I find buyers commonly debating total monthly cash outlay to own versus that of renting in year one. Though I admire the cash-is-king disciple of this, I would submit that the projected net cost to own compared to that of renting is so attractive that it offsets the typically small differences in cash outlay at inception. After all, the difference, over time, tends to be staggering.

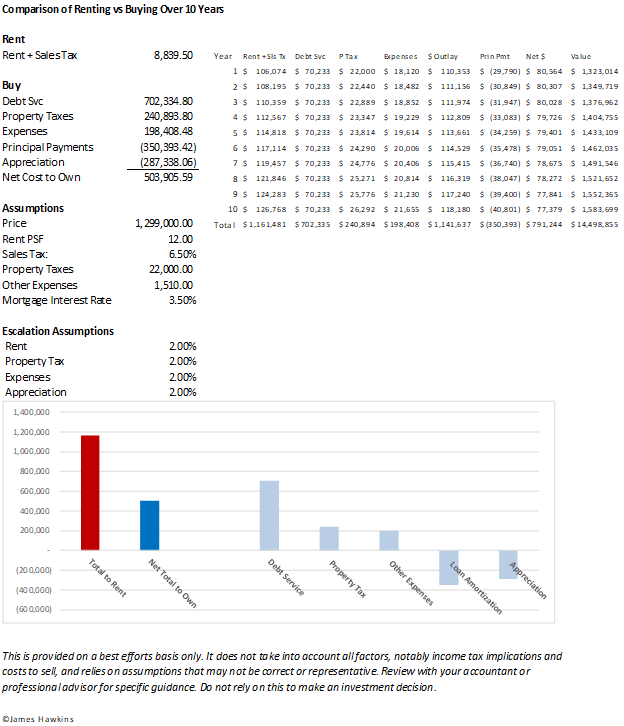

Consider an example, the detailed calculations for which are above, using a property that would rent for $8,300 per month gross, plus sales tax, thus $8,839.50 total. Assume this same property could be purchased for $1,299,000, and that total expenses of owning are $40,000 per year. Also, assume 90% financing at 3.5%, which I believe is available now by way of SBA financing. Finally, let’s assume rent escalates 2% per year, as is somewhat typical in leases, that expenses also increase 2% per year and that the property will appreciate by this same 2% per year.

Calculating the all-in costs of renting is easy. It is just total rent and tax, escalated by 2% each year. This adds up to $1,161,481.

Calculating net cost to own is a bit more complicated, but not overly so. It does, however, rely on assumptions to estimate a number. The formula for this is: debt service + expenses – loan amortization – appreciation. The “minus appreciation” aspect is often overlooked. If you occupy a building for a number of years that you then sell for more, that gain should be considered as reducing cost of occupancy over the term. Likewise, a loss should be considered an increase in the cost of occupancy, thus this can cut both ways.

Continuing with this same example, and assuming property value increases as rent increases, then net cost of owning over 10 years would net out to $503,905.59, as can be seen above. Notice that net cost to own is half the cost of renting in this example? That is fairly typical of most assumption sets. That’s my point; owner users (as buyers) commonly “step over dollars to pick up nickels” as they pay attention to current cash flow calculations without considering results for a longer term.

Granted, the assumptions to get to cost of ownership are only that. Generally, however, any number a buyer might reasonably plug in results in the same favorable comparison for buying versus renting. It should also be noted that this does not take into account taxation. Under current tax rules, however, I believe that would only make ownership yet more attractive, as the gain may be taxed at lower capital gains rates.

IMPORTANT: This is provided on a best efforts basis only. It does not take into account all factors, notably income tax implications and costs to sell, and relies on assumptions that may not be correct or representative. Review with your accountant or professional advisor for specific guidance. Do not rely on this to make an investment decision. Finally, don’t hesitate to contact me if you notice any glaring errors, as I’d want to correct such.