Beckham and Miami-Dade at odds over parking at stadium

David Beckham’s plans to build a soccer stadium in Miami have reportedly hit yet another roadblock: parking.

The soccer star and his development group Miami Beckham United missed their February deadline to close on the purchase of Miami-Dade County…

Seminole’s $1.8B expansion plan in jeopardy after Senate kerfuffle

The proposed guitar-shaped hotel that would be built in the Seminole Tribe’s Hollywood entertainment complex

The Seminole Tribe of Florida’s plan to spend $1.8 billion on expanding their gaming facilities — including the construction of a massive guitar-shaped hotel in Hollywood…

Brickman buys Courthouse Tower in downtown Miami: $28M

New York-based Brickman has made its second commercial real estate purchase in downtown Miami with the $27.5 million acquisition of the Courthouse Tower. In February, Brickman paid about $34 million for the newly renovated and repositioned 200 Southeast First building.

Jury Awards $17.5 Million For Real Estate Fraud By Property Managers

The pair worked for limited partnerships set up to pool money from 1,800 Germans and invest it in U.S. real estate.

Miami Comically Ranked Among the ‘Worst Places to Live’ in the USA

93rd? What? The winterless wonderland of Miami was ranked among the worst places to live in the United States, according to a recent study by U.S. News and World Report, with the Magic City ranking an unfathomable 93rd out of the 100 most populous cities. Behind Cleveland. Behind Detroit. Behind Day…

Design Board Approves 1824 Alton on Miami Beach

More Construction is coming to Sunset Harbor While Sunset Harbor continues to undergo major reconstructive surgery to its roads and buildings another project has been approved by the Miami Beach Design Review Board.

The four-story commercial project at 1824 Alton Road was been unanimously approved…

The Langford Hotel Opens in Downtown Miami on March 14

With a new restaurant in tow by The Pubbelly Boys The Langford Hotel is set to open in Downtown Miami on March 14 several months after its planned opening. The 126-room boutique hotel located a few blocks west of Biscayne Boulevard was developed by Stambul in conjunction with Trust Hospitality and…

Mayor ‘Skeptical’ of Miami Beckham United’s Parking Plans

Does David Beckham need to add a parking garage? David Beckham and the Miami Beckham United group are still seeking an additional partner while planning to wrap everything up by June before an MLS vote of approval, but there’s one item still lurking: parking. With no garage planned and the closest…

This Map Shows When Rising Sea Level Will Affect Your Miami Condo

Beware owners at the Floridian, Paramount Bay, and the Mutiny Which Miami condos are most at risk of flooding and destruction caused by rising sea level? Our friends at E Miami Condos created a map to visualize how specific condos will be hit most based on increases of two feet, three feet, and four…

If You Build It, Will They Come?

I have been up to my eyeballs in construction issues lately, so I wanted to share some trends I am seeing:

Construction costs continue to escalate sharply. Workers and materials continue to demand a premium which is driving costs upwards. Traffic, demand and logistics headaches have caused top…

What’s Next for Miami Real Estate?

Last week was the CREW Miami’s 19th Economic Forecast by NYU economist Hugh Kelley. I have written frequently about Hugh and his predictions. I always find his presentation insightful and this year was right on the mark. This year he spoke about the five basic forms of economic change and…

What’s In Your Office Lease?

It’s the start of a new year, so I would suggest that it’s time to pull out your lease file and run a quick lease audit. Here are a few suggestions of things you should know about your lease: When does it expire? You should begin your renewal process at least 12 months prior…

Danger Zone Ahead

Tenants need to be aware of the current office trends because the pendulum has swung to the landlords and it is going to hang there for another year or two. My thoughts were confirmed as I listened to a webinar last week on the Office Market from a national perspective. It is really interesting to…

Relocation Clauses

Oftentimes tenants overlook the Relocation Clause when they are negotiating their lease. This isn’t a good strategy these days. As office occupancy continues to improve, landlords are using the relocation clause more frequently to accommodate new or growing tenants to the dismay of their…

Off-Beat Office Design Ideas

Silicon Valley is the nation’s trendsetter in many ways. Not only do they introduce new technology seemingly every week, but they have enabled us to embrace tele-commuting, foster collaboration and turn every day into casual day. I just read a couple of great articles about companies sharing…

Wild Ride for Office Landlords

That was the theme for the CIASF Office Report today. I agree but I also want to add that the tenants are sitting right next to landlords on this rollercoaster. Here were three statistics that stuck out to me: 1) 75% of the Class A office buildings in the CBD (meaning Downtown and Brickell) are…

Negotiation Tactics

On Friday, I had a landlord, in front of some of my peers, slam me with the best backhanded compliment ever. He was graciously asking if my daughter had decided her medical residency specialty and I said that it would be surgical – she likes to cut people open. He replied, “Just like her…

Miami’s Top 2Q2014 Leases

It is a busy time in commercial real estate these days. The investment sales brokers are very busy and leasing activity is also brisk. Demand has been strong for a full range of sizes from Miami’s average square footage which is about 3,000 sq ft plus quite a few tenants over 50,000 sq ft.

If You Build It, Will They Come?

I have been up to my eyeballs in construction issues lately, so I wanted to share some trends I am seeing:

Construction costs continue to escalate sharply. Workers and materials continue to demand a premium which is driving costs upwards. Traffic, demand and logistics headaches have caused top…

On the scene at One Park Grove launch

Terra Group and the Related Group celebrated the launch of One Park Grove, the third and final Park Grove tower.

The developers hosted a talk with designer Will Meyer and restaurateur Michael Schwartz who will…

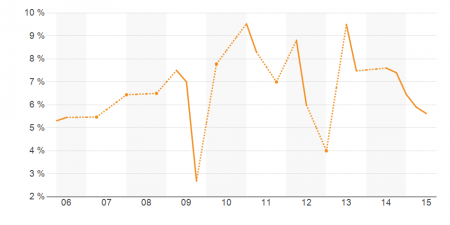

Mid-Market Miami-Dade Office Properties Cap Rate Dips Below 6%; Top Buyers, Sellers

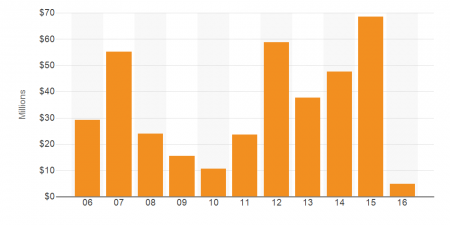

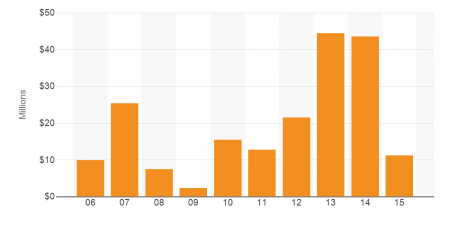

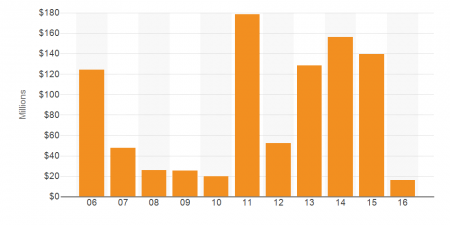

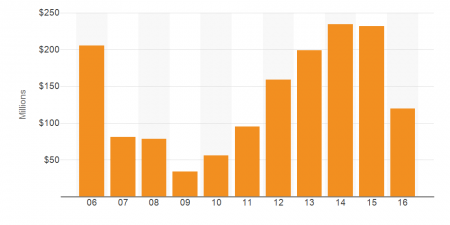

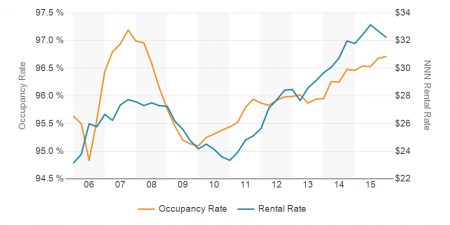

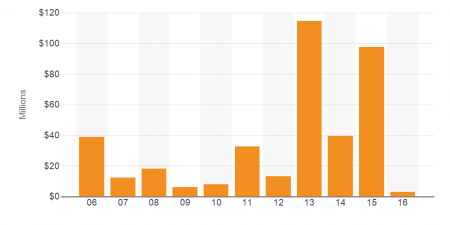

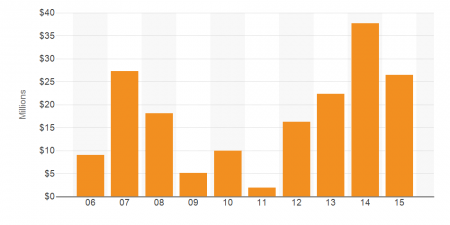

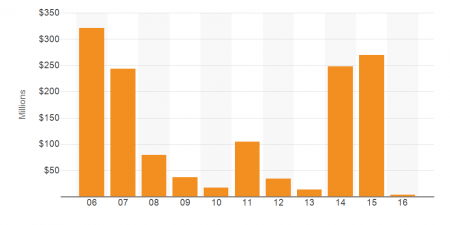

Cap Rate for Office Properties from 5,000 to 15,000 square feet in Miami-Dade County for the 10 Years Ending 2015

The capitalization rate (cap rate) for mid-market office properties in Miami-Dade County (5,000 to 10,000 square feet) drifted to just under 6% in the most recent period reported by…

Want to get around the FinCEN rules? There’s a class for that

The federal government’s tracking of secretive cash deals for pricey Miami real estate began Tuesday, and the question on Realtors’ minds has been “How does this affect me?” Not as deeply as you might think, real estate attorney Russell…

NAR Releases Q1 2016 Commercial Real Estate Outlook

The National Association of Realtors® (NAR) Commercial Real Estate Outlook for the first quarter of 2016 focuses on market performance large and small commercial property sectors. The…

Miami Beach’s West Avenue residents weigh in on convention hotel

Proponents and opponents of the proposed Miami Beach convention hotel voiced their opinions Tuesday night, as the proposed 288-foot-tall hotel was debated during a packed meeting of the West Avenue Neighborhood Association (WAvNA). Residents also heard…

Miami Beach to Consider Chinese Developer’s Proposal for 18-Story Condo Tower

Miami Beach to Consider Chinese Developer’s Proposal for 18-Story Condo Tower