When considering changes or potential changes in commercial real estate capitalization rates (cap rates), market participants tend to most commonly think of interest rates. However, rent growth assumptions also affect cap rates as the more one expect earnings to grow over time the less return an investor is willing to accept now. This is just like growth stocks in the financial markets, the higher a growth ratio the higher the PE (and thus the lower the earnings yield, a calculation for companies essentially equivalent to a cap rate). I know this intuitively, and commonly mention it to commercial real estate investors coming from other markets with lower assumed and historical rent growth; “cap rates are lower here as rent growth assumptions are higher.” I find it is generally not discussed – almost never, actually – by most market participants, but one can nonetheless see such effects in pricing. In writing this article I’m taking my first stab at quantifying the math of it. Here goes.

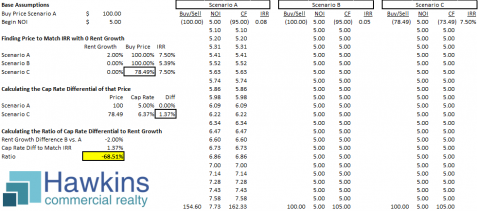

In the above I’m attempting to quantify a ratio is between rent growth and cap rates. I’ve done this by calculating how much lower a price would need to be assuming 0% rent growth (scenario C) to have the same IRR as if the rent growth rate was 2% for a purchase made at a 5% cap rate. Then, the implied cap rate for the lowered price (scenario C priced lowered to match IRR of scenario A) at purchase is calculated, then the difference in these two cap rates, then the ratio between the difference in rent growth (2%) and this cap rate differential (1.35%). This arrives at a ratio of -68.51%. In other words, according to this calculation, for every 1% change in rent growth assumption, the cap rate should decrease by .69%.

Let me say this ratio is bogus, then add that it is not. First, I’ve never seen this calculation done in practice, thus it seemingly isn’t actively considered, though the effects surely come into play for more sophisticated buyers doing long-term projections. Second, there are numbers of variables that could affect this. Taxes and their effects on investor decisions are ignored in the above, as are transaction costs. Plus, there is nothing magic about the twenty years I’ve chosen above. Change this to a shorter or longer period and everything moves. Finally, improved real estate over a long period of time tends to depreciate to land value, which is evidenced incrementally as cap rates steadily increase as a property ages (and drops in class). That effect is ignored in this. Thus, this is somewhat bogus. However, it isn’t in that it is a calculated measure of the effect on IRR of rent growth, and the adjustments necessary to make returns in the form of IRR equivalent and the resultant affect on cap rates as a ratio of rent growth. What I want to illustrate is not an exact effect, but that there is an effect and that it is not inconsequential. It is not the exact ratio that is valid, it is the general effect.

In practice, I would mark this ratio down to “something approaching half.” This not only serves to pull away some of the effects on IRR of rent growth that are noted in the prior paragraph, it also matches my personal observations as an active market participant. This exercise has provided me me with one calculated mathematical ratio, using a method, likely not nearly the most elegant, of surely many others. In the past, I’ve generally noted that rent growth rates in Miami tends to be assumed to be higher than many markets, and that drives down our cap rates. That is more than what most of my competitors would say, but still just a general approximation that, not adequately substantiated, likely tends to go ear to ear nonstop and out of a listener’s mind without registering. Now, having gone through this exercise, I’m comfortable tightening this general statement to something like: the longer term IRR calculations indicate that cap rates should drop by about half a point for every percent higher rent growth assumed. Much better. Love it.

Note: Do me a favor and check my math. This spreadsheet was put together quickly, thus there could be a formula error within. This wasn’t super complicated and the result was not out of line with what I would expect, thus I didn’t fine-tooth-comb review it. If you find an error in these calculations or with my logic in general, let me have it.

Any and all facts, statistics, financial information, specifications, and analysis provided are on a best efforts basis only, and should not be relied upon for making real estate or investment related decisions. Nothing in this post should not be relied on for, tax, legal or accounting advice.