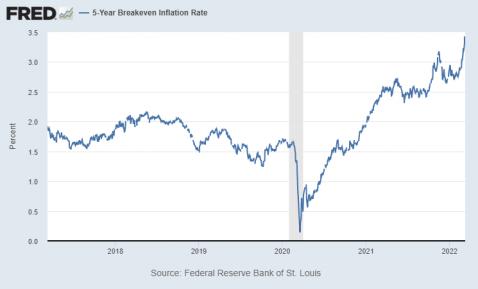

The 5-year TIPS spread, after almost calmly sitting a bit elevated over pre-pandemic levels in late 2021, has now spiked of a sudden spiked to the highest level in a number of years and to a level about 70% higher than where it was generally hovering pre-pandemic. There has been much talk in the financial press of inflation pressures in recent weeks, and the war in Ukraine looks like it will only exacerbate this.

“There are two main drivers of asset class returns – inflation and growth.”

~Ray Dalio

Real Money at Stake

Real money is at stake with these spreads. TIPS pay interest every six months, based on a fixed rate that is calculated by multiplying the adjusted principal by one-half the calculated interest rate (i.e. half a year’s worth of inflation at that rate). Thus, a “bet” that an investor makes in with these bonds has real financial implications. If actual inflation is higher than priced in the markets, a TIPS buyer will make more that a straight treasury buyer. If it is lower, that TIPS buyer will make less. How much money is at stake? In 2017 Morningstar pegged the market at $1.2 trillion. Thus, every 1/10% difference (10 bp) is a $1.2 billion swing. That is real money by my count.

Generally on Inflation and Commercial Real Estate

What is the impact of inflation on commercial real estate? In the near term, higher inflation tends to bring higher interest rates. Higher interest rates are a negative for commercial real estate in the near term. Higher rates means larger debt service payments, reducing the buying power of purchasers and negatively impacting deal economics. It also means makes fixed income investments a more competitive investment, likely pulling capitalization rates (cap rates) up, thus pricing down. Over a longer period, however, the prospect of inflation leads to a principal benefit of commercial property investment, that of its potential as a hedge against inflation. After all, more inflation should lead to higher rent, at least in time.

MIT published an excellent whitepaper on real estate’s ability to keep pace with inflation with data to 2016. They looked at then tendency of retail, multifamily, industrial, and office income and values to keep pace with inflation. The best at keeping pace income-wise was retail, with rent growth of 102% of inflation. Office was the worst performing at a quite dismal 18%. Values across the property types were more consistently kept pace, with retail again doing the best appreciating at 107% of inflation, office again the worst at 74% of inflation. I’ll speculate that the fairly drastic difference between income and value keeping pace with inflation is driven by vacancy. If you’re interested in the topic, read the paper.

Expectations for inflation also come into play with lease structure and due diligence. A lease structure with a fixed rent increase becomes less attractive for a landlord with higher inflation expectations. Similarly, a commercial property being acquired with existing leasing in place that have fixed or capped rent increases looks less attractive as inflation expectations increase. Also, a property being purchased with fixed rate financing will look increasingly attractive if a buyer anticipates inflation fueled increases in income. Inflation, in short, is very important to commercial property investors.

~

Considering commercial real estate for its inflation hedging possibilities? Check out Miami area listings in this HawkinsCRE.com site. You can view all the properties listed on the commercial MLS in Miami-Dade county, or view only certain types: industrial ; multifamily ; office ; retail ; vacant land . You can also view properties filtered for their municipal zoning code or view properties by zip code or by their general location/region in Miami-Dade. Also available are office condo listings by building and multifamily properties displaying and sorted by price per unit. Even better, contact us to help you find the right property to acquire with the benefit of our commercial real estate subscription resources, our proprietary database of off-market properties, and proprietary systems for identifying and securing acquisition candidates for select buyers.