $10 million property assuming a 1.5% growth rate for net operating income, $130,000 of net operating income (1.3% cap rate) for the property under consideration, a 5% cap rate (net operating income / investent) for reinvestment of sales proceeds into developed commercial property, and accumulation of income for both scenarios at 3%. As can be seen, the additional income adds up over time, in this hypothetical calculation accumulating such that the property and accumulated income for the sell and reinvest option grows to 163% of the hold option.

“Pure mathematics is, in its way, the poetry of logical ideas.”

~Albert Einstein

Allow me to note a couple of things about these calculations. I’m not an accountant*, and in any case I make mistakes. Thus, do not rely on my calculations. Instead, review them with your professional advisors, using this as only a conceptual framework for comparison. In particular, note that this ignores taxes completely. However, if you used a 1031 exchange to continue to defer taxes, having more improvements as a percentage of your cost basis I believe would only make the sell and reinvest strategy more attractive, relatively speaking. Again, consult with professional advisors to be sure. Also, if you find any fault with this post or my logic, let me know.

*But I have stayed at a Holiday Inn Express