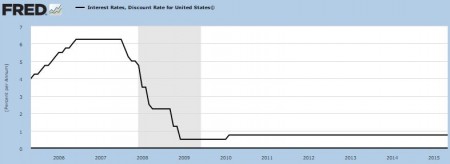

About a month ago, we reached out to a couple of our favorite banking contacts to get some current guidelines for financing of Miami area commercial properties. The near zero short term interest rate environment we have enjoyed since the end of 2008, as evidenced by the “Code Blue” chart pattern at right of the Federal Reserve Discount Rate for the past 10 years, presumably cannot go on forever. What follows is a synopsis of these conversations.

The first bank stated a willingness to finance at a loan to value ratio of 65-75% with debt coverage of at least 125%. For non-recourse loans, including non U.S. based investors, which are generally treated as non-recourse, the loan to value ratio would be more like 50% to 60%. They are generally comfortable with up to a 20 year amortization, perhaps 25 years for multifamily. At the time of the conversation in early May, their 3, 5, 7 and 7 year fixed rates ranged from 3.65% to 4.75%.

The second bank gave similar guidance. They stated a willingness to go to an 80% loan to value ratio for multifamily, or 75% for office, also with a debt coverage ratio of 125%. For non-recourse, they stated that the percentages they are willing to finance drop by about 20% as a percentage of the total. They also noted that, “true of all banks,” they will charge a vacancy rate, 3% minimum for reserves, and a 5% minimum management expense for NOI calculation.

We are only relaying a conversation. For actual terms, you would need to speak with the bankers directly. Contact me and I’ll put you in touch with my preferred contacts.