Design District Shopping Center Sells for $18M

A joint venture between TriStar Capital LLC and Principal Real Estate Investors sold the retail shopping center located at 3946 N. Miami Ave. in Miami, FL for $18.7 million, or approximately $1,500 per square foot, to L3 Capital LLC. The 12,292-square-foot asset is located within the Miami Design…

Green Cos Secures $25M Refi for Dadeland Centre II

Green Companies secured a $25.2 million refinancing for its Dadeland Centre II office building at 9150 S. Dadeland Blvd. in South Miami. Holliday Fenoglio Fowler, L.P. (HFF), led by Paul Stasaitis and Jose Carrazana, arranged the 10-year, fixed-rate, securitized loan, placing it with New York…

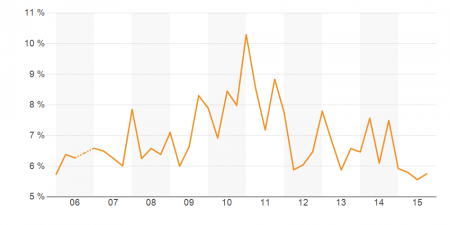

Cap Rate for Miami-Dade Retail Property Remains Just Under 6%

Cap Rate for Retail Properties 5,000 sf or Larger within Miami-Dade County, Florida in the 0 Years to 2015

The capitalization rate (cap rate) for retail properties in Miami-Dade County that are 5,000 square feet or larger (4,855 properties), as reported by Costar, remained under 6% in the most recent…

801 Brickell Brought to 95 Percent Leased

During the past 12 months, Colliers’ Stephen Rutchik has closed more than 50,000 square feet of leases at the 415,000 square-foot building. ents one of the top-five largest leases of 2015 in Palm Beach County.

$1B Armani Tower is Related Group’s Most Expensive Project

Residences by Armani/Casa broke ground in Sunny Isles Beach, per The Next Miami, and at the cost of $1 billion will be Related Group’s most expensive project ever according to Related founder Jorge Perez. The 60-floor project co-developed by Related Group and Dezer…

Miami vs. New York, Compared by Neighborhood Prices

The chart below compares neighborhoods in New York City and Miami by purchase price per square foot, courtesy of our friends at NeighborhoodX, the same folks who showed us what $1 million in rent yields across 14 Miami neighborhoods. For the high…

The Temple House on South Beach Adds Projection Mapping

Just about a year ago, South Beach’s The Temple House hit the market for $19.9 million. The residence/commercial space that has welcomed celebs like One Direction, Kim Kardashian, Jay-Z and Jennifer Lopez for photo shoots, music videos and television shows has added a new wild…

$22M Waterfront Acquisition Paves the Way for Elysee Miami

Two Roads Development closed on a $22-million purchase of waterfront land on Biscayne Bay that will house Edgewater’s newest luxury tower in the 57-story Elysee, which is scheduled to break ground by the second quarter of 2016. Located at 700 NE 23rd…

5 Breathtaking Photos of Miami at Night

Miami gets tons of pub for its sunny and sandy beaches, but often overlooked is just how much the Magic City glows when the sun plummets and dark skies engulf the ever-changing skyline. There’s nothing like a peak South Florida sunset, backdropping…

The See-Through LLC: Federal Tracking Of Real Estate Shell Companies Is On The Rise

In Miami-Dade County and Manhattan, be prepared this year for unprecedented federal oversight in the real estate deal space. Prompted by worries about money laundering, the US Treasury Department has announced it intends to require certain US title companies to identify the natural persons behind…

Commissioner: vote on Miami 21 changes could be deferred

A controversial amendment to the Miami 21 zoning code will likely be deferred a second time as its author hammers out the kinks, according to city commissioner Francis Suarez. The proposal met stiff resistance from Miami’s real estate…

Codina and Lennar to buy, redevelop White Course in Doral

In one of the priciest land deals in Miami-Dade County history, Codina Partners and Lennar Corp. are set to close on a joint purchase of the White Course in Doral, with plans to redevelop the golf course into a mixed-use project, The Real Deal has…

Billionaire Ken Griffin wants to flip his Faena penthouse: $73M

After buying a penthouse at the Faena House for $60 million last year in Miami-Dade’s top residential purchase, billionaire hedge funder Ken Griffin has put the property back on the market for $73 million. Griffin never combined the…

Terra unveils plan for 47-acre Pembroke commercial project

Terra Group President David Martin and the firm’s Pembroke Pines City Center project

Miami’s Terra Group has released details for its Pembroke Pines City Center commercial project, which promises to bring lifestyle-oriented retail spaces and residences to the Broward city. The development…

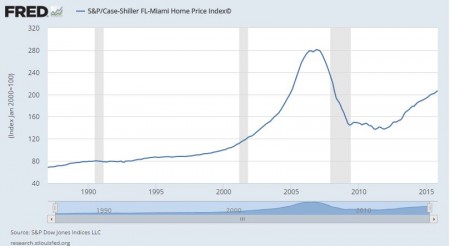

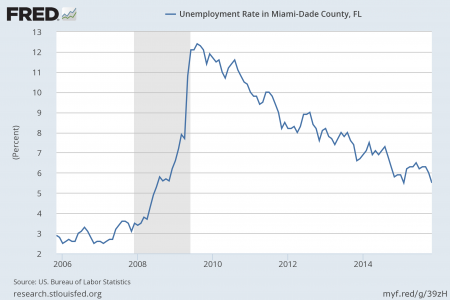

Miami-Dade falls to fifth place for most distressed properties

Miami-Dade County, once center stage for the U.S. foreclosure crisis, has fallen to fifth place out of the country’s biggest hot spots for distressed properties. Out of all the homes sold during November…

5 trends real estate investors should pay attention to in 2016: VIDEO

As foreign buyers flock into Miami real estate, the local market is increasingly at the whims of global forces. If investors and developers want to understand where the market is heading, they need to keep an eye to some major trends happenin…

Terra buys parking garage, retail in Coconut Grove for $16M

David and Pedro Martin’s Terra Group has picked up a Coconut Grove parking garage with retail for $16 million.

Miami-Dade County records show the city of Miami Parking Authority sold the Oak Avenue Parking Plaza at 2860 Oak Avenue. The garage was…

How Miami Industrial Stacks Up Against Other Metros

“There’s upside in industrial if owners can figure out a way to bring in all costs at $120 per square foot.”

Funding Arranged to Start Major Miami Waterfront Project

Famed Jockey Club site to re-emerge as a destination development offering luxury residences with a bay view.

How This Obama Move Impacts Foreign Investors

Although the United States has always been open to foreigners investing here, there is also a movement for more transparency.

This Miami Market is on Fire

“Investors of all sizes are clamoring to find acquisition opportunities in the region.”

Seminole tribe unveils $1.8 billion plan for Hollywood hotel

Seminole tribe unveils $1.8 billion plan for Hollywood hotel

Ten Year Lease Negotiated for Massage Envy Spa

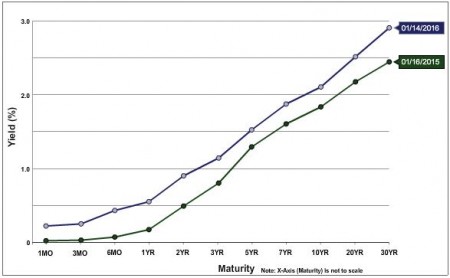

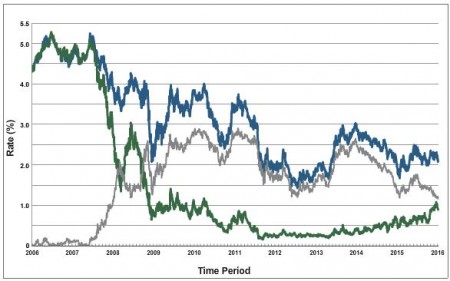

Ten Year Lease Negotiated for Massage Envy Spa The Federal Reserve has released its

The Federal Reserve has released its