Billionaire Zara Founder In Talks To Buy Brickell Office Tower ‘Sabadell Financial Center’

The investment office of one of the world’s richest men is in talks to buy a Brickell office building, according to The Real Deal and Bloomberg. The Sabadell Financial Center would be sold for about $275m, the reports said. The buyer would be the family investment firm of Amancio Ortega, Pontegadea . Pontegadea has already purchased multiple major real estate assets in Miami.

Amancio Ortega’s Ponte Gadea buying Sabadell Financial Center in Miami’s Brickell for $275M

KKR and Parkway are selling the 30-story tower they bought for $249M in 2018 Spanish billionaire Amancio Ortega is buying Sabadell Financial Center in Brickell for about $275 million. Ponte Gadea, Ortega’s real estate investment firm, plans to purchase the 30-story office tower at 1111 Brickell Avenue from New York-based KKR and Orlando-based Parkway.

Michael Swerdlow on track with Miami-Dade to build $295M mixed-use project

Developer is planning 809 apartments, warehouses, retail, hospitality training center and clinic on 38 acres Miami-Dade County Commissioner Marlene Bastien and Michael Swerdlow with a rendering of the Poinciana mixed-use project at 7200 Northwest 22nd Avenue (Getty, Swerdlow Group, Miami-Dade County Commission) Michael Swerdlow is lining up another…

Central Asia’s largest developer investing in Brickell condo projects, plans to expand in downtown Miami

Kazakhstani firm BI Group has pumped $30M into partnership with Habitat Group Central Asia’s largest developer, Kazakhstani firm BI Group, is partnering with Habitat Group on three mixed-use condo projects in Brickell and is looking for more development opportunities in Miami. BI Group is a roughly 50 percent partner in the planned short-term rental friendly condo…

Turmoil at Brickell condo complex over money and power

Owners at 17-year-old Miami building have been fighting the condo association over $21M special assessment, board leadership A group of unit owners at a two-tower condo on Brickell Avenue in Miami voted to oust their association president in late November, as they were fed up with a series of his and the board’s actions that included enacting a $21 million special assessment…

Moishe Mana scores $150M refi for 56-property portfolio in Miami’s Wynwood

No ground-up development has been completed since city OK’d 30-acre project in 2016 Moishe Mana scored a $150 million refinancing for his expansive property portfolio in Wynwood. The loan covers 56 properties in Miami’s arts district and was provided by WFL Lender, a Delaware-registered entity, according to the mortgage record. The properties surround his Mana Wynwood…

Stacy Robins seeks removal of curator overseeing late father’s estate

In court filings, she alleges Marsha Madorsky is doing a poor job tracking down Gerald Robins’ assets Stacy Robins is seeking to oust the curator overseeing her late father Gerald Robins’ estate. It’s the latest legal salvo against her mother and her three siblings whom she alleges have misrepresented how much wealth their family patriarch left behind when he died nearly three years ago.

MG Developer lines up $39M loan to build Coral Gables townhome project

Alirio Torrealba’s firm is planning 13-unit The George at Biltmore Square MG Developer’s pipeline keeps pumping along as Alirio Torrealba’s firm is about to score a $39 million construction loan for a Coral Gables townhome project. Miami-based Pine Bay Capital is providing the financing for The George, a planned development of 13 two-story townhouses at 717 Valencia Avenue…

A win for holdouts: Appeals court sides with Biscayne 21 condo owners in battle with Two Roads tied to redevelopment

Developer wants to buy build Edition Residences, now aims to take issue to Florida’s Supreme Court Two Roads Development was dealt a major blow in its legal battle over a condo buyout in Miami’s Edgewater, where the company plans an Edition Residences luxury condo project. The Third District Court of Appeal issued an opinion in response to Two Roads’ request…

Court’s decision in Two Roads’ buyout case won’t kill all condo deals, experts say

Attorneys agree the ruling will only affect condo associations with similar language as Biscayne 21 Developers were on edge Thursday after a Florida appeals court issued its long-awaited opinion in a lawsuit over a complicated condo buyout in Miami’s Edgewater. Yet, a consensus of attorneys contacted by The Real Deal agreed that the controversial ruling won’t kill all potential buyout deals…

Lease roundup: EV showroom, Japanese eatery Uchibā opening at Mary Brickell Village in Miami

Also, a law firm will move its HQ to BH Group and Pebb Enterprises’ Boca Raton project Kimco Realty scored four new tenants at its Mary Brickell Village retail center in Miami. In the biggest lease, Irvine, California-based electric vehicle company Rivian will open a 4,000-square-foot showroom this summer, according to a news release from Mary Brickell Village and Kimco.

Yamal Yidios’ Ytech proposes 113-unit condo tower in Brickell

Developer paid $12M for site in 2021, also purchasing development rights that could have allowed up to 80 stories Developer Yamal Yidios proposes a 54-story, 113-unit condo tower in Brickell. Yidios’ Brickell-based Ytech wants to build the tower on about a half-acre property at 41 and 75 Broadway, which also is listed as 41 and 75 Southwest 15th Road in Miami, according to city records.

Developers propose 140-unit apartment building ‘Rio Vista’ near Miami River

Italo Balbi of Bricka Real Estate, and Ashley Bosch and Gaston Corradi of CB Development plan the project Developers want to build a 140-unit apartment building near the Miami River, marking a continuing flurry of multifamily project applications in South Florida. Bricka CB Development –– led by Italo Balbi, Ashley Bosch and Gaston Corradi –– wants to build the 10-story Rio Vista…

Developers Propose Rio Vista Apartments at 413 NW 3rd Street in Miami

Bricka CB Development, a joint venture between Bricka Real Estate and CB Development, has proposed Rio Vista Apartments, a 10-story multifamily project near the Miami River. The development is planned for four parcels at 413, 421, 431, and 453 NW 3rd Street, on the northern edge of the Lummus Park Historic District, near the boundary of Overtown and Downtown Miami.

Lender wins Gateway at Wynwood bankruptcy auction with $90M bid

A10 Capital submitted the credit bid for distressed mixed-use building and adjacent bank property Gateway at Wynwood technically has a new owner, but a last-minute buyer offering to pay more could end up with the distressed Miami mixed-use building. A10 Capital, as special servicer… loan allegedly in default, won the property at 2916 North Miami Avenue in a bankruptcy auction…

Midtown Capital plans 348-unit Live Local Act tower in Miami’s Little River, amid flurry of proposals under state law

A city board will vote on the 22-story project at its July 16 meeting Midtown Capital Partners’ Alejandro Velez with a rendering of the proposed 348-unit Live Local Act project in Miami’s Little River neighborhood (Getty, Midtown Capital Partners, Corwil Architects) Midtown Capital Partners proposes a 348-unit Live Local Act tower in Miami’s Little River…

Fortune, Blue Road land $73M construction loan for EB-5-backed North Miami Beach condos

16-story, 254-unit Nexo Residences adds to packed pipeline of short-term rental-friendly projects in Miami-Dade County Edgardo Defortuna and Jorge Savloff with a rendering of Nexo Residences in North Miami Beach (Getty, Blue Road, Fortune International Group) Fortune International Group and Blue Road scored a $73.3 million construction loan for their planned Nexo…

Miami hotels looking to hometowners to fill rooms

With summer in full swing, area hotels and spas are seeing a trend in staycations as locals are looking to take advantage of Miami’s tourism industry offerings. Local, or staycation visitors are an essential part of Miami-Dade County’s tourism landscape, said Rolando Aedo, COO of Greater Miami Convention and Visitors Bureau. “Historically we know that day trippers within a 30-mile…

Miami seeks to replace aged police headquarters

Miami officials are looking for a new location for the city’s aging police headquarters as structural issues at the current downtown facility continue to worsen and concerns grow. During the July 10 city commission meeting, officials discussed the deteriorating state of the Miami Police Department headquarters and plans to eventually redevelop the site. Commissioners directed…

Plaza behind Kaseya Center on the way, three decades

After decades of dashed hopes, county commissioners are to vote to work toward a nearly three-acre public open space behind the Kaseya Center basketball arena on Biscayne Boulevard. Funding sources are unknown. A public space behind the arena where the Miami Heat plays was envisioned in the 1990s when the county approved the development agreement for the site…

Conceptual Plans For Waterfront Land Behind Kaseya Center Set For Vote

Miami-Dade commissioners are scheduled to vote on conceptual plans for a waterfront parcel in a prime downtown Miami location. The 2.7-acre parcel is located behind the arena where the Miami Heat play, Kaseya Center. It is owned by Miami-Dade County, but has been used by a Miami Heat affiliate during events. The land is needed for staging equipment and transport…

Pedestrian bridge to Freedom Park will miss opening games

Although preliminary work began two years ago on a Major League Soccer stadium next to Miami International Airport and games are due there next spring, planning for the pedestrian bridge to the stadium is still in early stages. Developers of the Inter Miami CF stadium are still trying to pin down the exact location of the bridge that they must provide and are still seeking government funds…

22-Story Live Local Act Tower Proposed for 7501 and 7553 NE 2nd Avenue in Little River

A 22-story residential tower is being proposed for 7501 and 7553 NE 2nd Avenue in Miami’s Little River neighborhood. Filed under the Live Local Act, the project is being developed by Midtown Capital Partners under the NE 2 LR, LLC, and designed by Coral Gables-based Corwil Architects. The site comprises two parcels totaling 57,642 square feet, or approximately 1.32 acres…

Ytech Submits Plans to UDRB for 54-Story ‘Seven Broadway’ in Brickell

Ytech has submitted plans for Seven Broadway, a 54-story luxury residential tower designed by Kohn Pedersen Fox (KPF), to Miami’s Urban Development Review Board. The proposed development will be situated on a 16,647-square-foot site located at 41 and 75 SW 15th Road in the Brickell neighborhood. The lot has frontages along SW 15th Road (Broadway) and SW 14th Terrace…

Aria Reserve’s Second Tower Tops Off At 62 Stories: ‘Record Construction Timeline’

Aria Reserve’s 62-story North Tower has topped off. In a statement, developer Melo Group said the dual-tower Aria Reserve has had a “record construction timeline.” Groundbreaking for the North Tower took place in October 2023, with a foundation pour in August 2024. The development also includes the first Edgewater luxury condo building to launch and reach completion…

Plans Filed For 375 Apartments In Overtown, Near Metrorail

Plans have been submitted to Miami-Dade for a complex with hundreds of new apartments in Overtown. The Administrative Site Plan Review filing comes two months after a pre-application had been filed, and adds new renderings. The mixed-use development is planned as a Live Local project with both workforce and affordable housing, and is also transit-oriented…

Temporary Cranes Approved For Citadel 1040′ Supertall Site In Brickell

The Federal Aviation Administration has issued a determination approving construction cranes at the Citadel site in Brickell. Citadel is planning a 1,040-foot supertall tower that company founder Ken Griffin has said will be “one of the greatest office buildings built in the world.” According to the July 10 FAA determination letter, the three proposed cranes can rise 1,049 feet…

26-Story Apartment Building `The Perrin` Breaks Ground In Brickell

In Brickell, developer Empira held a groundbreaking ceremony for a new 26-story class-A multifamily tower called The Perrin. The Perrin becomes one of a few multifamily projects to break ground in Brickell in recent years, and will have 310 apartments upon completion. It is also the second development in the downtown Miami area by Empira.

Brutalist Pan Am Building at Miami International Airport Being Restored Into Private Terminal

Miami-Dade broke ground last week on a restoration project of the former Pan Am building at the airport, which will see it transformed into a private terminal. It will allow passengers who pay an extra fee to skip the crowds and security checks of the public terminals at Miami International Airport entirely. Passengers will still be able to board commercial flights…

In Under 6 Years, All Terminals At MIA Will Be Expanded Or Rebuilt

Miami-Dade Aviation Director Ralph Cutié has revealed expected completion dates for construction projects that will transform Miami International Airport over the next few years, on the Day in Miami podcast. The expected completion for all of the major project are in less than 6 years. Every terminal at MIA will be rebuilt or expanded by then. Here’s when the expected…

Q&A: It’s Always Sunny in South Florida’s Office Market

“Smaller, move-in-ready spaces are well positioned to meet current market demands. We sometimes forget, but small businesses constitute the largest segment of private-sector employers in the U.S.,” says NAI Merin Hunter Codman Inc. COO Matt Brown. Image courtesy of NAI Merin Hunter Codman Inc. South Florida’s office market has emerged as a study in contrasts…

Notable Retail Leases Signed in South Florida Q2 2025

We’ve compiled a comprehensive list of the top retail leases signed by square footage in South Florida during 2023. This past quarter was busy overall, and there were a few big box leases signed and sealed. Despite the sentiment that the traditional retail market is taking a hit due to several factors, particularly e-commerce and several retail store closures nationwide…

Photos: Flagler Street Demolition In Downtown Miami

Photos by Phillip Pessar show demolition work last week on Flagler Street in downtown Miami. A report last year said that five buildings might be demolished and replaced by a temporary public park, which would be around 71,400 square feet. The temporary park would be known as Flagler Plaza.

L&L Holding, Oak Row Equities Secure 75,000 SF Office Lease Expansion with Amazon in Miami

L&L Holding Co. and Oak Row Equities have secured a lease expansion with Amazon at Wynwood Plaza, a 1 million-square-foot mixed-used development located within Miami’s Wynwood Arts & Entertainment District. The lease expansion — which will total more than 75,000 square feet — builds on Amazon’s original agreement in January to lease 50,333 square feet at the campus.

Amazon Expands Footprint at Wynwood Plaza to Over 75,000 Square Feet

L&L Holding Company and Oak Row Equities, along with project partner Shorenstein Investment Advisers and co-investor Claure Group, have announced an expansion of Amazon’s lease at Wynwood Plaza in Miami’s Wynwood Arts District. The tech giant will now occupy more than 75,000 square feet at the 12-story office tower, which is nearing completion.

Amazon Expands Miami Office Footprint

The 266,000-square-foot office building is set to come online in the following months. Image courtesy of Shoootin Amazon will expand its office footprint to 75,000 square feet at Wynwood Plaza, a 1 million-square-foot mixed-use development within Miami’s Wynwood Arts District. A venture between L&L Holding Co. and Oak Row Equities owns the campus.

Amazon’s Offices At Wynwood Plaza Will Now Be 50% Larger; TCO Issued

The Wynwood office building where Amazon will be located has just reached substantial completion, and the company is expanding the amount of space it is taking. Miami’s Building Department recently issued a Temporary Certificate of Occupancy for the building, according to its developers. The developers also announced that Amazon has agreed to increase its office size…

Codina Partners Breaks Ground on South Florida Multifamily Community ‘Sevilla,’ Secures $100M Construction Loan

Codina Partners has broken ground on Sevilla, a seven-story, 412-unit apartment property within the 250-acre Downtown Doral mixed-use development in metro Miami. Additionally, Codina Partners has secured a $100 million construction loan from Regions Bank and Ocean Bank. Regions Bank will fund 65 percent of the loan, while Ocean Bank is providing the remaining 35 percent.

Archaeological Discovery Surfaces at 1809 Brickell Avenue During Construction of St. Regis Residences

A previously undocumented indigenous settlement and burial site, believed to date back approximately 3,500 years, was uncovered during construction at 1809 Brickell Avenue, according to a recent article by the Miami Herald. The site lies beneath the future St. Regis Residences, a luxury condominium tower by Related Group and Integra Investments…

Developer Proposes Second Phase of Culmer Place at 800 NW 5th Avenue in Miami

Miami-based Atlantic Pacific Cos. has plans for the second phase of Culmer Place, the first phase of which broke ground last spring. The addition would feature a seven-story building with 375 mixed-income apartments and span about 270,000 square feet of new construction. Homes would run from studio to three-bedroom layout plans; 300 homes would be designated…

Atlantic Pacific proposes 71-unit affordable housing project on Liberty City’s Carver Theater site

All apartments will be for households earning up to 80% of AMI Atlantic Pacific Companies plans to redevelop the long-closed Carver Theater in Liberty City with a 71-unit affordable housing project. The Miami-based company plans the 11-story Lofts at Carver Theater building on the half-acre site at 6016 Northwest Seventh Avenue in Miami…

Dade To Vote On Development Agreement With Related For 628 New Apartments

Miami-Dade’s commission is scheduled to vote on an agreement with Related Urban Development Group for a new housing complex. The deal would see the Claude Pepper Tower Public Housing Site redeveloped, including replacing 166 housing units. Previous residents have already signed a Tenant Relocation Agreement and have the right to return once the new building is complete.

Design Revealed For Four Towers At The Former Miami Herald Site

Renderings and details of a plan to build four towers on the prominent Miami Herald site in downtown Miami have been uploaded to social media by an architecture firm. The plans were prepared by Gómez Platero Architecture & Urbanism of Uruguay. They date to 2021, according to Global Design News. It isn’t clear who they were prepared for. The property is currently…

Miki Naftali Shrugs At South Florida Boom Talk After Mamdani Win

On the couch of the sales gallery for his first South Florida project, Naftali Group CEO and founder Miki Naftali said talk of another wave of wealth migration from New York to Miami, spurred on by Democratic Socialist Zohran Mamdani’s mayoral primary win in NYC, is overblown. “I think that those are just stories,” Naftali said. “New York is booming. First of all, I don’t think…

Work Underway At ‘Signature’ $345M Royal Caribbean Terminal at PortMiami

Demolition is now underway at PortMiami to make way for a new signature cruise terminal for Royal Caribbean. The old Terminal G is being demolished to make way for the new complex. The new Terminal G will serve Royal Caribbean and its other brands, including Celebrity Cruises. It will able able to accommodate up to 7,000 passengers, and Icon-class ships.

Casa Bella Residences in Downtown Miami Tops Off At 56 Stories

A topping off ceremony was held yesterday for Casa Bella Residences by B&B Italia. The downtown Miami luxury condo tower topped off at 56 stories. According to an earlier FAA filing, the building is planned to have a permanent height of around 638 feet above ground, or 648 feet above sea level. There will be 319 residential condo units in the completed building…

‘Confident, Contemporary’ Little River Live Local Tower Submitted To UDRB With 348 Units

A developer has submitted plans for a live local tower in Little River to Miami’s Urban Development Review Board. In a letter, the architect preparing the plans said the new building would be a “confident, contemporary intervention” in the neighborhood. The new tower is planned to rise 22 stories, or around 235 feet above ground, and include: 348 residential units…

Turner Impact Capital Sues Akerman For Malpractice Over $45M ‘Mistake’

A subsidiary of a $2B impact investment firm claims real estate law firm Akerman LLP botched the drafting of a lease agreement that allowed a healthcare tenant to terminate seven leases and avoid paying tens of millions in termination fees. Turner Healthcare Facilities Fund filed a $45M malpractice lawsuit Monday in Miami-Dade Circuit Court against Akerman…

Miami Office Market Takes Step Back As Demand Wanes

After 2025 started with the best quarter for Miami office leasing since 2023, the market didn’t sustain that momentum. The slowdown is a return to the slower demand that made 2024 a sluggish leasing year. The wave of corporate migration that happened during the pandemic has continued to ebb, office brokers and analysts said. “National relocations to South Florida…”

Class A Properties Drive 10% Office Rent Growth in Miami

Office rents are experiencing explosive growth in Miami. A second quarter report from CBRE found that the prices in the market rose by 9.7 percent year-over-year to $64.36 per square foot. This marks the third consecutive quarter where rents have increased by roughly $5 per square foot. “In terms of rent growth Airport/Doral stood out with Class A rates rising 1,150 bps…”

MIA and PortMiami generate $242.8 billion in economic impact

Miami-Dade County Mayor Daniella Levine Cava announced Friday that Miami International Airport and PortMiami broke records in revenue, collecting more than $242 billion and supporting nearly 1.2 million jobs. The announcement was made at the annual State of the Ports luncheon, hosted by the World Trade Center Miami and attended by more than 500 business…

Back to work: New office space embraced in Coconut Grove

When Rebeka Ramos read the new lease terms for her company’s offices in Coconut Grove, she was outraged by what she called an “astronomical” rent increase. “Overnight, the rate went from $42 to $75 a square foot – up roughly 79%,” she said. The new terms for the office space near Oak Avenue and Mary Street, proposed last year, not only angered Ramos, but surprised her, too.

Miami Developer Esteban Merlo Transforms Urban Landscapes Through Strategic Real Estate Innovation

Esteban Eduardo Merlo Hidalgo, CEO of Esteban Merlo Development & Consulting, is a Miami-based real estate developer whose international career has positioned him as a leading figure in urban innovation, sustainability, and strategic development. His approach goes beyond construction–he is redefining how cities evolve.

Financing Secured for ‘the Residences at Beverly Park’ at 6017 Washington Street in Hollywood

NuRock Co. is one step closer to completing the Residences at Beverly Park, an affordable housing development in Hollywood, Florida. The 10-story venture is set to comprise 115 apartments: 16 one-bedroom units, 69 two-bedroom units, and 30 three-bedroom units. According to the South Florida Business Journal, the residences will span 650 to 1,023 square feet.

Memorial Regional Hospital Moves Forward with $670 Million Expansion in Hollywood

Memorial Regional Hospital in Hollywood, Florida is moving forward with a major $670 million expansion centered on the construction of a new Surgical and Patient Bed Tower. The development is designed to enhance patient care, accommodate growing demand, and expand the hospital’s capacity with the addition of 150 acuity-adaptable beds….

Longpoint picks up grocery-anchored shopping center in Miramar for $34M

Boston-based firm added Miramar Parkway Plaza to its South Florida portfolio Longpoint dropped $34 million for a grocery-anchored shopping center in Miramar. An affiliate of Boston-based Longpoint, led by Dwight Angelini, acquired Miramar Parkway Plaza, a 167,840-square-foot retail complex anchored by Presidente Supermarket, at 3176 South University Drive…

Moderno Refis Rivr Lofts Luxury High-Rise in Fort Lauderdale

Moderno Development Group has closed on a $117 million three-year, floating-rate refinancing loan for Rivr Lofts, its newly completed 352-unit luxury high-rise in downtown Fort Lauderdale, Fla. The loan was arranged by JLL Capital Markets. The 29-story Class A multifamily property is located at 307 SW 5th St. in Fort Lauderdale’s Tarpon River Entertainment & Design District.

Group P6 and Mill Creek score approval for 306-unit multifamily project in Boca Raton

Construction of the 12-story building is expected to start in January Mill Creek Residential’s William C. MacDonald and Group P6’s Ignacio Diaz with a rendering of the Modera Boca project (Getty, Mill Creek Residential, Group P6, Corwil Architects) Group P6 and Mill Creek Residential scored final approval for a 306-unit apartment building in downtown Boca Raton…

‘Alexan Boca’ Proposed for 790 Park of Commerce Boulevard in Boca Raton

A Boca Raton-based developer hopes to move forward with a multi-family development in its namesake city. Alexan Boca would span 293,182 square feet of new construction, measuring seven stories above grade. The project would feature 298 one-bedroom to three-bedroom apartments, with the average residence measuring about 985 square feet.

Judge approves Grant Cardone, Penn-Florida $235M 101 Via Mizner purchase

JV may convert 366-unit Boca Raton multifamily project into condos Grant Cardone, a crowdfunding multifamily syndicator, is one step closer to getting into the condo selling business. On Thursday, U.S. Bankruptcy Judge Erik P. Kimball approved the $235 million sale of 101 Via Mizner in Boca Raton to a joint venture between the current owner, Penn-Florida Companies…

Kolter plans 386-unit Live Local multifamily project in Delray Beach

Kolter Group CEO Bobby Julien with renderings of Alton Delray (Getty, Kolter Group) Kolter Group is seeking streamlined approval of Alton Delray, a 386-unit multifamily development with a workforce housing component, under the state’s Live Local Act. Kolter, led by CEO Bobby Julien, plans to charge below-market rents for 154 workforce housing units…

Townhome Development ‘Hibiscus Gardens’ Proposed for 6295 S Military Trail in Greenacres

A South Florida-based developer hopes to get approval for a for-sale townhome complex in Palm Beach County. Hibiscus Gardens would comprise 48 townhomes in nine buildings. The venture would offer 100 parking spots (averaging to about two per unit) and feature five workforce housing units. According to Palm Beach County records, workforce housing is defined…

O’Connor Capital expands Palm Beach County portfolio with $29M shopping center purchase

New York-based firm bought Delray Corner, anchored by CVS O’Connor Capital Partners boosted its Palm Beach County portfolio, paying $28.8 million for a Delray Beach shopping center anchored by Michael’s and a CVS store on an outparcel. An affiliate of New York-based O’Connor Capital, led by CEO Bill O’Connor, acquired Delray Corner at 14802 South Military Trail…

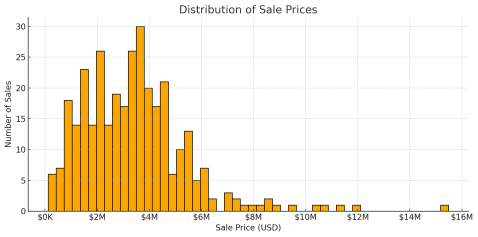

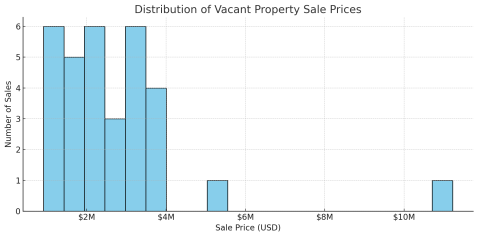

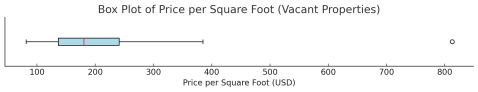

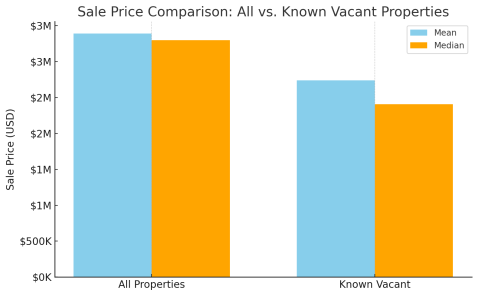

Distribution of Sales Prices Nationally of Big Box Drugstore Property Sales

Distribution of sales prices of 10-20k sf drugstores for single tenancy, USA, year ending 7/15/25. Data courtesy of CoStar Group. The question of market value arises with single tenant big box drugstore properties, particularly where the property is vacant or soon to be vacant. To get at this, we first queried Costar for sales in the prior year for the entire USA of 10-20k sf…

Navigating interest rate uncertainty

The Federal Open Market Committee (FOMC) kept the target range for the federal funds rate at 4.25% to 4.50% at its June meeting. Rates have held steady in 2025, following 100 basis points of rate cuts 2024 and a series of rate hikes in 2022 and 2023. “Interest rates have experienced some volatility year to date, as expectations for growth and inflation have shifted a few…

Beige Book: Southeast Economy Little Changed amid Uncertainty

Generally speaking, the economy of the Southeast from mid-May through June continued in a holding pattern amid ongoing uncertainty, according to the new Beige Book report from the Federal Reserve Bank of Atlanta. The Federal Reserve has a dual mandate established by Congress to foster price stability and maximum employment. The situation on the price stability side…

Updated Forecast Amid Declining Supply and Increasing Economic Uncertainty

The 2nd quarter 2025 brought a fresh round of uncertainty to the U.S. economy, largely driven by external developments. In early April, the administration announced a series of reciprocal tariffs on several major trading partners. The move triggered a sharp selloff in equity markets and added new pressure on an already cautious Federal Reserve. While Chair Jerome Powell…

Real Estate Investment In The Era Of Trade, Tariff Changes: Challenges And Opportunities

New tariffs are influencing global real estate investment strategies as investors reevaluate their capital deployment across different locations. The growing protectionist nature of trade policies and their reduced predictability now affect areas extending well beyond traditional manufacturing and shipping zones. Investors must understand that real estate asset demand patterns…

Video: Inside the Estate Battle of the Late Jimmy Buffett; A Lesson on Wealth Transition for CRE Owners and Otherwise

“Wastin’ away again in” Litigataville… The world of Margaritaville, an empire built on the sunny, laid-back ethos of the late Jimmy Buffett, has recently been clouded by an intensifying legal battle over his estimated $275 million estate. The dispute is between the iconic singer’s widow, Jane Buffett, and his longtime accountant, Rick Mozenter, who serve as co-trustees of the marital trust.

JP Morgan 2025 commercial real estate midyear outlook

A lot has changed for commercial real estate since the beginning of the year. One thing remains the same: economic uncertainty. “By some measures, there’s more uncertainty today than at any point in the last three to four decades,” said Victor Calanog, global head of research and strategy, Real Estate Private Markets at Manulife Investment Management.

Is your city a winner or loser in the return-to-office race? Capital Economics breaks it down

We’ve gradually seen more people return to the office since the remote-work norm of the pandemic, and now the winning and losing cities are becoming clearer. Capital Economics tackled the issue of commercial real estate in its U.S. Office Metros Outlook and found that 2025 will bring further pain for office values across all major metros, but a sharp regional divide is set…

Video: How a Hong Kong Dynasty Was Hit by China’s Property Crisis

In the heart of Hong Kong’s bustling cityscape, an ancient Chinese proverb, 富不過三代, whispers a warning that wealth does not pass beyond three generations. An enduring testament to this cautionary tale can be seen in the current trials and tribulations of one of Hong Kong’s four dominant property dynasties, New World Development. In the throes of a looming crisis…

US Office market continues heating up as deals hit $40B

US market trending positively as vacancy drops for fourth straight quarter (Photo Illustration by Steven Dilakian for The Real Deal with Getty) The U.S. office market posted its fourth consecutive quarterly decline in vacancy rates, signaling strong recovery momentum. Vacancy fell to 23.2 percent in the second quarter, dropping 15 basis points from the prior quarter…

Florida Sales Tax on Commercial Leases Eliminated Effective October 1st

Starting October 1, 2025, Florida will eliminate the sales tax on commercial real estate leases, marking a significant change for landlords and tenants alike. This repeal applies not only to the state-level sales tax but also to the local discretionary surtaxes that have historically added up to 1.5% in many counties. With this move, Florida becomes the only state in the nation…

![Baker, Scott R., Bloom, Nick and Davis, Stephen J., Economic Policy Uncertainty Index: Categorical Index: Trade policy [EPUTRADE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EPUTRADE, .](https://www.hawkinscre.com/wp-content/uploads/2025/06/economic-uncertainty-index-chart-20250618-768x360.png)