Real Page Director of Analytics Jay Parson joins host Michael Bull to discuss the growth of the multifamily market and share predictions for the market in 2016.

Real Page Director of Analytics Jay Parson joins host Michael Bull to discuss the growth of the multifamily market and share predictions for the market in 2016.

The Miami DDA has released it summer residential market research report. Some key points include:

The Miami DDA has released it summer residential market research report. Some key points include:

For more detailed information, view the full report here.

As anyone looking for office space in Coconut Grove can attest, finding space is no small task, and when you do, beware, it is a lessor’s market. Development in the area has been dominated by high-end luxury condos, perhaps keeping new office space from being developed.

Charts courtesy of CoStar.

The returns than investors in individual condo units will settle for never cease to surprise me. It makes some sense to settle for less return, somewhat less, as investing in a condo is easier and more hassle free. Also, there is a “strength in numbers,” “standardization of value” aspect to it, with properties selling for more or less some price simply because they do, and reliably so. However, I submit that it comes at a price.

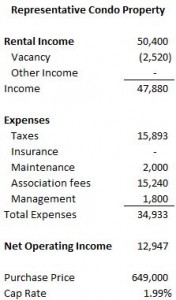

To illustrate this point I am going to to a use a representative condo in Miami as a comparison versus a typical multifamily property. There was a sale of a condo in at an established and nice building for $650,000. This particular unit will have property taxes of about $13,900 for an investor, and condo association fees of $15,200 per year. In addition to this, the condo, on average, has about $2,000 a year in additional maintenance costs, appliances, carpet, paint, and other maintenance expenses not covered by the association. Occupancy is strong at the building, so a low vacancy assumption of 5% is reasonable. Additionally, given that this is a condo, and as such that it has on site management, a lower management cost (allocation if self-managed) is also reasonable. We’ll assume a low $150 per month in management cost, $1,800 annually. Fair rent for this property is about $4,200 per month.

To illustrate this point I am going to to a use a representative condo in Miami as a comparison versus a typical multifamily property. There was a sale of a condo in at an established and nice building for $650,000. This particular unit will have property taxes of about $13,900 for an investor, and condo association fees of $15,200 per year. In addition to this, the condo, on average, has about $2,000 a year in additional maintenance costs, appliances, carpet, paint, and other maintenance expenses not covered by the association. Occupancy is strong at the building, so a low vacancy assumption of 5% is reasonable. Additionally, given that this is a condo, and as such that it has on site management, a lower management cost (allocation if self-managed) is also reasonable. We’ll assume a low $150 per month in management cost, $1,800 annually. Fair rent for this property is about $4,200 per month.

These assumptions are displayed at the right under the heading “Representative Condo Property.” As can be seen, the net of this is that an investor’s current return on investment from net operating income, i.e. its cap rate, would be equal to about 2% of the purchase price.

Now let’s consider the purchase of a typical multifamily property investment in the area, one with several units. The properties tend to provide a current return (net operating income / purchase price) today in the 5% to 7% range. For purposes of comparison, we’ll assume a purchase price affording a 6% current return (capitalization rate). This return could be construed as apples to apples as in both cases, for the individual condo and the multifamily property, the returns are for net operating income including expenses, whether paid or internally allocated, for management of the property.

Here is where I’ll lose some people, but not the truly investment minded. Prices over time should more or less move in line with changes in rental income. With multifamily properties, which are traded as investment vehicles, this tends to be the case in the short-term and long-term, adjusted for changes in interest rates, projected rental income growth, and other economic variables that affect the cap rate. With individual condos, the low cap rate hints at a different kind of market, more like art than of an investment, such that in the near term they can move out of lockstep with rental income. Over time, however, the movement should be more or less in line with changes in rental income.

So what kind of return does this offer? Above, we’ve crunched the numbers, showing the returns for an all cash buyer given different rental growth rate assumptions. This analysis shows that, with the higher 3% rental growth assumption, the after tax return equates to 3.5%, a 5.6% pre-tax equivalent in the highest bracket. These returns are better than the 1.99% current return, but are still not so exciting, particularly given that investing in real estate involves risk and lack of liquidity.

Few investments in condos have been made with this low of an exception of return, so what gives? Buyers of individual condos seldom make any such calculations. They don’t do it today, and they’ve not done so for years. Consequently, values have increased well in excess of rental income growth in recent years, and buyers have no clear reason to expect that this will not continue. I can’t make a rock solid case for the “end of the party” in the near-term, either.

At this point I need to mention that leverage isn’t much of an option in this individual condo analysis. Given that current rates are more than twice as high as the cap rate, income wouldn’t cover the interest, let alone amortization, even with a 50% loan. Any amount of leverage would decrease income in this example, and would result in lower returns with any reasonable set of assumptions.

Now let’s consider a typical multifamily investment using the same assumptions but with a 6% cap rate. As can be seen at right, the higher current income results in higher rates, 5.8% after tax, a 9.7% pre-tax equivalent for investors in the 39.6% bracket, again assuming the higher 3% net income growth rate. Looked at differently, one could say that an investor is behind 3.1% per year with the individual condo investment versus a typical multifamily property. This may not sound like much, but it builds over time.

Further, given that in this case the cap rate is higher than prevailing mortgage rates, the multifamily property allows for leverage to be utilized to enhance potential returns. Above, we’ve assumed 40% of the purchase price is borrowed at 4.5% with a 25 year amortization. As can be seen, with the higher 3% rental income growth rate assumption, returns bump up to 7.6% after-tax, a 12.6% pre-tax equivalent at the 39.6% tax bracket. Given some of the comforting aspects of real estate ownership, that you can touch it, this is the kind of return that compares favorably with other investment alternatives.

Walter Page, Director of Research for Costar Group, joins host Michael Bull to discuss the office market.

Scene from Miami City Commission Meeting on November 19, 2015 Where a Vote on Controversial Changes to the Miami 21 Zoning Code Were Deferred

The Miami City Commission elected to defer a vote on controversial changes to the Miami 21 Zoning Code until late January. The changes are controversial mainly as they would drastically increase the minimum lot size for development in some transects.

A video of the meeting may be viewed at the City of Miami’s Live and Archived City Commission Page. From that page, view the November 19, 2015 Planning and Zoning meeting.

Walter Page, Director of Research at the CoStar Group, joins host Michael Bull to discuss the current state of the office Investment market.