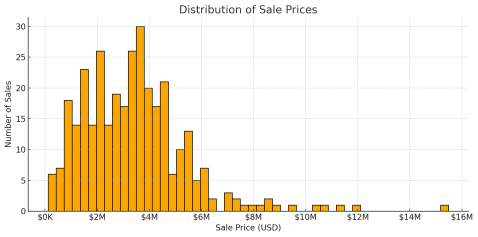

Distribution of sales prices of 10-20k sf drugstores for single tenancy, USA, year ending 7/15/25. Data courtesy of CoStar Group.

The question of market value arises with single tenant big box drugstore properties, particularly where the property is vacant or soon to be vacant. To get at this, we first queried Costar for sales in the prior year for the entire USA of 10-20k sf “drugstore” properties for single tenant occupancy. The distribution chart above was created using this data.

Key Takeaways:

-

The bulk of the market activity is in the $2M–$4.5M range, with a pronounced spike between $2.5M and $4M.

-

Few sales occur above $7M, and very few above $10M — indicating limited demand at the high end. These almost may be trading for another higher and better use.

-

A vacant property priced in the $3M–$5M range may be competing with income-producing ones unless it’s positioned as a value-add or owner-user play.

-

Anything under $2M likely requires significant lease-up or improvements or is in a secondary location.

Where Known Vacant…

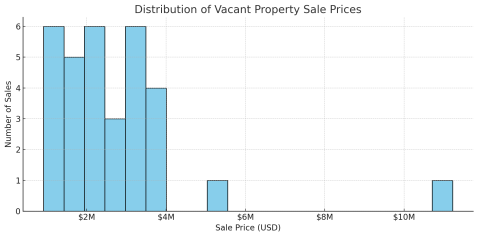

Some of the takeaways are speculative, so we then queried Costar for these same types of properties, but where 0% of the property is leased, i.e. where they are vacant. This filter is only as good as the data entry was and likely missed numbers of properties. Regardless, the result is insightful, particularly in the contact of the full dataset above.

Distribution of sales prices of vacant 10-20k sf drugstores for single tenancy, USA, year ending 7/15/25. Data courtesy of CoStar Group.

Key Takeaways from this Second Chart:

-

Most vacant properties sold between $1M and $4M, with noticeable clustering in the $2M–$3.5M range.

-

Very few sales occurred under $1.5M.

-

A couple of outliers exist:

-

One near $5.5M

-

One extreme outlier at $11.2M

-

-

Mean (average): $2,741,353

-

Median (50th percentile): $2,407,500

This suggests that while vacant properties tend to trade below the overall market median, many still transact at mid-range levels, especially if they offer redevelopment, location advantages, or owner-user utility.

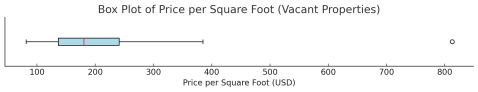

Known Vacant PSF

Box plot chart of known vacant drugstores for single tenancy 10-20k sf in USA – Data Courtesy of Costar

Key Takeaways of Above Box Plot Chart

-

Typical Range Falls Between ~$130 and ~$275 PSF

-

This is the interquartile range (IQR), where the middle 50% of sales occur.

-

It reflects the most common market range for vacant buildings.

-

-

Median PSF Is Around ~$180

-

Half of the vacant sales were below this number, half above.

-

A useful benchmark when evaluating or pricing a vacant asset.

-

-

Low-End Outliers Near $80 PSF

-

These may be larger, older, or less desirable buildings needing renovation or located in secondary markets.

-

-

One High-End Outlier Over $800 PSF

-

This is likely a very small building with a high price, a redevelopment play, or a premium location.

-

Important not to let this single point distort broader value expectations.

-

-

Tight Clustering Below $300 PSF

-

Most of the market activity sits well below this line.

-

Vacant properties priced above $300 PSF would need strong justification in terms of location, build quality, or unique attributes.

-

Comparing the Datasets

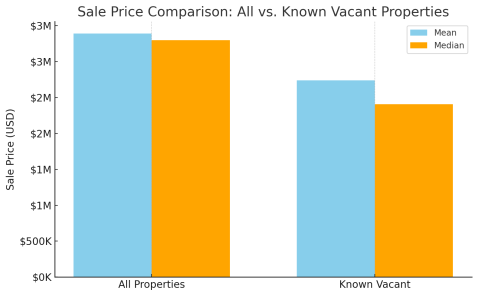

Mean and median sales prices of 10-20k sf drugstores for single tenancy, all properties vs. known vacant, USA, year ending 7/15/25. Data courtesy of CoStar Group.

Vacant vs. All Sales: Price Comparison Summary

A review of recent sales of drugstores from 10-20k sf for single tenancy reveals a clear and measurable discount associated with vacant properties compared to the broader market.

| Metric | All Properties | Known Vacant Properties |

|---|---|---|

| Mean Sale Price | $3,392,630 | $2,741,353 |

| Median Sale Price | $3,300,000 | $2,407,500 |

| Price Difference | $651,277 | $892,500 |

| % Difference | -19.2% | -27.0% |

Key Takeaways:

- Vacant properties sell for significantly less.

The average sale price of a vacant property is nearly $650K lower, and the median is almost $900K lower than the overall market. - The discount is steepest at the median.

A 27% drop in median price underscores how most vacant properties are trading well below the norm, not just due to size or location but likely due to lease-up risk and downtime. - Market preference for income-producing assets is clear.

Buyers are placing a premium on occupied properties, which offer immediate income and reduced uncertainty. - Implication for buyers and sellers:

If you’re evaluating a vacant property, especially one priced near or above market averages, it must be justified by compelling fundamentals such as prime location, redevelopment opportunity, or owner-user appeal.

All data referenced herein is courtesy of Costar.

This information is provided for general informational purposes only and does not constitute investment, financial, legal, or tax advice. No warranty or representation is made as to the accuracy, completeness, or reliability of the data or analysis. All real estate investments carry risk and should be evaluated with the guidance of qualified professionals. Past performance is not indicative of future results. Always consult your attorney, financial advisor, or other appropriate professional before making any investment decision.