View on Google

NOI Speculation

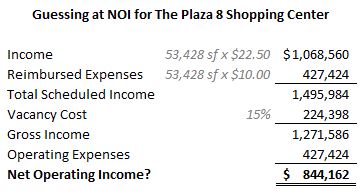

Costar reports that The Plaza 8 shopping center, located at 9600 SW 8th Street, Miami, FL, 33174, sold for $$11,186,604. Our data, sourced from Miami-Dade, shows this property as 56,493 adjusted square feet on a 106,350 square feet lot, while Costar indicates 53,428 of gross leaseable area. The average lease rate for the last 4 leases in Costar is $22.50 NNN. Costar further reports the building as 87.1% occupied. The sales price equates to $214.31 per gross leasable square foot. In the accompanying “Guessing at NOI for The Plaza 8 Shopping Center,” we speculate at to how an investor might evaluate this property financially. We assume an average rental rate of $22.50 psf, NNN (triple-net), in line with the aforementioned average for recent leases which are conveniently and appropriately split between 1st and 2nd level properties. Expenses are assumed at $10.00 psf. This is a rough guess, but note that not getting expenses exactly right – at least when vacancy is moderate, – has a muted effect with a NNN assumption as expenses are reimbursed by tenants for occupied space. Thus, expenses only affect income to the extent that they are not fully reimbursed due to vacancy. Speaking of vacancy, we assume that at 15%. We are assuming this a touch higher than what Costar currently indicates to account for potential collection issues and the prospect for vacancy as rates are increased from what we guess may be long-term legacy leases . Finally, gross leasable area is assumed to be 53,482 sf as indicated by Costar.

In the accompanying “Guessing at NOI for The Plaza 8 Shopping Center,” we speculate at to how an investor might evaluate this property financially. We assume an average rental rate of $22.50 psf, NNN (triple-net), in line with the aforementioned average for recent leases which are conveniently and appropriately split between 1st and 2nd level properties. Expenses are assumed at $10.00 psf. This is a rough guess, but note that not getting expenses exactly right – at least when vacancy is moderate, – has a muted effect with a NNN assumption as expenses are reimbursed by tenants for occupied space. Thus, expenses only affect income to the extent that they are not fully reimbursed due to vacancy. Speaking of vacancy, we assume that at 15%. We are assuming this a touch higher than what Costar currently indicates to account for potential collection issues and the prospect for vacancy as rates are increased from what we guess may be long-term legacy leases . Finally, gross leasable area is assumed to be 53,482 sf as indicated by Costar.

The assumptions result in arrives at net operating income of $844,162, indicating a 7.5% cap rate (capitalization rate), higher than average for retail properties in Miami-Dade county, but seemingly about in line for this kind of property. For a commercial property investor, however, the cap rate is just the start.

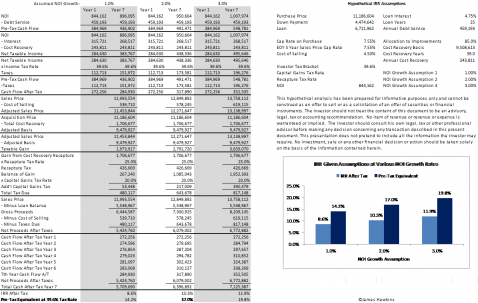

Potential Internal Rate of Return

In the accompanying and entirely speculative IRR (internal rate of return) calculation, we speculate at to what a buyer’s return might be, pre-tax and after tax, given various rent growth assumptions and a set of other various assumptions including 60% debt financing, the same cap rate upon sale after 7 years, etc. As can be seen, the mid-point rent growth assumption of 2% provides more than a 17% pre-tax equivalent internal rate of return, not bad indeed in today’s low interest rate environment. It should be noted that this return is not without risk. History is replete with failed commercial real estate investors, particularly in South Florida, and success at such requires time and the ability to tie up capital in a non-liquid investment. The potential, however, can be aptly rewarding for those willing to assume the risk and suffer the lack of liquidity.