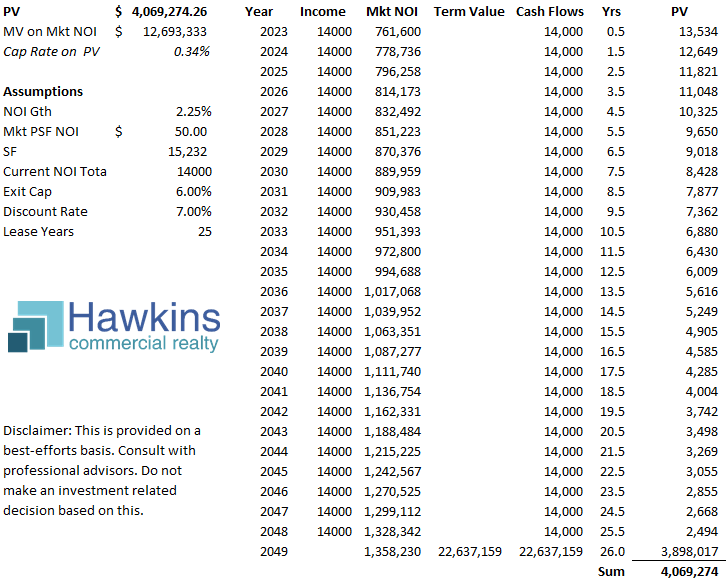

Calculation of Discounted Present Value of Cash Flows for a Below Market Rent Ground Lease with 25 Years Remaining

We recently had an owner of land on which a 99-year ground lease had been put in place nearly 75 years prior ask us for a broker opinion of value. The lease was at a flat annual rent, plus expenses, with no escalation, and is a fraction of current market rent for the property. Given my Wall Street experience, this seemed very much in my wheelhouse.

Given the length of a ground lease like this, though it is a real estate interest, this would have financial characteristics more like a financial instrument. Each income stream until the end of the else is seemingly highly secured and specifically defined. The rent payments can be discounted back to a present value; it is only a matter of deciding on a discount rate. The value at the end is not known exactly, but can be reasonably projected, which for purposes of selling to another really means “negotiated.” That projected value can then also be discounted back to a present value. There are a few variables to plug in to estimate the present value. Modifying these changes the present value calculation.

The calculations at the top of this post summarize my thoughts. If the property was owned currently, the market value would likely be approaching $13 million. However, what is owned is encumbered by a below market lease. The present value of that income stream and the termination value at the end, the escalated net operating income assumption divided by the assumed exit cap rate, discounted back at 7%, works out to a present value of just over $4 million.

The assumptions can be tweaked, but there was thought put into each of these. The discount rate is a big one, for example. Given the lack of liquidity, inexact termination value, limited buyers for such an asset, etc., a discount rate 235-ish basis points over the 10- or 30-year treasury seems warranted.

In the end, it is of course what a buyer is willing to pay. For a certain type of buyer, however, this would also be a sweet deal. Much of the highly secured return would come from the discount, which as I understand it would be a tax deferred return that would step up in basis on an owner’s death. Thus, perhaps a higher price / lower discount rate deal could indeed be struck. In any case, it will be at a steep discount to the market value of the property if it was free and clear of any lease.

The owners did nothing. I got the feeling that they’d had someone less sophisticated tell them they could get more. Discounted present value of cash flows is a fairly straightforward concept and calculation, but the eyes of many with a real estate license will gloss over at the utterance of those words in sequence. In any case, as soon as I hear the specifics of this, I figured it would go nowhere. As I told the owners in our discussion, if they don’t need the current income – and they do not seem to – why sell it? It made for an interesting exercise, in any case.

This exercise also brought to mind a couple of owners of undeveloped commercial land that stubbornly only want to execute a 99-year ground lease on their properties. Most developers want to own, they don’t want a ground lease, and banks don’t love financing them. This thus narrows your pool of what I will still call buyers, as a 99-year commitment is more like a purchase than a lease. Also, as evidenced by this situation – an eye roll and chuckle to accompany any reference to “Great Grandpas’ great deal” – a lot can change in 99 years.

In conclusion, the evaluation of a long-term ground lease encompasses a multifaceted analysis that extends beyond mere financial calculations. While the discounted present value of cash flows forms the cornerstone of valuation, it’s crucial to navigate through legal intricacies, anticipate market trends, and meticulously assess associated risks. Moreover, understanding the tax implications and exploring comparative data provide invaluable insights into the lease’s true worth. As we contemplate the future, it’s imperative to consider a spectrum of exit strategies and investment avenues, tailored to the lessor’s objectives and market dynamics. By embracing this comprehensive approach, stakeholders can unlock the full potential of their real estate interests, transcending the boundaries of time and capitalizing on opportunities that endure across generations.

~

The numbers have been modified versus the actual situation in the interest of keeping the owner unidentifiable; I’m a stickler for maintaining confidentiality. Nonetheless, the ratios are similar. If you could have an interest in this, contact me. The owners may or may not be sellers.