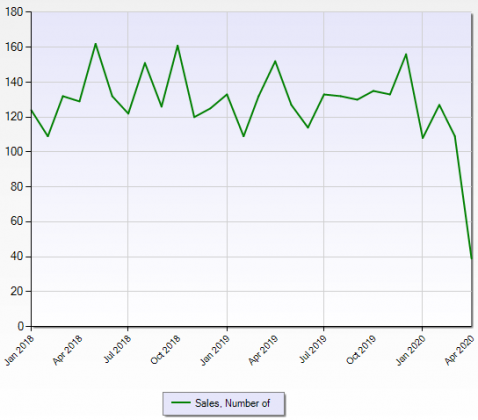

Miami Association of Realtor’s MLS commercial sales, charted above, may not be representative of all commercial sales, but they are representative of a level of sales such that one period can be compared to another. In the accompanying chart, one can see that closed transactions declined by 2/3 in April 2020, to 40, from a run rate of about 120.

Obviously, this is COVID-19 related. Though at any given point there are storm clouds on the horizon of one sort or another, all was going along swimmingly in the world of commercial property until coronavirus tipped arrows started flying. Ditto, well, about everything else…

Some of this slowing is surely closings that are delayed. To the degree that is the case, the effect would appear exaggerated. However, also true is that these closings likely are for contracts entered in before the pandemic, which would mean we’re not seeing the worst of it. Anecdotally speaking, I would say general transaction related activity dropped nearly 100% for about a one month period, but seems to be recovering as I write this.

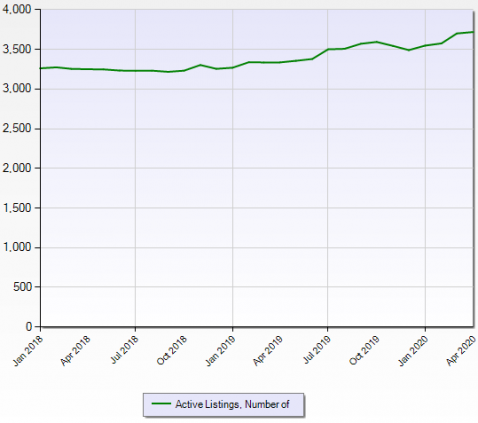

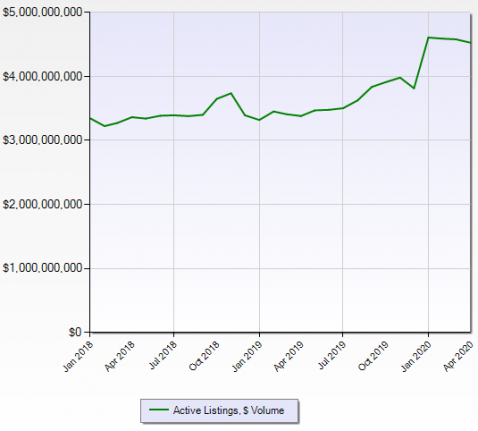

Active commercial listings are stable if not elevated. Though I’ve an idea this may be numbers of smaller AirBnB type properties hitting the market quickly. To check this, I looked at listings volume to see if indeed the volume number was declining as listings quantify was stable to increasing (indicating smaller properties hitting the market):

Indeed, this appears to be the case. In my practice, which doesn’t deal with those smaller AirBnB type properties, I’ve not felt any mad scramble to sell by owners. I’ve run into buyers purporting to be ready to snap up the deals – I say purporting as talking is one thing, stroking a check is another – but I’ve not run into the desperate sellers they are seeking.

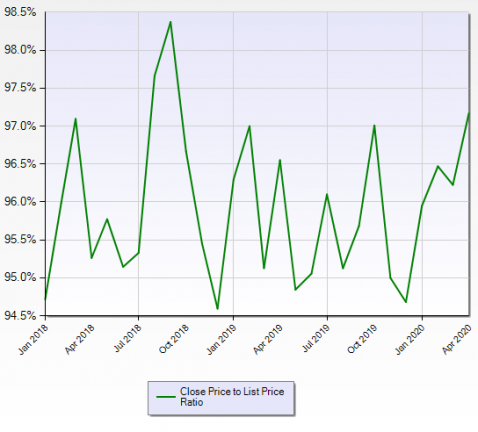

Finally, it is worth noting that the ratio of closing price to list price has yet to budge. In fact, in the month of April, it was over 97%, in the upper end of a range of 95-ish to 98-ish percent. The counter to this would be that any effect here would likely be delayed. That is true, to be sure, but this ratio would indicate in the closings that did happen they appear to have largely done so at the contracted price. One would think that if there had been a renegotiation of price on numbers of transactions that closed in April, this would surely budge this ratio to the lower end of its range.