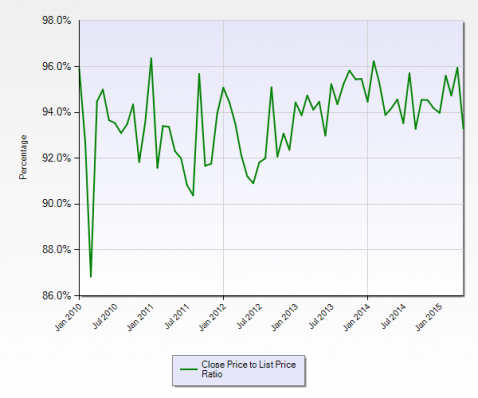

The closing price to listing price ratio tracked by MLS for Miami-Dade on improved commercial property dipped back to the lower end of a range is has been in for over a year. In the month prior, this ratio tipped 96%, a level surpassed in only 2 months since 1996, January 2011, when this ratio hit 96.5%, and February 2014, when it reached 96.2%. This recent dip (to 93.3%) is the lowest this ratio has been since September, 2014, when it was also 93.3%. One has to go back 2 years to June 2013 to find a lower level, 93.0%, and 3 years to find a more prolonged period with this ratio hovering lower.

What does one make of this? Certainly t is notable that this ratio has dipped to the lower end of a recent range, but it may in fact mean nothing. Time will tell. This ratio is, after all, erratic, and in any case is affected by numerous factors, how reasonable asking prices are, what transaction close, etc. If June is similarly low, and particularly if June and July both are on the low end, this ratio should garner more attention, as it could portend a slight softening of the market.

You only know it was time to sell when it was time to sell.

Chart courtesy of MLS.