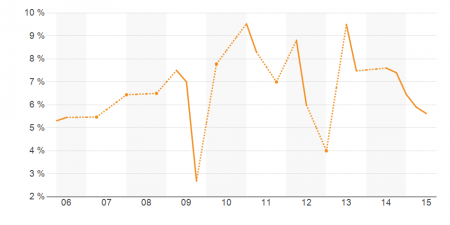

Cap Rate for Office Properties from 5,000 to 15,000 square feet in Miami-Dade County for the 10 Years Ending 2015

The capitalization rate (cap rate) for mid-market office properties in Miami-Dade County (5,000 to 10,000 square feet) drifted to just under 6% in the most recent period reported by Costar. As can be seen in the attached chart, cap rates have gyrated around 6% to 7% midpoint, and of late have been in decline since their 2013 peak a couple of points higher.

In recent years, increases in rent and declines in vacancy, combined with stable cap rates, have led to higher prices on many area office properties. Much of these gains, however, has been in class A properties, with many mid-market properties experiencing less rental increases and decease in vacancy.

Top Buyers, Sellers

The top buyers of office properties (listings, trends) in Miami-Dade County from 5,000 to 10,000 square feet per Costar as of February 11, 2016 include: The Related Companies; Infinity Group; IMC Property Management & Maintenance; Mario Scarpetta Gnecco; Jenel Management; Catherine Lorie; MMC Equity Partners; Beachfront Commercial Realty, Inc.; RAS Development, Inc.; MasTec, Inc. Top sellers of such properties include: Canepa U.S. LLC, Century Homebuilders Group, LLC; Mario Scarpetta Gnecco; Adrian Builders Inc.; Irene & Patrick Marie; Landmark Companies; Golden Glades Associates; CREC LLC, Orion Real Estate Group; ACV Properties, Inc.

Chart courtesy of Costar.