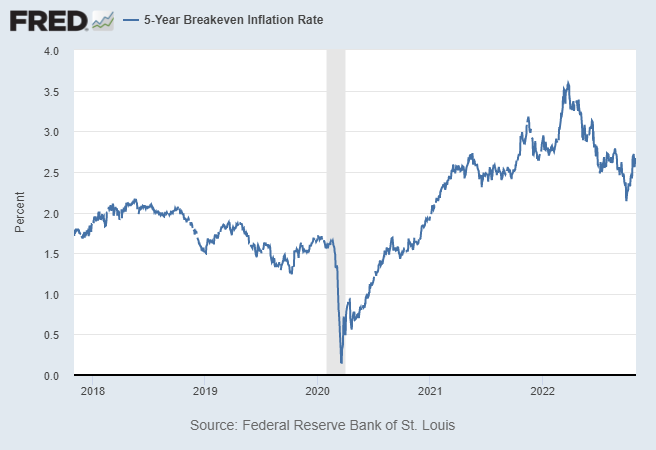

Federal Reserve Bank of St. Louis, 5-Year Breakeven Inflation Rate, commonly referred to as the TIPS Spread, a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation-Indexed Constant Maturity Securities, for the 5 years ending 10/31/22

Posted above is the chart for the 5-Year breakeven inflation rate, commonly referred to as the TIPS spread, for the five years ending on Halloween, October 31, 2022. A calculation of the difference in the yields, i.e. the spread, between United States Treasury bonds and Treasury Inflation-Protected Securities (TIPS) of the same maturity, this spread is a useful and oft-quoted measure of expectations for (CPI) inflation in the financial markets. The spread indicates expected inflation, of interest to investors in commercial real estate – more on that below – and for that matter any asset class.

As one can see in these charts, the 5-year TIPS spread topped off in March at 3.59%. As the Fed has maneuvered to tap inflation down, this has now pulled back to an All Hallows’ Eve closing level of 2.67%. This indicates that financial markets participants are confident that inflation is coming down, likely sooner rather than later given that five year expectation level as compared to recently inflation readings. Investors are putting their money on a bet that inflation it going to be just a bit over a 2.5% inflation rate for the next five years. This indication may be wrong, of course; traders lose money – cough LTCM – all the time, after all. The relevance here is that those who are paying the most attention and that are confident enough in their opinions to put their money where their mouths are believe inflation is going to subside.

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

~Sam Ewing

Not Just Opinions, Real Money is on the Line

Real money is at stake with these spreads. TIPS pay interest every six months, based on a fixed rate that is calculated by multiplying the adjusted principal by one-half the calculated interest rate (i.e. half a year’s worth of inflation at that rate). Thus, a “bet” that an investor makes in with these bonds has real financial implications. If actual inflation is higher than priced in the markets, a TIPS buyer will make more that a straight treasury buyer. If it is lower, that TIPS buyer will make less. How much money is at stake? In 2017 Morningstar pegged the market at $1.2 trillion. Thus, every 1/10% difference is a $1.2 billion swing. That is real money by my count.

Generally on Inflation and Commercial Real Estate

What is the impact of inflation on commercial real estate? In the near term, higher inflation tends to bring higher interest rates. Higher interest rates are a negative for commercial real estate. Higher rates means larger debt service payments, reducing the buying power of purchasers, and negatively impacting deal economics. It also means makes fixed income investments a more competitive investment, likely pulling capitalization rates (cap rates) up, and thus prices down. Over a longer period, however, the prospect of inflation leads to a principal benefit of commercial property investment, that of its potential as a hedge against inflation. After all, more inflation should lead to higher rent, at least in time.

MIT published an excellent whitepaper on real estate’s ability to keep pace with inflation with data to 2016. They looked at then tendency of retail, multifamily, industrial, and office income and values to keep pace with inflation. The best at keeping pace income-wise was retail, with rent growth of 102% of inflation. Office was the worst performing at a quite dismal 18%. Values across the property types were more consistently kept pace, with retail again doing the best appreciating at 107% of inflation, office again the worst at 74% of inflation. I’ll speculate that the fairly drastic difference between income and value keeping pace with inflation is driven by vacancy. If you’re interested in the topic, read the paper.

Expectations for inflation also come into play with lease structure and due diligence. A lease structure with a fixed rent increase becomes less attractive for a landlord with higher inflation expectations. Similarly, a commercial property being acquired with existing leasing in place that have fixed or capped rent increases looks less attractive as inflation expectations increase. Also, a property being purchased with fixed rate financing will look increasingly attractive if a buyer anticipates inflation fueled increases in income. Inflation, in short, is very important to commercial property investors.

Destinations Related to this TIPS Spread Post: