Flashback Friday: Cassius Clay Knocks out the Beatles in Miami Beach

Yes, this is just for fun, but there is a commercial real estate angle; look at what the area looks like today.

Brickell Avenue – The Manhattan of the South

Brickell is a popular and urban neighborhood in Miami, Florida, United States. Brickell is famous for being South Florida and Miami’s main financial district and it has a large infrastructural network to support this. Brickell’s modern settlements have their roots in the mid 1800s and it grew to become Miami’s prime “Millionaire’s Row” in the early 1900s. This was after the development of lavish mansions and homes along Brickell Avenue. Hotels, office Towers and apartments had replaced the historic mansions by the 1970s and as of today, Brickell stands as the prime financial district in Miami overtaking the historic central business district that is located to the north. Brickell is now the largest financial district in the United States. As a result, it is the fastest growing residential hub with a dense neighborhood whose population was 31,000 in 2010.

Brickell’s population has a high concentration of rich Colombian, Nicaraguan, Venezuelan, Argentine and Cuban residents who mostly live and work in the trade and financial sectors or live part-time in Brickell. Brickell has many upscale and luxurious apartments and condominium. It is a dense, flamboyant high-rise residential and financial district often referred to as the “Manhattan of the South”. It has the largest concentration of international banks in the entire country mostly situated along Brickell’s main north south avenue, Miami avenue and Brickell Avenue. These streets are also home to the most popular Miami Shops, restaurants and entertainment spots. Located on the northeastern side of Brickell is an upscale, hotel towers and high-rise residential island known as Brickell Key.

Brickell, with its signature buildings including the Four Seasons Hotel, 1450 Brickell Avenue, and the soon to be addition of Brickell City Centre, is South Florida’s main financial district at at the core of Miami’s investment, financial and banking sectors. It is situated in Miami’s 33131 zip code, with demographics evidencing its affluent, professional population. Pput together with Downtown Miami, it has the largest number of foreign state consulates including Brazil, Argentina, Chile, Ecuador, Dominican Republic, France, Guatemala, Great Britain, Japan, Netherlands, Mexico, Peru, Trinidad and Tobago, and Peru, among many others.

Brickell’s transportation system is served by Metromover’s Brickell Loop that has 5 stations and the Miami Metrorail at Brickell Station. Public transportation is a vital part of the Brickell community and the Brickell station serves a key role in Miami’s heavy railway system. Metromover trains run 3 lines in Downtown Miami. They are the Omni Loop, the Brickell Loop and the Downtown Loop. Roughly every two blocks, you will run across a Metromover station which makes it very accessible to the residents of Brickell. On the other hand, Metrorail provides direct access to all Miami Dade County bus lines, Tri-Rail, Miami International Airport and Amtrak.

Biking is also very popular among Brickell’s residents and as a result, the city of Miami introduced bicycle initiatives through bike lanes and city wide bike parking areas. This has consequently made biking even more popular. Taxis are also very common in Brickell. They mainly run from Brickell to Design District, Coconut Grove or South Beach. Most Brickell residents prefer not to own cars and this makes taxis very common for rides withins Brickell’s Downtown. Their popularity increases after midnight when the Metromover closes down for the night.

Considering Miami-Dade Office Property Sales Increases in Recent Quarters

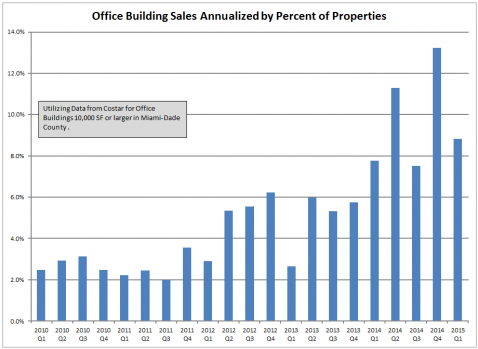

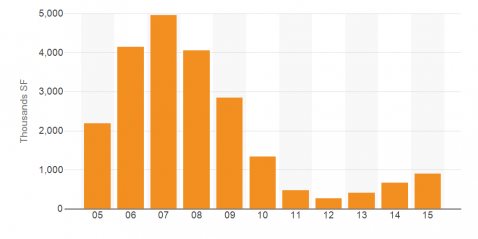

We recently extracted some office building sales data from Costar, specifically sales by quarter. We were looking at sales in units, not dollars, to get an idea of what percentage of properties were turning over. As those in the industry can attest, sales have been increasing.

After hovering at around or just over 2% throughout 2010 and 2011, sales began to pick up pace in Q2 of 2012. Early on the increase was notable, as sales more than doubled to more than 4% annually. Beginning in 2014, however, sales really picked up steam, passing “notable” on their way to “jeepers” with annualized sales around 8% or more, even 13% in one quarter, four to six times the rates in the aforementioned 2010 to 2011 period. This growth in the number of properties that sold matches up well with the growth in dollar volume of sales of commercial property.

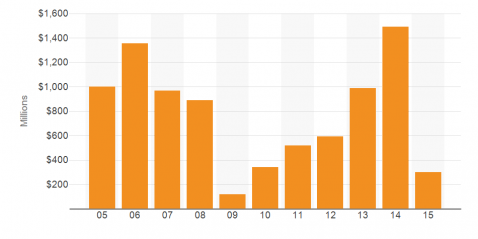

After hovering around a billion dollars per year in 2005 to 2008, sales of office properties did their best Tom Brady imitation as they went off a cliff to around $100 million in 2009. From there, they climbed, but only steadily and incrementally, not reaching their billion-ish level again until 2013. In 2015, they climbed further to near $1.5 billion, and appear on track for another $1 billion plus level in 2015.

What gives?

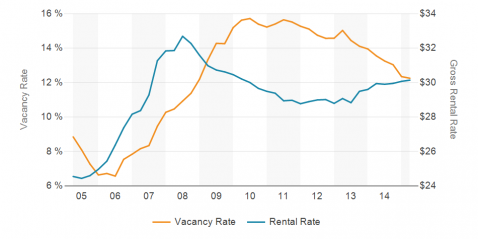

It is always a bit of a guess as to why certain property types turn over more than others in different periods. One reason for the momentum in office buildings may be the pain of recent years, with higher vacancy rates and lower rental rates during this time causing pain, combined with recent improvements in these measures now providing a means for exiting that which caused the pain. This can be felt rather clearly when one considers vacancy and rental rates in recent years.

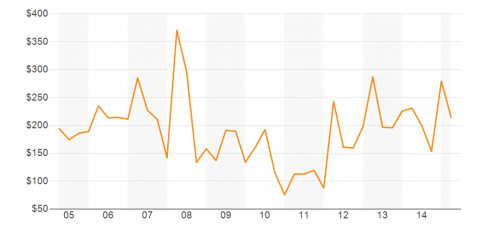

Office vacancy rates, after sitting at single digits in 2005, 2006, and 2007, began their steady and painful climb to 15%, then stayed at double digits thereafter. Most recently measured at around 12%, they are at their lowest level since 2008. This vacancy rate placed and kept tenants in control of pricing, causing gross rental rates to decline from the lower 30s peak in 2008 to a rough in 2011 to 2013 around $29 psf. Of late, they are on a firming trend, something likely not overlooked by buyers as sales prices firm up since 2011.

All this is a graphic history of pain for office property owners, followed by a better opportunity than there has been in a while to divest of the asset(s) that caused the pain. At the same time, Miami is increasingly on the mind of investors as a place of opportunity for commercial real estate, with that opportunity driven by economic growth, foreign inflows of investor capital, and recognition of the area’s lifestyle benefits. Office property construction also is not at high levels, further garnering the attention of buyers.

Sales of office properties are increasing, whatever the reason. As to whether this is an indication to buy or sell yourself, the answer is the proverbial (and our standard) “yes.”

A PDF of this piece is available here.

Charts and data courtesy of Costar.

Commutes to Proposed American Dream Miami Mega Mall & Theme Park

Given the ability of a mall and entertainment complex as significant as the proposed American Dream Miami to draw people to it, we thought it might be worthwhile to take a look at how long it takes to get to the proposed location from key locations. The locations highlighted below consist of population centers, tourist destinations, and other major shopping areas.

We’ve created this post to assist commercial real estate investors in the area with conceptualization, as it were, of the effect on commerce in the area. These directions are to the general area, is in close proximity to the proposed location for the proposed Miami Lakes area mega mall and entertainment / theme park complex. These are not perfect, but seemingly good enough for this purpose.

Before reviewing the commute maps to the proposed location, first consider its general location on the South Florida map:

In the maps below, it is worth considering not only how American Dream Miami might pull from these areas, but also how it might affect other shopping areas and tourist destinations. A consumer can visit more than one destination, of course, but if a consumer must choose, he can’t be in two places at once.

Naples – About 1.5 Hours

We always think of Miami with these Miami area shopping destinations, but something as big as this, particularly given that it would sit on the western edge of Miami-Dade county, is bound to pull from the Naples and Fort Myers areas.

Likewise, the mall is near much of the population base of Fort Lauderdale and nearby Hollywood.

How far away this will be depends on what you consider Miami to be and what part of it you are in. From downtown, it will be about 40 minutes away, without traffic. We’re going to call it 1/2 an hour or less, as this will be the case for most that consider themselves in Miami.

Many in Miami will be surprised that this is not farther, but consdier that it is already up the road a good ways toward Orlando. This bodes wells for its ability to attract tourists down from Orlando. Miami is a pull itself. Once one adds a theme park for the kids and a mega mall for mom and dad, it is a sure deal.

Yes, this is a ways away, but this is a big potential development, big enough to make the curious travel farther than they otherwise might.

Another map, another major center of population and buying power within close reach…

Uh-oh, City of Sunrise. If this mall goes forward, it it bound to take business away from Sawgrass. Its proximity may in the end be a good thing, as the NW Miami-Dade and West Broward area may be seen as a regional shopping hub, which it would obviously then be.

Another mall that seemingly stands to lose business to this proposed mega mall.

Different mall, same potentially sad story…

This one may be unaffected by this development, as it is so unique in nature. It has its own competitvie challenges on the horizon, but seemingly this is not one of them.

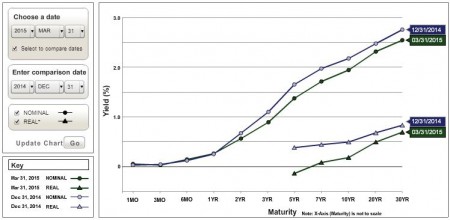

Yield Curve Quarterly Snapshot – 2015 Q1

U.S. Treasury Yield Curve Nominal and Real Q1 2015 vs. Q4 2014

At the end of the 1st quarter of 2015, U.S. Treasury yields, on a nominal basis, were fairly unchanged in the shortest maturities, a touch higher in the 2-year maturity, and about 20 to 30 basis points higher for all maturities longer than 2 years. On a real basis, these yields dropped similarly, as the inflationary environment was relatively unchanged.

Interest rates affect commercial real estate in numerous ways (see this, this, and this). Borrowing costs are affected directly, with higher rates increasing borrowing costs and thus negatively affecting demand. Cap rates typically move with interest rates, albeit not in lockstep, with considered analyses generally seeming to conclude that cap rates on average move in the direction of 10-year rates, but only about a third as much. Interest rates affect the economy, which in turn affects vacancy and rents. In short, the interest rate environment is highly important to commercial real estate investment.

View more yield curve quarterly snapshots.

Commercial Property Profile: Miami Tower

Located in Central Downtown, the Miami Tower is a 47 story landmark skyscraper in Miami, Florida. It was primarily built as an office tower and it is currently the 8th tallest skyscraper in Miami and in the state of Florida as well. The Miami Tower, originally known and still referred to by many as the Centrust Tower, rises 625 feet (191 metres) and it is famous for its dramatic three glass tiers and the extravagant night time illuminations. The building’s architecture was designed by Pei Cobb Freed & Partners. Miami Tower is made up of two seperate buildings, one of which serves as a 10 story parking lot while the other is an office tower that is 47 stories high.

A pedestrian walkway connects the tower to the James L. Knight Center and on the 1st floor is a green marble covered retail spine. 1,160,000 square feet (108,00 m2) of floor space is divided into a 535,000 square feet (49,700 square meters) parking garage with 1,500 parking spaces and 503,00o square feet (46,700 square meters) of office space.

Commercial Real Estate Profile: 1450 Brickell Avenue

1450 Brickell is an all office high-rise in Miami, Florida. This huge skyscraper has a total of 35 floors and stands 165 meters. (540 feet). It is located in the southern Brickell Financial District in Downtown Miami next to One Broadway. It’s precise location is on the corner of Broadway and Brickell Avenue. !1450 Brickell has a total of 54,000m2 (580,000square feet) of office space and was designed by Nichols, Brosch, Wurst, Wolf & Associates, Inc. 1450 Brickell is only one of several office space projects to be developed and opened in Downtown Miami.

This office skyscraper is elegantly designed to have an astounding and artistic quality of light and texture. It makes good use of exquisite finishing materials such as imported stone, polished hardwoods accentuated with stainless steel, and this gives of a unique and beautiful interaction from the natural morning light to the afternoon sunlight. The higher floors offer a breathtaking panoramic view of the Atlantic ocean as well as the city that is arguable one of the best views you can find in Miami.

The ground floor has a cascading fountain that is the foreground to a restaurant that provides a cosmopolitan and outdoor dining atmosphere. The 14th floor of 1450 Brickell features a terrace lounge that was created to temper hectic working hours and offer the ideal outdoor working environment that overlooks the Brickell Business District. The low-rise and high-rise floor plates provide approximately 24,000 to 26,100 square feet of rentable office space that is ideal for a contiguous full floor set-up. The almost column free floors offer an abundance of breathtaking skyline and water views and a core window distance as well.

1450 Brickell will require you to wait 4-6 months from lease signing for this first generation space and occupancy. The minimum lease duration is 5 years. Its adjacency to Four Seasons, W Marriot Hotel and Conrad makes it a prime office location. The building’s unique design was inspired by its location on an acute corner, a 70o angle. This gave rise to the opportunity of giving the building a sharp edge.

Another enterprising feature of 1450 Brickell is that is it a LEED Gold Certified Building and it is especially resilient to hurricanes. Another distinguishing design feature is the impact resistant blue glass that forms the building’s facade. Miami’s building code requires the first thirty floors to have large missile impact resistant glass while higher floors should feature small missile impact resistant glass.

There are a total of 1.200 parking spaces that include on-ramp parking. The parking garage is located on the lower floors and entry is from the Southeast 15th Road. The building ground floor has a breezeway running through the base of the building and connects the driveway entrance with Brickell avenue and features outdoor seating.

Located on the same floor as the terraced skydeck is conference space equipped with videoconferencing technology available to the building’s tenants and a gym. The building’s ventilation, heating and air-conditioning system cleverly includes sensors that help in managing electricity consumption. The sensors are in over 6,000 locations all over the building.