Vlad Doronin adds to Edgewater assemblage with $54M purchase

Vladislav Doronin’s OKO Group just paid $54 million to buy a 2-acre parcel fronting Biscayne Bay, adding to the Russian billionaire developer’s assemblage in Miami’s Edgewater neighborhood. The property, at 720 Northeast 27th Street, is north of OKO Group’s Missoni Baia, a 57-story, 146-unit luxury condominium planned for 777 Northeast 26th Terrace. London and New York-based private investment firm Cain Hoy partnered with OKO on the purchase. An OKO…

JV Sells 100 Biscayne Office Tower in Miami for $84 Million

East End Capital Partners LLC acquired the 100 Biscayne office tower at 100 Biscayne Boulevard in Miami, Florida for $84 million, or about $271 per square foot, from a joint-venture partnership comprising The Witkoff Group, Panther Real Estate Partners LLC and Highgate Holdings, Inc. The 30-story…

EastGroup Buys 61 Acres in Miami Gardens

EastGroup Properties, Inc. acquired 61 acres in Miami Gardens, FL, where it plans to construct a new industrial park. The buyer is planning an 850,000-square-foot campus on the site. The land sold for $27 million, or $442,622 per acre. The parcel is located adjacent to the Calder Casino and Race…

How Trump could shake up real estate finance

At his campaign rallies, Donald Trump presented himself as an anti-establishment populist looking to rein in Wall Street’s gross excesses. But when he stepped in front of a crowd of finance and business big shots at the New York Economic Club on Sept. 15 to outline his economic policy, he showed a completely different face. “One of the keys to unlocking growth is scaling-back years of disastrous regulations unilaterally imposed by our out-of-control bureaucracy,” he said.

Wynwood attracts Florida’s first industrial design college

Miami’s Wynwood neighborhood, already a hub for artists, technologists and other creatives, will soon be the home of the new Miami College of Design. It’s the vision of Walter Bender and Franco Lodato, experts in industrial design. The co-founders broke ground last month on the-state-of-the-art educational facility, which will be Florida’s first accredited college focused solely on industrial design, they said. The state-licensed associate and bachelor of science curricula will focus…

Chart: Commercial Properties Sold Versus Total Listings

This is a chart of the number of total commercial improved properties listed at the end of a given month (right axis) versus the number of properties sold in that month (left axis) in the Miami MLS. While the number of properties listed has declined more than 25% from its peak a few years back, the number of closed sales…

Icon Brickell’s pool closes next week with no alternative pool option

Will units at Icon Brickell drop in value? Icon Brickell’s pool is set to close next Monday with construction expected to last 12 months (bet the WAY over) according to its condo association. Unfortunately for residents, an alternative pool will not be provided “due to limited…”

County flyspecks lease for big film studio

“There’s no news, which is probably good news,” on negotiations for a mammoth studio complex comprising 11 sound stages and 4 million cubic feet of water in 10 giant tanks, said Rodolfo Paiz, a principal of Miami Ocean Studios LLC. His company is in lease negotiations for 160 acres…

Questions fly on new I-395 bridge

Design-build contracts for a long-awaited “signature bridge,” part of an upgrade of I-395 from west of I-95 to the MacArthur Causeway, will be advertised next year. But Metropolitan Planning Organization members are already discussing specific challenges, as well as whether the project…

Rubell Family Collection to move from Wynwood to Allapattah

Don and Mera Rubell and renderings of the new Rubell Family Collection. The Rubell Family Collection will move from Wynwood to Allapattah as investors continue to target the industrious neighborhood. The art collection will move to a new 100,000…

Zak the Baker’s 7,000-Square-Foot Temple of Bread Opens in Wynwood

About five years ago, Zak Stern took to Kickstarter in hopes of cobbling together the final bit of money he needed to open his Wynwood bakery, Zak the Baker. Soon after, seating in the place around lunchtime was hard to find. On Thanksgiving morning, Stern opened his art-gallery-turned-bakery (297 NW 26th St., Miami) down the street from his original spot. The place is open from 7 a.m. to 5 p.m. every day but Saturday. Here, find coffee, the country loaves and sourdoughs…

Shiman to Oversee Edens’ South Florida Portfolio

Nicole Shiman recently joined retail owner and operator Edens as vice president/investments. Based in the firm’s Miami regional headquarters, Shiman is responsible for the strategy and operation of the firm’s South Florida portfolio. Before joining Edens, Shiman was a vice president at 13th Floor…

CSC Closes on $71.7M Acquisition of Five Charter Schools Across Southern Florida

Portland, OR-based Charter School Capital, Inc. has purchased a portfolio of five charter schools located in Florida from ESJ Capital Partners LLC and minority partner MG3 Development Group for $71.74 million, or about $242 per square foot. ESJ Group is a full-service asset management firm based…

Commercial Real Estate Appraisals: What You Need to Know

Stay informed and be prepared to get the most out of the appraisal process. If you’re looking at buying, selling, or signing a major lease on a commercial property, you likely want to get a property appraisal first. But before you do, it pays to understand a bit about how appraisals work, an…

“Fix Transit, But Don’t Bust The Budget,” Says Miami Mayor Carlos Gimenez

As it pursues an ambitious transit plan amid the best budget picture in years, Miami-Dade must resist the kind of over-spending that can cause a revenue squeeze on taxpayers, Mayor Carlos Gimenez said Tuesday in his first major address after winning reelection. “We must focus on doing even more…”

Commercial real estate market facing challenges

With the close of another year coming up soon, many Florida businesses are making adjustments and planning for 2017. This is particularly true for those involved in commercial real estate, which is likely to see some changes in the upcoming year. Experts are raising concerns about the commercial real estate…

Video: Multifamily Market Trends and Forecasts ~ Marketplace Trends

This is a video of a short discussion of major trends in multifamily with Steven DeFrancis of Courtland Partners, an investor in multifamily properties, Benno Rotschild, a lawyer with Hartman Simons who works with multifamily investors, and Jamie Teabo, a board member of the Atlanta Apartment Association and Executive VP of Post Properties, a company with multifamily properties in Florida, Georgia, Texas, and the District of Columbia, and Michael Bull…

US 1 Project To Rise At Douglas Road Metrorail Station

A mixed-use project with new office, retail and residential uses is being proposed at the foot of a pedestrian overpass that connects to the Metrorail Douglas Road Station.

Video: Multifamily Market Trends and Forecasts: Interest Rates and Foreign Investors

Steven DeFrancis of Courtland Partners, an investor in multifamily apartment properties, Benno Rotschild, a lawyer with Hartman Simons who works with multifamily commercial property investors, Jamie Teabo, a board member of the Atlanta Apartment Association and Executive VP of Post Properties, a company with multifamily properties in Florida, Georgia, Texas, and the District of Columbia, and Michael Bull, a commercial broker…

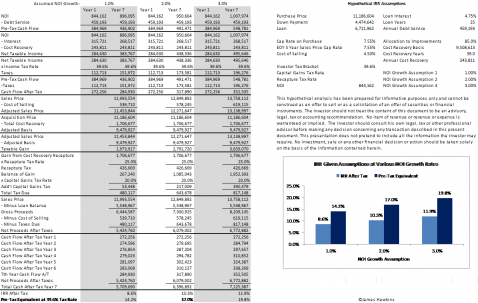

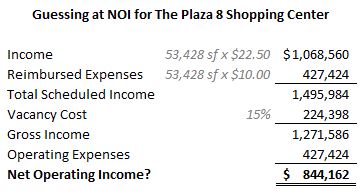

In the accompanying “Guessing at NOI for The Plaza 8 Shopping Center,” we speculate at to how an investor might evaluate this property financially. We assume an average rental rate of $22.50 psf, NNN (triple-net), in line with the aforementioned average for recent leases which are conveniently and appropriately split between 1st and 2nd level properties. Expenses are assumed at $10.00 psf. This is a rough guess, but note that not getting expenses exactly right – at least when vacancy is moderate, – has a muted effect with a NNN assumption as expenses are reimbursed by tenants for occupied space. Thus, expenses only affect income to the extent that they are not fully reimbursed due to vacancy. Speaking of vacancy, we assume that at 15%. We are assuming this a touch higher than what Costar currently indicates to account for potential collection issues and the prospect for vacancy as rates are increased from what we guess may be long-term legacy leases . Finally, gross leasable area is assumed to be 53,482 sf as indicated by Costar.

In the accompanying “Guessing at NOI for The Plaza 8 Shopping Center,” we speculate at to how an investor might evaluate this property financially. We assume an average rental rate of $22.50 psf, NNN (triple-net), in line with the aforementioned average for recent leases which are conveniently and appropriately split between 1st and 2nd level properties. Expenses are assumed at $10.00 psf. This is a rough guess, but note that not getting expenses exactly right – at least when vacancy is moderate, – has a muted effect with a NNN assumption as expenses are reimbursed by tenants for occupied space. Thus, expenses only affect income to the extent that they are not fully reimbursed due to vacancy. Speaking of vacancy, we assume that at 15%. We are assuming this a touch higher than what Costar currently indicates to account for potential collection issues and the prospect for vacancy as rates are increased from what we guess may be long-term legacy leases . Finally, gross leasable area is assumed to be 53,482 sf as indicated by Costar.