In this video from 2014, a panel consisting of Avra Jain of the the Vagabond Group, Jodi McLean of Edens, and Vincent Signorello of Florida East Coast Industries discuss South Florida commercial real estate.

In this video from 2014, a panel consisting of Avra Jain of the the Vagabond Group, Jodi McLean of Edens, and Vincent Signorello of Florida East Coast Industries discuss South Florida commercial real estate.

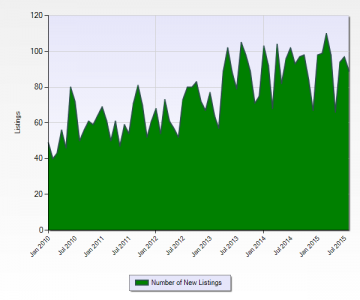

New Commercial/ Business/ Agricultural/ Industrial Land MLS Property Listings Miami-Dade County January 2010 to August 2015

New listings for commercial/ business/ agricultural/ industrial/ land dipped from 97 in the prior month to 89 in August. This level remains, however, elevated relative to levels in prior periods, as can be seen in the accompanying chart. It is considerably higher than recent dips to the mid 60s in recent months, and is higher than that for any month prior to April of 2013.

In the seven days to September 28, 2015, MLS shows 69 new listings for improved commercial/industrial properties within Miami-Dade County, down somewhat from 90 in the prior week ending September 21st. Notable among the listings is the former Parkway Medical Center, an 11 story vacant building in Miami Gardens with an asking price of $7 million.

In addition to the 69 new improved commercial property listings in Miami-Dade County, 3 properties were put back on the market. Twenty eight improved commercial properties already listed had their asking price decreased, while 8 saw their price increased. Also during this period, 22 closed sales were recorded in MLS in the county for improved commercial property.

Other indicators during this time that commercial real estate investors may desire to review are trends in commercial real estate prices and availability. These metrics are influenced by trends nationally as well as by demographic and economic trends and expectations in the area. To get an idea for how the market is today, view Miami area commercial property listings filtered by zip code, price range, or property type.

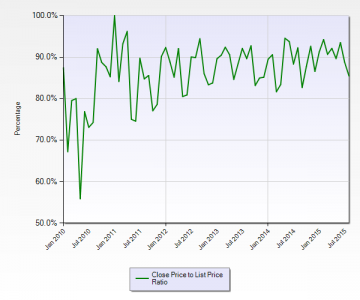

Miami-Dade County MLS Commercial/ Business/ Agricultural/ Industrial Land Closing Price to List Price Ratio January 2010 to August 2015

The closing price to listing price ratio for commercial/ business/ agricultural/ industrial land, for those transactions recorded in MLS, edged down in August to 85.5% from 88.8% in the prior month and 93.5% in the month before that. Considered over a longer period, this ratio falls more in the middle of a range since early 2011 of more or less 82% to 92%.

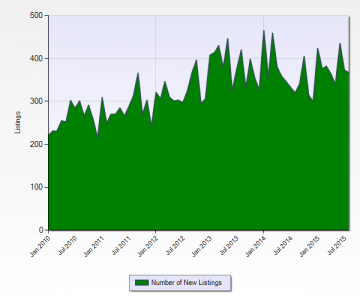

Commercial Improved New MLS Miami-Dade County January 2010 to August 2015

The number of new commercial improved property listings in August dipped a bit from the prior month to 367 (from 373). This level, however, remains consistent with a general upward trend in this metric, as such new listings have steadily risen from just over 200 monthly in early 2010 to around 300 a couple of years later and today to near or more than 400 in most months.

In the week to September 21, 2015, MLS counts a 20 new listings for commercial/business/agricultural/ industrial land, a low number, but up slightly from the prior week ending September 14th which had a rather paltry 16 new such listings. Notable among this week’s listings is a set of 3 adjacent lots on NE 34th Street with T6-36 zoning and with an asking price of $7.5 million.

Fifteen commercial land (commercial, business, agricultural, industrial land) already listed had their asking price decreased, while 3 saw their price increased. Also during this period, 5 closed sales for such were recorded in MLS in the county.

Other indicators during this period that commercial property investors may want to review are trends in commercial property prices as well as availability. These tend to be influenced by trends nationally and by demographic and economic trends and expectations in the area. To get more of a feel for how the market for vacant land is at the moment, view Miami area vacant land listings,

Days to sell commercial improved property in Miami-Dade, where recorded in MLS, remained low in August as it dipped from an already low 110 to 104. This is not as low as the 79 level reached years prior, or the 83 days reached this past June, but nevertheless remains around a low “more or less 100 days” that this metric has hovered around for the past year or so after, in prior periods, moving around from 100 up to 150 days or more.

In the seven days to September 21, 2015, MLS shows 90 new listings for improved commercial/industrial properties within Miami-Dade County, up a bit from 83 the prior week ending September 14th. Notable among the listings is Miami Design District trophy property with an asking price of $11 million.

In addition to the 90 new improved commercial property listings in Miami-Dade County, 9 properties were put back on the market. 47 Improved commercial properties already listed had their asking price decreased, while 26 saw their price increased. Also during this period, 34 closed sales were recorded in MLS in the county for improved commercial property.

Other indicators during this time that commercial real estate investors may desire to review are trends in commercial real estate prices and availability. These metrics are influenced by trends nationally as well as by demographic and economic trends and expectations in the area. To get an idea for how the market is today, view Miami area commercial property listings filtered by zip code, price range, or property type.