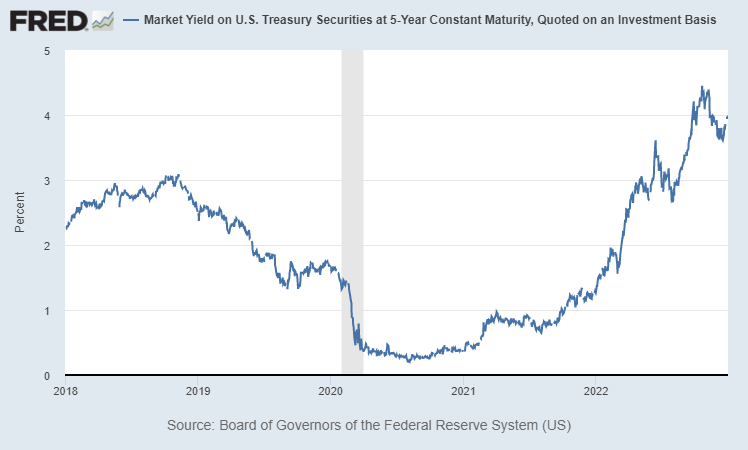

The interest rate environment has changed fairly dramatically over the past 18 months. At the end of 2022, five year treasury rates, most closely tracked for commercial property borrowing cost, closed at 3.99%, up from the 0.2% to 0.4% range it was bouncing around within during the months preceding February 2021. If one considers this essentially 4% versus 0.5%, then this would represent a 350 bp increase. If CRE financing is assumed at 2.25% over the five year treasury yield, this would mean an interest rate of 2.75% would increase to 6.25%, more than double. Considered practically, the principal and interest (P&I) for a 15 year mortgage, per million, would increase 26% from $9,784 to $12,326. For a 25 year million dollar mortgage, it would increase by 48%, from $6,651 to $9,483. Considering this in reverse, buying power in terms of P&I, i.e. debt per dollar of P&I, decreases by 21% for a 15 year mortgage, 30% for a 25 year, given these assumptions. These are hypothetical assumptions, mind you, but the real effect in the marketplace has at least approached these levels. The bottom line is that buyers utilizing financing to purchase property now have larger monthly debt service expense at the same price, and consequently have reduced buying power. Those buyers paying cash in turn have less competition.

“A bank is a place that will lend you money if you can prove that you don’t need it.”

~Bob Hope

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates.