Miami-Dade College history professor Paul George remembers when Flagler Street was literally Miami’s main street. “Growing up here in the 1950s,” he says, “downtown was the center of almost everything. There were movie theaters, Burdines, five-and-dime stores. It was…

700 Midtown rentals get cold shoulder

A developer’s plan to turn half a dozen acres next to Midtown into row upon row of rental apartments is in limbo after a less-than-favorable examination by the city’s Urban Development Review Board. The angular site on Northeast Second Avenue hugs the FEC railroad tracks and is…

Goldman Properties buys Wynwood Doors in Miami for $12 million

Goldman Properties has acquired more land in Miami’s Wynwood neighborhood with the purchase of mural project Wynwood Doors. The 31,000 square feet of land and 3,960-square-foot warehouse are directly adjacent to Wynwood Walls, a large collection of graffiti and street art from notable artists, which gives the neighborhood its…

Marlins Could Kill Soccer Stadium; Mayor Consults Lawyers

Mayor Tomás Regalado was apparently unaware of the rights that the Marlins have to essentially kill a soccer stadium next to Marlins Park, until Michael Lewis wrote about it in Miami Today last week. Beckham’s partners were also apparently not informed of those issues by local politicians, who had pushed for the soccer stadium…

Adult entertainment firm buys Miami Gardens site for $15M

An adult entertainment company has picked up a warehouse, showroom and strip club in Miami Gardens for 15,300 stacks, or $15.3 million, according to Miami-Dade County records. An affiliate of RCI Hospitality Holdings, a publicly traded operator of strip clubs, nightclubs and adult entertainment websites, was the buyer. Strip club…

826-836 interchange on fast track

While all the finishing touches on Miami-Dade County’s most impactful road project – the interchange of state roads 826 and 836 – won’t be in place until January 2016, “We expect the project to be substantially completed by the end of this year,” project spokesman…

Niche in container market pays off big

A Florida East Coast train arrives at the PortMiami via an on-dock rail connection in the morning, then departs in the afternoon, carrying with it an assortment of commodities that range from garments to waste paper to refrigerated cargo. As of July 28, the two-year-old rail service had transported…

Push to handle air traffic boom

With numbers of passengers and flights entering and leaving Miami International Airport continuing to outpace projections, the airport is pushing forward efforts to accommodate the influx. Those efforts include changing the airport’s infrastructure as well as working closely with…

Which way will Calle Ocho run?

Residents and business people in East Little Havana, a historic neighborhood at the western edge of booming Brickell, are concerned about changes that are coming for two major streets that slice through the area. The Florida Department of Transportation in June completed a study of Southwest Seventh…

CBRE Arranges 50,000 SF Lease For Healthcare Tech Company

The company is expanding its operations and plans to hire approximately 500 employees from Deerfield Beach and surrounding communities when it opens on August 16.

NAI Miami To Offer Private Equity Development To CRE Clients

NAI Miami will work together with 607Cogent to offer this unique service to its retail clients.

Former Carlisle Development Group CEO Matthew Greer and five others were charged Tuesday with conspiring to defraud the U.S. government out of millions of dollars through a low-income housing scheme, the U.S. Attorney’s Office for the Southern District of Florida announced. About $36 million in funds were stolen because…

213,000 SF Miami Airport West Industrial Facility Trades

CBC Alliance Miami Managing Principal Jim McCoy and Jeff Hartsook of Americas Industrial Realty Corporation exclusively represented the seller, Leyjon Investments Corp, in the $15 million, all-cash transaction.

Adler Group Buys Vacant Lot For $14.25 Million

Zoning for the parcel allows for a developer to build up to 36 stories, or up to 60 stories if the builder uses the bonus program under the Miami 21 Zoning Code.

Turnbridge Equities Acquires Entire Block On Washington Ave.

Miami Beach-based Turnbridge Equities has acquired a pair of older retail properties located at 601-615 Washington Avenue and 657-685 Washington Avenue in Miami Beach from GSL Management. Turnbridge paid $36 million or about $621 per square foot for the buildings, which were purchased for their land…

The very slim Mansions at Acqualina has been completed, received its TCO (Temporary Certificate of Occupancy), and is ready for move-in, according to the developer. Oh, and the joint is completely sold out, which means that the Palazzo di Richezze, the building’s $55 million…

Two Years Late, Merrick Manor is ‘One Step Closer to Groundbreaking’

We originally reported that Merrick Manor, the luxury midrise condo tower in Coral Gables, was set for an August groundbreaking, exactly two years ago. So, obviously something came up, and that something was all that drama over Trolleygate. Finally it’s August again and Merrick…iece up, arguing that a certain gang of decor trends are so ubiquitous that they’re “on the verge of extinctio…

One Thousand Museum’s Thrillingly Glass-Walled Rooftop Pool Could Quietly Lose its Glass Wall

One Sotheby’s, the official leasing agent of Zaha Hadid’s One Thousand Museum condo tower, has dropped a few new renderings on its blog of the penthouse, two-level rooftop amenity area, and the lower pools on the amenity deck. Everything looks shiny and gorgeous, including a long blank wall on…

On the market: $20 Million for Almost An Acre of Land on North Bay Road?

The Jills have listed a 37,895 square foot bayfront vacant lot on North Bay Road for $19.95 million along with floorplans for a contemporary house, making it the largest and most expensive empty lot and the fourth most expensive listing on the road. It may not be as wildly overpriced as two other…

National Commercial Real Estate Roundup For August 3, 2015

Like-kind exchanges get a census, Q2 sales slump, office construction booms in ten markets, an intergovernmental turf war, and what does $12 million get you in Milwaukee? It’s all here at the Commercial Real Estate National News Roundup for August 3…

One of the largest available land sites in Miami-Dade County has been sold. The 95 acres of land is located in the Redland on Southwest 328th Street just west of 217th Avenue. The sale price was $2,775,000 or about $29,000 per acre. ComReal Miami’s…

American Dream Mall Will Have World’s Largest Indoor Ski Slope

Being called a luxury shopping and entertainment center rather than a mall, skiing, sledding, tobogganing and ski instruction will be available daily.

Opa-Locka warehouse trades for nearly $6M

A warehouse in Opa-Locka traded hands for nearly three times its last sale, Miami-Dade County records show. The 91,813-square-foot building, at 12845 Northwest 45th Avenue, sold for $5.8 million to S.K.L. of Miami Inc. The company lists Sang….

Hotel Astor in Miami Beach granted EB-5 status

After a grueling two-year application process, Miami Beach’s Hotel Astor has been granted EB-5 status by the U.S. Citizenship and Immigration Services office, The Real Deal has learned. That means the 18 investors from Brazil, China, and…

Hotel sales in 2015 reach $42B worldwide

From the New York website: It seems like Monopoly had it right: it’s all about the hotels. Global investors poured a whopping $42 billion into hospitality properties in the first half of 2015, with Asian and Middle Eastern buyers providing a major boost, according to JLL…

Office building along Biscayne sells for $11.5M

A Miami investor has sold a five-story office building in Miami, according to county records. The Sunset View Office Tower, at 4700 Biscayne Boulevard, sold for $11.5 million. An LLC led by Pablo Umansky was the seller. Miami Beach-based MGB Biscayne Blvd. Corp….

How to Attract More CRE Millennials

More than one-in-three American workers today are Millennials. How can the commercial real estate industry prepare for the future?

55 Miracle Mile Sees Breakthrough

“Our team took over the leasing four months ago, and we were able to bring the vacancy rate down to…”

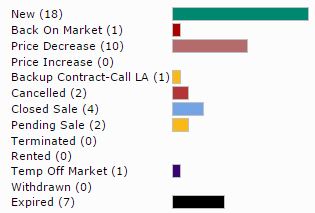

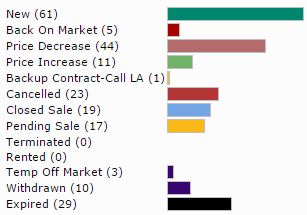

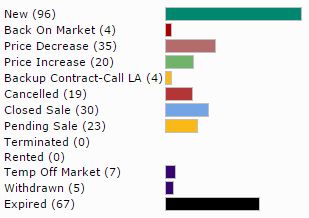

al number of active commercial/ business/ agricultural/ industrial land

al number of active commercial/ business/ agricultural/ industrial land

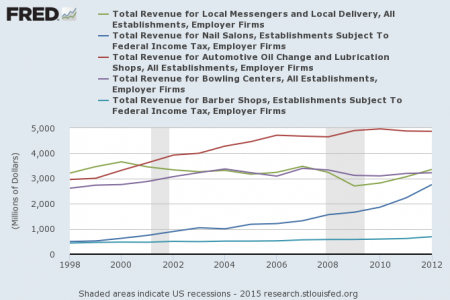

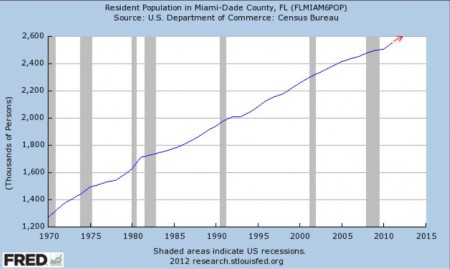

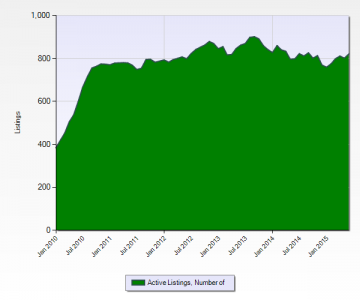

Development, likewise, tends to gravitate toward the middle of economic activity. Progress in areas north and west of Miami in recent years cause me to suspect this gravitational pull is increasingly to the north.

Development, likewise, tends to gravitate toward the middle of economic activity. Progress in areas north and west of Miami in recent years cause me to suspect this gravitational pull is increasingly to the north.