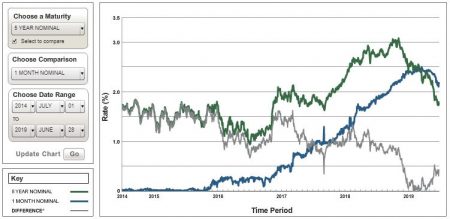

5-Year and 1-Month Treasury Yields Five Year Chart Ending June 30, 2019 for Consideration of Commercial Real Estate Borrowing Cost

At the end of the 2nd quarter of 2019, both short and intermediate yields continued their decline from higher levels reached late in the prior year. Also of note is that the yield curve has inverted, with five year rates higher than short term, as can be seen here with 1 month treasuries yielding more than those with five year maturities. Historically, an inverted yield curve is highly predictive of a looming recession. This time. I can tell you with absolute certainty what this means, but in a couple of years. After all…

“It’s tough to make predictions, especially about the future.”

~Yogi Berra

For borrowers financing commercial real estate the news here is great, from a financing cost perspective, as five year rates, most closely tracked for commercial property borrowing cost, declined to under 2% on a nominal basis, “happy money” levels. Meanwhile short term rates, here represented by 1 month treasury rates, hovered just a touch above 2% in this inverted environment.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates.