A vacant land owner, where the property that has seemingly topped out its HABU (highest and best use) potential, is forgoing potential income from reinvestment of potential sales proceeds (of the vacant land) for no apparent benefit. In other words, if HABU is topped out, there is not a higher value HABU to come, thus there is no HABU upgrade benefit potential. In surely any reasonable modeling scenario that forgone income would accrue to more than the value of the land in around 15 years. Also, as time passes, there is always the risk that something will change in the market or specific to the location to cause prospective buyers of the property with its current HABU to evaporate, with the value being less to buyers for the next in line highest and best use.

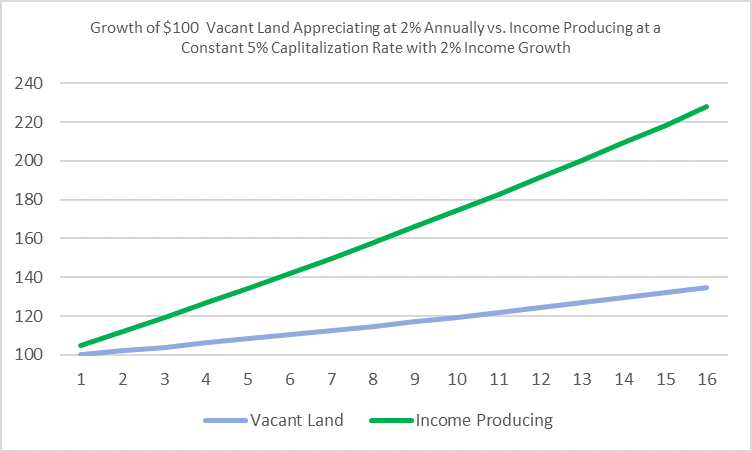

In the above chart two straightforward scenarios are illustrated:

Blue line – The blue line, shows the climbing of value vacant land with net operating income of $0, which is better than reality as in most cases vacant properties have net operating losses principally due to property taxes. As for the value accretion, here we are assuming the potential net operating income grows by 2% annually, and the the value moves in line with this potential income as would be expected over time and with other factors, cap rates a notable one, being constant.

Green line – This shows the same starting point, but here for developed property earning income at an initial cap rate of 5%, with net operating income growing by (the same as above) 2% annually, and with the cap rate remaining constant.

Which line would you prefer?

Alas, it may not be exactly as simple as that. Developed property over time may become obsolete, such that the value is only that of the land underneath it, or rent growth may become compromised such that the cap rate moves for the property. Regardless, given that with developed property you are earning and accumulating net operating income over time, such an owner will get so far ahead over time that there would in all probability be no contest between the two outcomes. Taxes also are not considered here. In any case, though one should speak with his or her accountant for guidance, under current tax law and assuming one took advantage of IRS Section 1031 to defer gains, I think most advisers would say the outcomes remain similarly disparate, as depreciation on improved property would largely offset taxable income on developed property.

You might ask; given this, why is there any undeveloped property?

I ask myself this all the time.

The truth is, the obvious HABU topped undeveloped properties are few and far between. Generally, these properties have been pursued, and owners have rationally arrived at a conclusion similar to the above. The math to get there may be somewhat different in path or assumptions, but it is so compelling few owners will resist in perpetuity. But there are exceptions. owners And, owners of properties for which HABU upgrades have increased values bask in their brilliance and thus are hard to reach with boring old “yeah but there’s no more” argument. This is reminiscent of an old Wall Street adage attributed to Humphrey Neill, the founder of the Contrary Opinion Forum; “Don’t confuse brains with a bull market.”

If you have a vacant piece of land with a market value of $3 million, you likely have a piece of land that could be monetized (rented) a bit more or less than $125,000 a year in this market, assuming it is land of interest to top quality credit tenants. The reason your land has the value it does is because of this potential income. Thus, by keeping the land vacant, an owner is only forgoing income that the property’s value could be garnering, income one could be earning if the property was sold and the proceeds were used to then purchase income generating property. Stated differently, there is opportunity cost – the loss of potential gain from other alternatives when one alternative is chosen – to holding on to undeveloped property.

This adds up over time. Bigly. These stories likely live in family legends, but only in their best PR form. There surely are countless family legends that ring like “your brilliant grandfather multiplied his money ten times on a piece of land” that should instead be “your grandfather multiplied his money 9 times in a ten year period on a piece of land, then stubbornly held on for the next twenty years as the property increased in value a mere 2% per year thereafter.

Granted, this isn’t the whole story. Sometimes there is the potential for a rapid change in the potential use of a property, particularly if a property is near a central business district. I would note, however, I’m not referring to properties like that. Also, vacant land doesn’t have zero income, it usually has either a net carrying cost, principally property taxes, or a small net operating income from pylon signage or other partial monetization. Also, in this chart above, I’ve not taken into account earnings from reinvestment of net operating income, which would make vacant land look even less appealing to hold.

Returning to Wall Street thinking as with the quoted adage above, an efficient market proponent would say that the above disparity, as significant as it is, is impossible. That person would be right, but wrong. The above underperformance of vacant land is not due to disparity of returns, but instead is due to the active choice of an owner ~ no decision is a decision. These owners are the equivalent of investors accepting less income, not less income with less risk, just less income.