John Worth , Executive Vice President of Research and Investor Outreach with Nareit, joins America’s Commercial Real Estate Show to discuss highlights from their (Nareit’s) 2022 Mid-Year Outlook Report. Discussions include the impact of inflation, rising interest rates, and developments in the labor market.

Video: Global Chair of Counselors of Real Estate Marilee Utter Discusses Top Ten Issues Affecting Real Estate 2022-2023

Marilee Utter, 2022 Global Chair of the Counselors of Real Estate, joins the host of America’s Commercial Real Estate Show to share and discuss highlights from the Counselors of Real Estate annual Top Ten Issues Affecting Real Estate. Topics (issues) discussed include inflation and interest rates, geopolitical risk, hybrid work, wupply chain disruption, energy, labor shortage strain, the great housing imbalance, regulatory uncertainty, cybersecurity interruptions, and ESG requirements forcing change.

Miami Commercial Real Estate News August 31, 2022: Gables Station MXU Trades for $430M, Miami Worldcenter Dev Site for $30M; Site for $185M Riverside Wharf Project Headed for Lease; More…

Swiss developer debuts in Miami with multifamily project

Swiss firm Empira Group is making its foray into South Florida with a $9 million purchase of a multifamily development site in Miami’s The Roads neighborhood. Empira wants to build the eight-story CoralGrove Brickell project on a half-acre site along Coral Way, at 3025 and 3051 Southwest Third Avenue, according to the developer’s news release. Sources…

Setai wants Miami Beach to reverse Shore Club approval

Setai’s Ariel Nakash, Monroe Capital’s Theodore Koenig and Witkoff’s Steve Witkoff with rendering of planned Shore Club project: Owners at the Setai are challenging the approval of the neighboring Shore Club project in Miami Beach. The Setai Resort & Residences condo association is seeking a re-hearing of the city’s historic preservation board vote in favor of…

Lissette Calderon’s third Allapattah project scores $58M loan

Lissette Calderon’s third apartment project in Miami’s Allapattah neighborhood nabbed $57.5 million in construction financing. Churchill Real Estate provided the loan for Fourteen Residences Allapattah, a two-building complex with 237 units planned for 1470 Northwest 36th Street, according to a press release. Berkadia’s Charles Foschini and Chris Apone…

Hines pays $430M for mixed-use Gables Station

Hines’ Jeffrey Hines and Alfonso Munk; Nolan Reynolds International’s Charles Nolan Jr.; 54 Madison Partners’ CEO Henry Silverman; Nolan Reynolds International’s Brent Reynolds; and the Gables Station at 235 and 237 South Dixie Highway in Coral Gables: Hines bought a mixed-use multifamily development in Coral Gables for $430 million, marking one…

A recently completed mixed-use development in Miami’s Coral Gables submarket has traded in one of South Florida’s largest deals this year. Hines Global Income Trust bought the 1.2 million-square-foot Gables Station from co-developers Nolan Reynolds International and 54 Madison Partners. According to The Real Deal, the price of acquisition was $430 million.

Hines Drops $430M On 1.2M SF Mixed-Use Building In Coral Gables

A mixed-use development in Coral Gables that features a Life Time residential, fitness and coworking concept has sold for $430M in one of the largest real estate deals in South Florida this year. Houston real estate giant Hines, through its Hines Global Income Trust, has acquired Gables Station, the 1.2M SF building at 251 South Dixie Highway that stands 14 stories…

Lynd buys Miami Worldcenter multifamily dev site for $30M

E11even co-owner Marc Roberts and Lynd President and CEO David Lynd and aerial of the development site at 941 North Miami Avenue: Lynd Living bought a Miami Worldcenter development site for $30 million from a company managed by E11even nightclub co-owner Marc Roberts and Titan Capital’s Ira Saferstein. The San Antonio-based firm is the latest…

Doronin’s 830 Brickell scores Chicago law firms for 53K sf

Two Chicago-based law firms leased a combined 53,000 square feet at 830 Brickell, marking continuing tenant demand for the Miami office tower that’s under construction. Winston & Strawn took 35,000 square feet and Baker McKenzie took 18,000 square feet at the project at 830 Brickell Plaza in Miami, according to a news release…

Developer Jackie Soffer on SoLé Mia, Miami’s boom & more

Developer Jackie Soffer is working on some of South Florida’s largest projects, but that doesn’t stop her from noticing the smallest of details — like the placement of power outlets. “Outlets are a big issue for me,” she said. “Plugging in your phones and your computers is so important. It’s such a pain when you can’t find the outlets easily. I don’t know that it affects…”

Developers study North Miami Beach’s tennis complex

The City of North Miami Beach gave local developers an opportunity to learn more about a 10-acre P3 development opportunity and explore creative ways to reimagine the space. During last week’s private pre-solicitation open house for the proposed city-owned development site at Arthur I. Snyder Tennis Complex at 16851 W Dixie Hwy., city officials…

Riverside Wharf heading for City of Miami lease

City of Miami voters have granted overwhelming approval to advance a vast mixed-use downtown project that will add a luxury hotel and a site lease for up to a century. At a special election Aug. 23, voters approved a proposal to allow the development of Riverside Wharf, a $185 million hospitality-driven entertainment complex on the Miami River.

Miami to seek proposals for large Allapattah complex

In 2019, Miami was eyeing 18 acres it owns in Allapattah for private development. Now an unsolicited proposal for development of the city’s General Services lot on Northwest 20th Street is triggering a request for proposals for a large mixed-use development including 2,500 housing units, a hotel and office space. According to city representatives, as part of…

578 apartments, townhomes replace South Miami public housing

A $158 million mixed-use affordable housing development in South Miami will produce 458 housing units after both construction phases are completed, replacing the South Miami Gardens public housing. Miami-Dade County, in partnership with Related Urban Development Group, Related Group’s public-private development arm, which has built over 22 public…

County to buy Girl Scouts camp, create park, save Rocklands

Miami-Dade is buying 20.2 acres from the Girl Scouts where Camp Choee stands for about $2.7 million. The land is to be used for public park and conservation purposes. The property includes 14 acres designated as a Natural Forest Community by the county and about six acres with camp improvements and supporting facilities in poor to average condition.

University of Miami expanding campus

The University of Miami is advancing plans to expand and lift its Coral Gables campus buildings with the construction of new projects with just a few delays. During the summer, the Florence Ruth Hecht Residential College site, which was built in 1968 on the shores of Lake Osceola as a 12-story dorm building, was demolished, making way for the start of the…

IHOP heir’s family sells Aventura industrial complex

An IHOP heir and his family sold an Aventura industrial complex for over $300 a square foot, an indication that properties in this sector are selling at a premium due to low inventory and a lack of developable land. An entity… Yakov Cohen paid $10.7 million… 35,000-square-foot industrial site with two buildings at 2655 Northeast 189th Street and 2660 Northeast 189th Street.

After Drawn-Out Legal Saga, Wawa Backs Out Of Planned Coral Gables Store

After a nearly decadelong battle, a group of elementary school parents has defeated an attempt by a developer to put a Wawa gas station in Coral Gables. A Miami-Dade County Circuit Court judge has approved a settlement agreement voiding Wawa’s deal to open a location at 280 South Dixie Highway, across from George Washington Carver Elementary School…

Berkadia has arranged a $57.5 million construction loan for Fourteen Residences Allapattah, a 237-unit apartment community located within an opportunity zone at 1470 N.W. 36th St. in downtown Miami’s Allapattah neighborhood. Charles Foschini, Chris Apone and Shannon Wilson of Berkadia’s Miami office secured the financing on behalf of the borrower…

Singapore wealth fund, U.S. REIT splurge on suburban office properties

A foreign wealth fund and a U.S. partner cast a billion-dollar wager on suburbs as the future of offices. Singapore’s GIC and Boca Raton-based Workspace Realty Trust bought majority stakes in 53 suburban office buildings, the Wall Street Journal reported. The properties are scattered across the country, but many are concentrated around Atlanta, Dallas…

Lease roundup: Brick & Timber, UBS nab tenants

Solana Spaces I Wynwood Annex I Miami Solana Spaces, the retail arm of blockchain company Solana, will open a location in Miami’s Wynwood. The crypto event venue, called Solana Embassy, leased 4,200 square feet at the Wynwood Annex building at 215 Northwest 24th Street, according to a news release from Retail by MONA, which advised the tenant. The store…

Changes Made to 40 Year Recertification Inspections

If you own any South Florida real estate, there’s something important that you need to know about commercial properties: the 40-year recertification requirement. In Miami-Dade and Broward Counties, all buildings which are 40 years old from the date of the original Certification of Occupancy must be recertified by the Building Official every 10 years to ensure they are…

Namdar pays $41M for downtown Miami apartment towers dev site

Namdar Group paid $40.5 million for the downtown Miami development site where it plans to build a pair of apartment towers. The New York-based firm bought 1.3 acres at 50 and 60 Northeast Third Street, and at 222 and 234 Northeast First Avenue in two deals, according to records. Namdar also scored a $195 million loan for the purchase and construction of the…

Trinity buys, flips Hialeah Gardens gas station for $3M-plus gain on same day

Talk about jacking up the price at the pump. Trinity Pro bought, then immediately flipped a Hialeah gas station for a $3.7 million gain. The Boynton Beach-based retail investor, led by CEO Christopher J. Martonaro, paid $12 million for a Citgo station at 13899 West Okeechobee Road, records show. It purchased the property from an entity managed by Rodolfo…

Bentley Plans 62-Story Sunny Isles Condo Tower

Luxury brand Bentley Motors, in partnership with REALM-Global, is planning to develop Bentley Residences, a 62-story condominium high-rise located in Sunny Isles Beach, Fla. Dezer Development is in charge of the project, while Sieger Suarez Architects is handling design. Expected to become the tallest coastal residential building in the U.S., the project is…

Lender seeks foreclosure of stalled Arbor Coconut Grove project

The developer of a boutique condo project near CocoWalk at 3034 Oak Avenue in Coconut Grove has gone dark, and its lender is looking to foreclose on the partially completed building. Canadian lender Trez Capital filed a foreclosure lawsuit against the developer of Arbor Residences, alleging the company failed to repay its nearly $21 million loan and…

South Florida by the numbers: Headquarters heading here

Cube Wynwd, Ken Griffin and a Windstar Cruiseship: “South Florida by the numbers” is a web feature that catalogs the most notable, quirky and surprising real estate statistics. Over the past few years, South Florida has been transformed by the unprecedented flow of capital, people, jobs, and companies to the region. While the names of companies that have…

Namdar nabs $195M loan for downtown Miami apartment towers

Namdar Group scored a $195 million loan to buy the development site and build a pair of apartment towers in downtown Miami. The New York-based real estate investment and development firm wants to build Namdar Towers, with a 41-story, 640-unit tower and a 43-story, 714-unit tower, for a total of more than 1.2 million square feet, according to the lender’s news…

U.S. property value to fall 20% in likely recession, Cushman forecasts

Economic uncertainty is the flavor of the day, but Cushman & Wakefield foresees a sour taste for U.S. property values. The brokerage forecast a 50 percent chance of a mild recession. There was also a decent chance of a soft landing for the economy (30 percent), but only a marginal shot at stagflation or an upside scenario. Under a mild recession, Cushman…

Avra Jain and Robert Zangrillo get new partners for Miami River project

Dragon Global’s Robert Zangrillo and Vella Group’s Zach Vella with Vagabond Group LLc’s Avra Jain and 555 Northwest South River Drive: A stalled Miami River mixed-use project is getting restarted after Robert Zangrillo and Avra Jain landed new partners in a $21 million buyout deal. Oklahoma-based Zerby Investments sold its 74.1 percent stake in the…

Coral Rock plans workforce, affordable housing in North Miami

A rendering of the Kayla at Library Place apartment building planned for North Miami with Coral Rock Development Group’s principals David Brown, Michael Wohl, Victor Brown and Stephen Blumenthal: Coral Rock Development Group plans a 138-unit workforce and affordable housing project in North Miami. The 10-story Kayla at Library Place will rise…

Miami-Dade judge sides with Caroline Weiss in property dispute with daughter

With the recent dismissal of a lawsuit filed by her daughter, Caroline Weiss is one step closer to removing a familial obstacle blocking development of a 7-acre site in Miami’s Blue Lagoon. Miami-Dade Circuit Court Judge Alan Fine on Tuesday tossed a complaint Adeena Weiss-Ortiz filed in April against two entities controlled by her mother and TIG Romspen, a lender…

Azora Exan pays $22M for Aldi-anchored retail center in Plantation

In a $22.2 million deal, a partnership involving a Spanish real estate investment firm added an Aldi-anchored shopping center in Plantation to its South Florida shopping spree. Azora Exan, a joint venture between Madrid-based Azora and Miami-based Exan Capital, acquired Plantation Crossing, a 70,369-square-foot retail site at 2140 West Sunrise…

Lender pays $43M for Broward Mall in foreclosure auction

The Broward Mall has a new owner after a lender acquired the retail property for $43 million in a foreclosure auction. An entity representing a U.S.-Barclays commercial mortgage-backed securities trust, or CMBS trust, submitted the winning bid for the roughly 469,000-square-foot mall at 8000 West Broward Boulevard in Plantation, court records show. The only…

Dania Beach mobile home park residents buy out landlords

Why rent when you can own? Residents of a historic Dania Beach mobile home park bought the 27-acre property from their landlords for $7.8 million. Records show Ocean Waterway Co-Op bought the mobile home park at 1500 Old Griffin Road from Amy Fletcher, James Branham, Dewey Daniel, and David Daniel III. The buying entity took out a $6.8 million…

James Batmasian buys Walmart shopping center in Deerfield Beach

Boca Raton-based commercial real estate investor James Batmasian picked up another retail plaza in Deerfield Beach, paying $17 million for a shopping center anchored by a Walmart Neighborhood Market. An entity managed by Batmasian bought Palm Trails Plaza at 1101-1149 South Military Trail, records show. The seller, an affiliate of Savitar Realty…

Sternlicht’s Starwood makes Lantana affordable housing play

Barry Sternlicht’s Starwood Capital Group scooped up an affordable housing complex near Lantana, adding to its portfolio of low-income rentals in Palm Beach County. Starwood, through an affiliate, bought the 94-unit Villas at the Cove Crossing at 2738 Lantana Road and 2735 Donnelly Drive for $16 million from an entity tied to…

Oregon firm pays $33M for two Palm Beach County self-storage facilities

A Beaverton, Oregon-based self-storage firm scored a double play in Palm Beach County, acquiring a pair of facilities for a combined $32.5 million. Entities tied to State Storage Group CEO David Heil acquired a self-storage complex at 500 North Haverhill Road in Haverhill for $24 million, and a self-storage building at 900…

Miami Commercial Real Estate News August 24, 2022: Voters Approve Miami River Dream Project; Wynwood Development Site Hits Market for $32M; More…

Miami Beach voters approve upzoning referendums

Miami Beach residents voted in favor of zoning changes that could boost floor area ratio — or overall project size — of certain properties in the city. They also approved closing a loophole tied to the city’s vacation of public streets. Voters on Tuesday approved an increase in FAR to 2.6 from 2.0 for the Alton Road gateway area, which will allow Russell Galbut and…

Miami voters approve Miami River Dream hotel project

In a low turnout election, Miami voters approved a new 100-year lease for the developers of a proposed Dream Hotel-anchored mixed-use project on the Miami River. MV Real Estate Holdings, led by Alex Mantecon and Guillermo Vadell, and its partner Driftwood Capital, led by Carlos Rodriguez Jr., can now proceed with their…

Thor Equities lists Wynwood dev site for $32M

Thor Equities is listing a Wynwood assemblage that’s primed for a hotel, retail and restaurant development. Asking price: $32 million. The New York-based firm, led by Chairman Joe Sitt… to market the five contiguous empty parcels at 2724 Northwest Second Avenue, 208 Northwest 28th Street and 229, 235 and 245 Northwest 27th Street. “It is the last remaining…”

BH Group: Big investments, big partners and big mystery

Generating industry buzz and making headlines is part of the thrill for most developers when they jump on a new project. Not so for BH Group. The firm has developed a playbook that is ambitious just as much as it is clandestine. Over the past year, it’s taken aim at South Florida’s lucrative real estate market, often teaming up with Israeli billionaire Ted…

Integra JV lands $101M construction loan for Biscayne Shores project

An Integra Investments joint venture scored $101.4 million in financing to develop Biscayne Shores, a mixed-use project of apartments and villas on a waterfront site next to the Jockey Club condominium complex. Synovus Bank provided the loan to the Miami-based developer and its partners, Andrew Korge of Korgeous Group and David Larson of…

Downtown Union Station, library theater planned

The Miami-Dade County Internal Services Department will be receiving industry feedback on the proposed Metrocenter project to redevelop nearly 17 acres of county-owned land in downtown Miami. Staff is to meet with real estate developers Aug. 29 to 31 to get their input on the project prior to publishing the final request for proposals. On Tuesday, the county…

Four-way suit threatens Miami Wilds water park’s progress

The Miami Wilds waterpark planned beside Zoo Miami may suffer another setback in its schedule, as four conservation groups say they plan to sue the National Park Service and US Fish and Wildlife Service arguing violations of the Endangered Species Act related to the project. The Center for Biological Diversity, Bat Conservation International, the Miami Blue Chapter of…

PortMiami dredging study years off as Army Engineers fall short

The long-awaited US Army Corps of Engineers study to evaluate widening and deepening the harbor of PortMiami is now due in June 2026. Results were initially expected this fall, but after the team behind the analysis ran out of time and funds, it requested an added $4.48 million and 57 months to carry the study forward. The specialized segment of the Corps of…

Camilo Miguel Jr.: Founder doubled Mast Capital’s size during the pandemic

Camilo Miguel, chief executive officer and founder of real estate investment and development firm Mast Capital, began in the industry in 2003 with the help of acquaintances who were willing to guide him in his first project. After he successfully completed the property, in 2006 he founded the company and to date has acquisitions in the residential, hospitality…

Billionaire TV Station Owner Makes 7.3M SF Mixed-Use Play On Tiny Island In Biscayne Bay

The owner of a local TV station in North Bay Village is hoping to redevelop its nearly 13-acre site to build a new 7.3M SF, mixed-use development. WSVN’s parent company, Sunbeam Properties, has applied for a special area plan to allow for a huge project on a series of properties on either side of the 79th Street Causeway, which will be discussed at the…

Silicon Valley Bank Signs First Miami Lease At Four Seasons Tower

Silicon Valley Bank has signed its first direct lease in South Florida, furthering its quest to finance the burgeoning tech scene in Miami. The bank, owned by parent company SVB Financial Group, signed a 9K SF lease for the majority of the 15th floor of The Four Seasons Hotel and Tower in Brickell. The office space in the 1.5M SF, 70-story mixed-use building…

Brazilian billionaire proposes oceanfront condos in Surfside

Multiplan Real Estate Asset Management is seeking approval of an oceanfront condo building in Surfside that would replace older buildings that are in “dire” condition. Multiplan, led by Brazilian billionaire José Isaac Peres, plans to build 93 Ocean, a 12-story, 27-unit project at 9309 and 9317 Collins Avenue, according to documents filed with the city. The town’s…

Longpoint buys shuttered trailer park in Miami’s Allapattah

Industrial land is so scarce, a Boston-based developer picked up a former mobile home park in Miami’s Allapattah neighborhood for potential redevelopment. An affiliate of Longpoint Realty Partners paid $16 million for a nearly 6-acre site at 2260 Northwest 27th Avenue, according to records. Formerly the River Park Trailer Court mobile home park, the…

“Slamming on the brakes”: South Florida’s record rent hikes slow

Affiliated Development co-founder Nick Rojo along with 9445 Fontainebleau Boulevard in Miami and the Bohemian apartment project in Lake Worth Beach: Apartment broker Carlos Larocca’s phone is buzzing much less often than a year ago. Not only has interest waned in the South Beach building he leases, but monthly rents — now close to $1,800 for a…

Lease roundup: Terranova, Millennium, R&B, Duke nab tenants

Callista Couture, Unfashional I Lincoln Road I Miami Beach In another example of New York businesses’ migration to South Florida, two retailers are making their debut with new stores on Miami Beach’s Lincoln Road. Stephen Bittel’s Terranova, among the biggest landlords on the shopping and dining pedestrian street, signed Callista Couture for…

Don Peebles: All cities aren’t created equally. New York City has changed dramatically. People are not coming back into their offices. And as a result of the decline in commercial office space, demand, is very significant. Record-breaking vacancies, record-breaking low occupancy numbers, and that’s affecting, of course, the retail around it and businesses that depend…

Vlad Doronin denied business in Russia. Court filings suggest otherwise

Vladislav Doronin held an ownership stake in a Russian company as recently as this year, court records show, despite the billionaire developer’s assertions that he has not done business in the country since 2014. The owner of OKO Group and the luxury hotel chain Aman Resorts, who has developed major U.S. projects including the hotel and condo conversion…

SB Development completes bulk condo purchase in Edgewater

A New York condo and multifamily builder picked up another potential development site in Miami’s Edgewater neighborhood. An entity managed by SB Development principal Joseph Stern paid $12 million for all 13 units at the Belmar Condominium at 419 Northeast 19th Street, records show. The bulk purchase breaks down to $923,076 per condo. The buyer…

Moishe Mana buys “South Beach Classics” property

Moishe Mana added to his land holdings with the purchase of a West Little River property that was once home to Ted Vernon’s “South Beach Classics” TV show. A Mana-led company paid about $10.5 million for the assemblage at 8301 Northwest Seventh Avenue in Miami, near Liberty City and west of I-95. Property records show Frank Soar sold part of the land for $4 million…

Rent control’s on November ballot in Orlando. Is Miami next?

As Florida experiences unprecedented apartment rent hikes amid a pandemic migration to the Sun Belt, Orlando is taking a step toward trying to curb the increases. The Board of Commissioners for Orange County, which includes Orlando, moved last week to put a rent-control measure on the November ballot that would cap increases tied to the adjustment…

South Beach parking lot ripe for development sells for $20M

An aerial of the parking lot at 125, 137, 141 and 151 Collins Avenue and Story nightclub at 136 Collins Avenue: Sometimes, a long-term real estate hold is well worth the payoff. The property owners of Story Nightclub in South Beach sold an adjacent parking lot for $20 million — more than $19 million above their purchase price 36 years ago. In 1986, an entity…

Trinsic nabs $99M loan to build North Miami Beach rentals

Trinsic Residential Group scored a $99 million loan to build an apartment complex in North Miami Beach, making the developer the latest to bet on the city’s multifamily market. The project will have 373 units and an eight-story garage on roughly 4 acres at 16955–17071 West Dixie Highway, according to Trinsic’s notice of construction commencement filed to…

County deals to lower $1 billion Beach transit link cost

Miami-Dade continues price negotiations with concessionaires for the Beach Corridor Trunkline long-term project agreement with an extended negotiation progress until at least 2023, the county announced last week. During a Project Development and Environment (PD&E) Study meeting Aug. 9, presenters spoke about the current configuration of the Beach Corridor…

Doral incinerator location might get a second look

The location of a new Miami-Dade waste-to-energy incinerator plant, currently set to be constructed in the City of Doral, may be revised in the future. “If I get elected, I would request that the four different sites be considered,” said Juan Carlos Bermudez, city mayor and candidate for the District 12 county commission seat. Miami-Dade Mayor Daniella…

Super-tower from Swire, Related Companies faces another test

Brickell City Centre is growing, wide and tall. Helping that achievement is recent action from the Miami City Commission. At its last meeting before the August break, commissioners unanimously approved on first reading two resolutions that would amend the current Special Area Plan, or SAP, for the sweeping mixed-use development in the heart of the city’s financial…

Developers given shot at city’s 10-acre tennis center land

The City of North Miami Beach is inviting local developers to learn more about a P3 development opportunity and pitch creative ways to reimagine the space. The city is hosting a private pre-solicitation launch event Aug. 25 at the proposed city-owned development site, which is the Arthur I. Snyder Tennis Complex at 16851 W Dixie Hwy. Developers will get the chance…

The lowdown on 17-acre county downtown mega-project

Miami-Dade County has unveiled features of its much-anticipated downtown redevelopment project, for which the county is offering about 17 acres of county-owned land, branded as MetroCenter, in the heart of the 28 acres that serve as the seat of the local government. The county aims to redevelop downtown and transform it into a 24-hour community. To that…

LA developer plans Little Havana short-term rental hotel

Los Angeles developer David Herskowitz is planning to build a short-term rental hotel in Little Havana, the first of its kind in the historic Miami neighborhood. Designed by Miami-based Modis Architects, the proposed 12-story, 140-room building would rise on an assemblage at 930, 940 and 950 Southwest Eighth Street that his company, Icon on 8…

Adam Neumann raises $350M from a16Z for multifamily venture

Adam Neumann is back in the real estate game with a new venture and a heavyweight backer. The WeWork founder is set to launch Flow, a multifamily market venture, next year. The company has the backing of prominent venture capital firm Andreessen Horowitz, which has invested about $350 million into the company, the New York Times reported.

Adam Neumann’s Apartment Startup Lands $350M Investment From Andreessen Horowitz

Venture capital firm Andreessen Horowitz, known for its early investments in the likes of Facebook and Airbnb, invested in former WeWork CEO Adam Neumann’s latest company, a residential real estate entity known as Flow. The VC firm announced the investment in a blog posting by General Partner Marc Andreessen lauding Neumann’s talents as an entrepreneur…

Video: Damac boss talks making his US debut in Surfside

South Florida’s luxury condominium market has cooled from two years of feverish demand and sales. High mortgage rates, inflation and the looming possibility of a recession are giving some developers pause. Hussain Sajwani is unfazed. The Emirati who plans to develop the Surfside condo collapse site is not only undeterred by an economic slowdown, but he…

Lease roundup: Nuveen, Allianz ink 6 new tenants at Waterford Biz District

Pernod Ricard Travel Retail, Current Builders, others | Waterford Business District | Miami-Dade County Nuveen Real Estate and Allianz Real Estate scored six new leases and an expansion for an existing tenant at their Waterford Business District near Miami International Airport. Pernod Ricard Travel Retail, a division of the spirits company that produces…

Location Ventures sells Coral Gables luxury student co-living building

Location Ventures sold a luxury co-living building marketed towards University of Miami students. Records show the company unloaded all 24 of the units in Orduna Court for $14.7 million through an LLC. The condo building is located at 800 South Dixie Highway. The buyer is Orduna Courts LLC, a Delaware Corporation, affiliated with Christian Giraldo and Paola…

Terra’s CentroCity Little Havana project nets $230M in financing

Terra’s CentroCity mixed-use development in Little Havana scored $230 million to finance construction. Athene, an affiliate of Apollo Global Management, provided a senior loan and Mack Real Estate Credit Strategies contributed a mezzanine component, according to a press release. The financing was arranged by Walker & Dunlop. Terra, led by CEO David…

Yachts, parties and private islands: The indulgences of real estate’s richest

Clockwise from top left: a Bugatti Chiron; Drake; a “Madsummer” yacht; Manny Khoshbin’s 70,000-square-foot property; and the Four Seasons Hotel in Lanai Remember the bad old days in New York? The 1970s had the city on the precipice of fiscal ruin, but a mouthy tax attorney named Steve Ross bet big on the metropolis that many landlords were ready to give up on.

Canadian investors drop $22.5M on Bay Harbor Islands apartments

Canadian investors scooped up a pair of mid-rise apartment buildings in Bay Harbor Islands for $22.5 million. Entities tied to Toronto-based Westdale Properties bought the Rexleigh building at 9881 East Bay Harbor Drive and the Kingsley Arms building a few blocks south at 9291 East Bay Harbor Drive for $11.25 million apiece, according to deeds and state…

Birge & Held pays $55M for NW Miami-Dade apartment complex

Birge & Held doubled its South Florida footprint with the $55.1 million acquisition of a 175-unit apartment complex in northwest Miami-Dade County. The Indianapolis-based multifamily real estate investment firm paid $315,029 per unit for The Lakeridge at the Moors at 17200 Northwest 64th Avenue in the unincorporated neighborhood…

Trammell Crow, Baptist scoop up Kendall Town Center dev sites

Crow Holdings’ Michael Levy and NAI Miami’s Robert Eckstein with Southwest 88th and 91st streets, and between Southwest 162nd and 158th: Planned multifamily and medical-use portions of the massive Kendall Town Center mixed-use project are coming closer to fruition after a pair of sales. Dallas-based Trammell Crow Residential scooped up its 20-acre…

Miami-Dade seeks partners for Government Center redevelopment

Miami-Dade is calling on developers to overhaul the county’s Government Center headquarters in what could be one of South Florida’s biggest public-private ventures. The county is seeking proposals for the 17-acre site, which includes the commissioners’ chambers and county administrative offices at 111 Northwest First Street. The property has 1.1 million square feet of…

Wave-Shaped 54-Story Miami River Tower Now Rising Out Of The Ground, with Photos

The first 54-story Miami River tower is rising out of the ground, and its wavy architecture can now be seen for the first time, new photos by Ryan RC Rea show. The Miami River phase 1 tower itself is planned to top off with a permanent height of 640 feet above ground, making it the only tower to surpass the 600-foot mark this far west in Miami. The first phase of…

Jeffrey Soffer’s Turnberry Isle resort scores $412M refi from Bank of China

Jeffrey Soffer’s Fontainebleau Development refinanced its JW Marriott-branded resort in Aventura’s Turnberry Isle with a $412 million loan. Bank of China New York Branch is financing the Fontainebleau affiliate that owns the JW Marriott Miami Turnberry Resort Hotel & Spa at 19999 West Country Club Drive, records show. The loan refinanced $339.5 million in debt…

Plans Filed With FAA For Construction Cranes At Former Miami Arena Site, Nearly 800 Feet High

An application has been submitted to the Federal Aviation Administration requesting permission to install two tower construction cranes at the former Miami Arena site. According to two applications filed August 4, the cranes will rise 779 feet above ground. One will reach 793 feet above sea level, while the other will reach 794 feet above sea level. The permanent…

Flex Office Provider Expands in Miami

The Gateway at Wynwood, a Class A office building in Miami, has leased 30,000 square feet to Mindspace. The entire sixth floor will be occupied by the global boutique flex office operator, which is set to install 435 workstations. Owned by Aron Rosenberg, The Gateway at Wynwood offers 195,000 square feet of leasable office space in addition to 25,900 square…

Hollywood’s Bread Building redevelopment project scores $83M loan

A joint venture led by BTI Partners can warm up construction of the former Bread Building site in Hollywood, after nabbing an $83 million loan. The Fort Lauderdale-based developer’s partnership with Bridge Investment Group secured the financing from Canadian Imperial Bank of Commerce, according to a press release. Cushman & Wakefield brokered the loan…

American Landmark JV sells Hollywood apartments for $70M

A joint venture led by American Landmark Apartments sold a Broward County multifamily complex to a New York-led partnership for $69.5 million. Park Row Equity Partners and Phoenix Realty Group, both based in Manhattan, along with two separate entities based in New Hyde, New York, acquired the Park Colony Apartments at 812 South Park Road in…

Hollywood site of derailed condo project trades for $15.5M

Years after taking on the city and losing in appeals court, a partnership including Château Group’s Manuel Grosskopf has sold a Hollywood Beach site where it once hoped to build a 15-story condo. An entity led by Ulvi Mammadov bought the 1.2-acre site at 901 South Ocean Drive for $15.5 million, or about $12.5 million per acre, from GSK Hollywood…

Raanan Katz buys Hallandale Beach shopping center

Another day, another shopping center sold in South Florida. An affiliate of Raanan Katz’ RK Centers paid $14 million for the Publix-anchored Hallandale Place Shopping Center at 1400-1484 East Hallandale Beach Boulevard in the Broward County city, records filed Wednesday show. The seller, Elias M. Loew Florida Realty Trust, had owned the property…

Developers score OK for 30-story Flagler Village rental tower

Steven Hudson and Charles Ladd Jr. are closer to embarking on the first of their two planned apartment towers in Fort Lauderdale’s Flagler Village neighborhood. The Fort Lauderdale City Commission on Tuesday gave final approval to the duo’s 30-story Flagler Residences South. The 320-unit building will have 31,000 square feet of commercial space…

Naftali’s building purchase roils Fort Lauderdale church

Thou shall not close real estate deals involving church property in secret — or thou shall feel thy flock’s wrath. Dissident members of the First Baptist Church Fort Lauderdale are accusing the congregation’s leadership of surreptitiously selling a nearly 0.2-acre lot with a two-story building at 501 Northeast Second Street to New York-based developer Naftali Group…

American Landmark pays $60.5M for North Lauderdale rental community

American Landmark Apartments bought a North Lauderdale rental complex for $60.5 million. The Tampa-based multifamily operator paid nearly double the previous sales price for the 214-unit Glen at Cypress Creek at 1949 Cove Lake Road, records show. The buyer also assumed a $27.4 million mortgage with Berkeley Point Capital, and increased the…

All aboard! Gatsby buys railroad-themed Delray Beach retail plaza for $30M

Gatsby FL’s Nader Shalom and Babak Ebrahimzadeh bought a retail and office plaza in downtown Delray Beach for $30 million. The duo, through an affiliate, bought the four-building, 50,000-square-foot complex at 25 and 45 Northeast Second Avenue and 220 Northeast First Street from Janet and Tim Onnen, according to records. Southdale Properties…

Estate proposes 321 apartments in downtown West Palm

Estate Companies proposes a 321-unit apartment project, marking its first Soleste-branded multifamily development in downtown West Palm Beach. Estate filed plans for an eight-story project on 2.5 acres at 410 and 510-560 North Rosemary Avenue, according to the application submitted to the city this month. Renderings show two buildings connected by an overpass.

Nora developer plans townhouses in West Palm Beach

A partner in the Nora District that is slated to breathe life in a long-overlooked part of downtown West Palm Beach is zeroing in on another area that developers have glossed over for years. Ned Grace and Damien Barr’s NDT Development accumulated 1.6 acres on the south side of Nottingham Boulevard, from South Dixie Highway west to…

California firms pay $39M for West Palm mobile home park

A California joint venture dropped $39.1 million for a West Palm Beach mobile home park. An entity managed by Sacramento-based BoaVida Group and Auburn, California-based Nella Invest acquired the Holiday Ranch Mobile Home Park at 1375 Military Trail and 1396 Ranch Road, records show. The partnership assumed a $15.6 million Fannie Mae mortgage…

Video: WELL Building Institute’s Dr. Matt Trowbridge Discusses Whether Offices Are Really Prioritizing Health and Wellness

It’s clear that creating healthy and well-designed office spaces, whether in Miami, elsewhere in South Florida, or anywhere for that matter, is crucial for the well-being of employees. In this video interview, Dr. Matt Trowbridge emphasizes the importance of the built environment in influencing health outcomes, both physical and mental. Here are some key points from the discussion:

1. Data-Driven Approach: Dr. Trowbridge highlights the data that led him to focus on the built environment. He mentions that only about 20% of health outcomes are determined by the quality of medical care, while the rest are influenced by social and environmental factors.

2. Social and Environmental Determinants: The social and environmental determinants of health play a significant role in shaping people’s well-being. The way we build places, including offices, can impact factors like physical activity, healthy eating, and community connections.

3. Well-Building Standard: The Well Building Institute’s Well Building Standard is organized into 10 concepts, covering aspects like air, water, light, movement, and more. Dr. Trowbridge emphasizes the importance of holistic features and intentional design to create spaces that foster collaboration, diversity, and inclusion.

4. Mental Health Considerations: The discussion touches on the mental health aspect, especially in the context of the challenges posed by remote work. Dr. Trowbridge acknowledges the impact of isolation on mental health and the need for gathering moments in people’s lives.

5. Benefits to Individuals and Businesses: Creating environments that promote well-being is not just about meeting a standard; it’s about sending a clear signal that the organization values and invests in its employees. Businesses can use their spaces to manifest their brand, contribute to employee satisfaction, and become part of their ESG (Environmental, Social, and Governance) story.

6. Implementing Well-Building Standards: Dr. Trowbridge suggests that office building owners and managers can start by sending a strong signal of investment in their people. The Well Building Standard provides a framework that encourages organizations to think holistically about the opportunities within their spaces.

7. Addressing Return-to-Office Challenges: In the current context of the return to office, considerations include acoustic needs for virtual meetings, creating inclusive communal spaces, and addressing the specific requirements of diverse talent.

8. Small Changes with Significant Impact: There are small changes, such as incorporating plants, optimizing lighting, and providing healthy food options, that can have a positive impact on the well-being of individuals in office spaces.

9. Cost of Ignoring Well-Being: Dr. Trowbridge suggests that it’s essential for business leaders and property owners to recognize the potential costs of neglecting the physical and mental health of employees. It’s not just about a trend; it’s about making spaces that remain relevant and beneficial over time.

10. The Role of Well-Building Institute: The Well-Building Institute has experienced a significant increase in interest and adoption of its standards, especially with the introduction of the Health Safety Rating during the COVID-19 pandemic. The focus is not just on individual assets but on organizational commitment to well-being at scale.

11. Performance-Based Certification: The Well Standard includes a performance rating, rewarding organizations that maintain ongoing vigilance and performance in areas like air quality, CO2 levels, and other factors influencing well-being.

12. Creating Value: Ultimately, taking care of the people around us adds value to both individuals and the organizations they are part of. Well-designed and healthy spaces contribute to a positive and productive work environment.

The key takeaway is the recognition that the built environment plays a crucial role in shaping the well-being of individuals and communities. Businesses and property owners have the opportunity to contribute to a healthier and more sustainable future by prioritizing the design and management of their spaces.

Video: Commercial Edge’s Manager of Business Intelligence Doug Ressler Discusses Office Property Market Update and Opportunities

The Discussion: Navigating the Changing Landscape of the Commercial Real Estate Market

This video interview delves into the current dynamics of the office sector in the commercial real estate market. As the landscape undergoes significant changes due to factors such as remote work, higher interest rates, and inflation, Doug Ressler, Manager of Business Intelligence at Commercial Edge, provides valuable insights into the absorption, performance, and future outlook of the office property market.

Absorption and Performance:

The discussion kicks off with an analysis of absorption and performance in the office sector. Despite the challenges posed by remote work trends and hybrid models, Russell notes that sales transactions year-to-date are comparable to 2021, totaling around $44 billion. The market is witnessing a shift in demand, with a focus on life science, boutique offices, and suburban spaces. The adaptability of asset owners and developers is evident as they explore different types of office spaces to meet evolving demands.

Geographical Variances:

Russell highlights the migration away from gateway cities, with a specific focus on emerging life science cities like San Mateo and Redwood City. The Southeast cities, such as Atlanta and Charlotte, are thriving due to their adaptability to the new pandemic paradigm, emphasizing a knowledge-based economy driven by digital technology.

Cap Rates and Prices:

The conversation addresses the stability in cap rates and prices per square foot, indicating a balance between supply and demand. The bid and ask remain close, showcasing a hesitancy among sellers to put assets on the market if there is a significant gap. The future trajectory of cap rates remains uncertain, with the ongoing question of whether the office market will return to pre-pandemic norms or if remote work will persist as the primary method.

Impact of Employment Market:

The dialogue delves into the connection between the office market and the employment market. Russell notes that smaller tenants are more inclined to return to the office, while larger companies may struggle to bring back employees. The changing dynamics of the employment market, with increased job opportunities and higher wages, pose a challenge for companies insisting on in-office work.

Opportunities and Adaptations:

Despite uncertainties, Russell sees opportunities in the market, particularly in adaptive reuse. The speed at which adaptive reuse is occurring is exciting, with a focus on converting older buildings into different asset types such as co-working spaces, life science facilities, and data centers. The trend towards mixed-use developments is also evident, with office buildings being converted into apartments and retail spaces.

Foreign Investment:

Foreign investment in U.S. office properties is expected to continue, with Canada currently leading the way. The secure investment environment, coupled with a lower risk and the potential for high returns, makes U.S. commercial real estate an attractive option for international investors.

Conclusion:

As the office property sector continues to evolve, the key takeaway is the adaptability and creativity of asset owners and developers. The willingness to explore new strategies, including adaptive reuse and mixed-use developments, reflects a dynamic approach to meet changing market demands. The office market, while facing uncertainties, presents opportunities for investors to strategically navigate the evolving landscape and contribute to a healthier and more productive environment.

~

Miami Office Property Market:

Hawkins Commercial Realty would note that Miami is somewhat in its own world with regard to about everything, including office. While office buildings are being sold at deep discounts to prices a couple of years ago in other cities, in Miami a new 724′ office tower, 830 Brickell, is already fully leased and ground has been broken on another office tower to reach 1,046′ into the sky. A number of office properties for sale can be viewed on the Hawkins Commercial Realty site here.

Miami Commercial Real Estate News August 10, 2022: Medley Industrial Trades at 4x 2017 Price; Hialeah Shopping Center Sells for $43M; More…

Enrique Manhard, Miami’s great land gambler

Enrique Manhard, whose past bets on clothing stores turned him into a fashion mogul, is wagering on another lucrative industry: Miami real estate. Manhard and his partners have purchased 27 lots in the city since 2017. They join other tycoons who have built empires across industries such as professional sports or spirits brands but are now gambling on land…

Building Boom in Miami’s Brickell Bucks National Bust

Boston-based Rockpoint and Montreal-based Ivanhoe Cambridge have sold Mary Brickell Village, a Publix-anchored mixed-use property in Miami’s Brickell district. RPT Realty purchased the 200,503-square-foot development for $216 million. Danny Finkle, Chris Angelone, Matthew Lawton, Eric Williams and Kim Flores of JLL represented the sellers in the transaction.

Mapping out Ken Griffin’s Miami shopping spree

1201 Brickell Bay Drive, Citadel’s Ken Griffin and 830 Brickell office tower in Miami: Ken Griffin has a history of making bets and breaking records. The billionaire hedge funder began investing in college at Harvard ahead of his 1989 graduation. Those early bets paid off for him and his alma mater. He returned in 2014 with a $150 million donation to the university, which…

Iconic NYC eatery Rao’s to open at Loews Miami Beach

Good luck getting a table. Rao’s, a classic New York City restaurant known as much for its exclusivity as its red-sauce fare, is planting a flag in Miami Beach. The Italian eatery, owned by the Pellegrino family, is expected to open at the Loews Miami Beach Hotel early next year, sources confirmed to The Real Deal. It will take the ground-floor space occupied by Lure…

Longpoint picks up Hialeah shopping center for $43M

A Boston-based private equity firm is continuing its shopping spree for grocery-anchored retail properties in South Florida. Longpoint Realty Partners has acquired El Paraiso, a two-building shopping center at 1700 and 1800 West 68th Street in Hialeah, for $43.2 million, or about $317 a square foot, in an off-market deal, the…

“We took action and moved fast”: Damac boss on Surfside plan, US expansion

Hussain Sajwani had been trying to break into U.S. real estate for years. The Emirati billionaire’s Dubai-based development firm, Damac Properties, looked at New York properties prior to the pandemic, hoping to land a prime site near Central Park, but had no luck. So when the Surfside site became available less than two months after the condominium…

LeFrak, Soffer kick off leasing at SoLé Mia rental

Richard LeFrak and Jackie Soffer have begun leasing the third multifamily development at their massive SoLé Mia mixed-use project in North Miami. Known as Villa Laguna, the 190-unit rental building sits on 2.3 acres at 2200 Sole Mia Square Lane, overlooking a 7-acre artificial lagoon intended to evoke “Caribbean waters…”

Coral Gables mobility hub slowed as costs rise

Challenging market conditions continue to hinder the construction start date for the Coral Gables Mobility Hub. Due to current market conditions, construction costs have increased substantially and many materials are in short supply, so city staff determined it was best to wait to begin construction, said City Manager Peter J. Iglesias. Groundbreaking…

Miami taxes stay flat, but bills may rise

The proposed overall millage rate in the City of Miami, used to calculate property tax bills, will remain unchanged for the fiscal year that begins Oct. 1. The city commission on July 28 set the proposed overall millage rate for fiscal year 2022-2023 at 7.99 mills. It includes general operating millage of 7.6665, and debt service of 0.3235, reflecting no adjustments from…

Miami and Freedom Park developers hammer out deal’s benefits

Miami Freedom Park is one step closer to becoming a reality. At its last meeting, the Miami City Commission approved on first reading two planning and zoning requests related to Miami Freedom Park, the planned home for David Beckham’s Inter Miami CF soccer team. The vote was 4 to 1, with Commissioner Manolo Reyes casting the lone no vote. In April…

Property insurance turmoil meets climate change threats

More than half the homeowners in the South expect their home to be damaged by climate change-related weather in the next 30 years just as property insurance turmoil and insecurity hit hundreds of thousands of homeowners in Florida who are either losing their policies or paying a lot more in premiums with insurers at risk of downgrading. Florida is…

W. A. Spencer Morris: Heading multiple developments locally and across Sunbelt

W.A. Spencer Morris recently became president of The Allen Morris Company, one of the largest real estate firms in Florida and in the Southeast. He is now responsible for overseeing the investment portfolio and projects under development. The company currently has $2.5 billion in its development pipeline, 718,000 square feet in office space…

Azora Exan Acquires Miami-Area Office Asset

Miami-based real estate fund manager Azora Exan has finalized its $37 million buy of 429 Lennox Ave., a 43,500-square-foot office building in Miami Beach, Fla. The sale was subject to a $19 million loan from Abanca Corporacion Bancaria, according to CommercialEdge data. JLL Capital Markets represented the seller, Goddard Investment Group, and procured…

Judge rules Surfside condo owners off the hook for $800K tax bill

Unit owners of the collapsed Surfside condo are no longer on the hook for their 2022 property tax bills. Judge Michael Hanzman, who has been overseeing the collapse litigation, ordered that the unit owners’ property tax bill this year be paid out of the proceeds from the $120 million sale of the property in July. The 136 owners of the collapsed Champlain…

Lawsuit settled, closings underway at Trump Group’s delayed Sunny Isles tower

The Estates at Acqualina’s south tower has finally been completed. The Trump Group also settled litigation with the project’s general contractor, marking a major step forward for the long-planned luxury condo development. Eighty five closings have been recorded with Miami-Dade County for the 154-unit, 49-story south building at the two-tower…

Medley industrial site trades for 4x its 2017 price

A warehouse boom is taking shape in Medley, where a 4-acre industrial site just sold for more than four-times what it last traded for five years ago. An affiliate of Maryland-based Realterm Logistics paid $15 million for two properties at 9455 Northwest 104th Street in the western Miami-Dade town, records show. The lots include two 6,500…

Blackstone sells five South Florida budget hotels for $61M

Blackstone sold off a quintet of budget hotels in South Florida for $61 million as part of an eight-property portfolio deal in the Sunshine State. Affiliates of Georgia-based Global Hotel Group bought three Motel 6 properties in Cutler Bay, Dania Beach and Fort Lauderdale, as well as two Studio 6 extended-stay hotels in Coral Springs and West Palm Beach…

Facing High Inflation, Commercial Real Estate Investors Reevaluate Their Strategies

In a market slammed by the greatest inflation in more than 40 years, as well as the economic consequences following Russia’s invasion of Ukraine, real estate investors appear to be rethinking what they’re purchasing. At least for the time being, income from occupancy is preferred versus risk. The sales statistics for last quarter revealed a significant reevaluation…

Ken Griffin’s Brickell takeover: Citadel adds to its properties with $20M purchase

Billionaire hedge funder Ken Griffin is continuing his Brickell shopping binge, scooping up properties across the street from the development site his Citadel bought this spring. In the latest deal, an entity led by Citadel COO Gerald Beeson bought the three-story, 12-unit apartment building at 1250 Brickell Bay Drive and… at 1260 Brickell Bay Drive for $20 million, a…

Federal Realty buys Pembroke Pines shopping plaza for $180.5M

Federal Realty Investment Trust is jumping on the South Florida shopping center bandwagon, acquiring a Pembroke Pines retail plaza for $180.5 million. An affiliate of the Rockville, Maryland-based real estate investment trust bought Shops at Pembroke Gardens at 527 Southwest 145th Terrace at a $7.5 million discount from the previous sale…

Who wants Cookies? National cannabis firm opening dispensary in Westchester

From left: TRP’s President Daniel Firtel, MV Real Estate Holdings’ Alex Mantecon, and TRP’s Brandon Johnson with 8303 SW 40th Street: One of the nation’s most popular cannabis brands is setting up its first Florida pot shop in Westchester, an unincorporated neighborhood in Miami-Dade County. Cookies, a San Francisco-based marijuana firm co-founded by rapper…

Here are the resi projects planned for Bay Harbor Islands

Developers are zeroing in on Bay Harbor Islands, planning almost a dozen projects with nearly 400 condos and apartments. An analysis by The Real Deal found that developers have pumped nearly $150 million into land purchases in the waterfront town since May of last year. Here are some of the residential projects planned for Bay Harbor Islands: Ugo Colombo’s…

Brick & Timber to buy Cube Wynwd office building for $60M

Brick & Timber’s Jesse Feldman and Glenn Gilmore, Tricera Capital’s Ben Mandell, and Lndmrk Development’s Alex Karakhanian with Cube Wynwd: Brick & Timber Collective plans to purchase its second Wynwood office building, The Real Deal has learned. Glenn Gilmore’s Brick & Timber put Cube Wynwd at 222 Northwest 24th Street under contract for over $60…

“We’re in the eye of the hurricane”: Sternlicht eyes growth in economic turmoil

Against soaring inflation and interest rates, a global economic slowdown and trillions of dollars wiped from the stock and crypto markets, billionaire Barry Sternlicht believes real estate has “held up well” this year. But despite an upbeat second-quarter earnings report, the chairman and CEO of Starwood Property Trust and Starwood Capital Group said he is…

Seritage flips Hialeah shopping center for $28M, banking $6M profit in hours

From left: RK Centers principal Ranaan Katz and Seritage CEO Andrea Olshan in front of the shopping center at 1460 West 49th Street in Hialeah: Seritage Growth Properties made a $6 million profit in a single day by quickly flipping a Hialeah shopping plaza to RK Centers. A Seritage affiliate bought Westland Gateway Plaza at 1460 West 49th Street for $22.1 million…

Jorge Pérez’s Related wants to build apartments in Miami’s Little Havana

Related Group wants to build a 167-unit, mixed-income apartment project in Miami’s Little Havana neighborhood. The developer, led by Jorge Pérez and Jon Paul Pérez, proposes a 12-story building at 450 Southwest Fifth Street and 445 Southwest Sixth Street, according to plans filed to Miami-Dade County late last month. The…

Ken Griffin’s Citadel comes to Brickell — and supercharges the market

A home in north Coconut Grove sparked a bidding war, even though the house wasn’t built yet. One buyer was paying all cash, and the other was financing his purchase. The seller, a spec home builder, saw an opportunity. The builder raised the price to $4.9 million from $3.8 million, said the listing agent, Compass’ Liz Hogan. The all-cash buyer then…

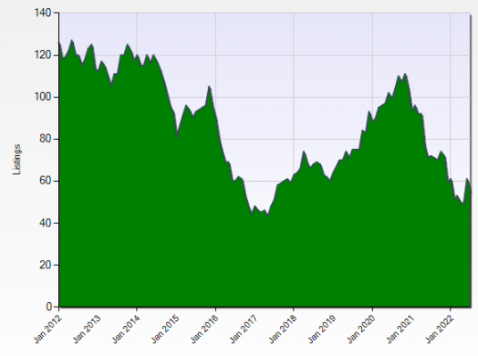

Chart Reflects Dearth of Industrial for Sale in Miami-Dade

About any active commercial broker in Miami-Dade will tell you that there is all kinds of demand for industrial property, but none to buy. I can personally attest to this. This chart of properties noted as “industrial” in the Miami-Dade MLS and with an asking price of $1 to 5 million (mid-market industrial) illustrates this. The number of such active listings has only…

Aimco completes $100M Flagler Village dev assemblage with latest $16M deal

Aimco added the final piece to its Flagler Village development site where the company plans a major mixed-use project. Denver-based Aimco bought 1.4 acres of land on the southwest corner of Northeast Ninth Street and Northeast Fifth Avenue in downtown Fort Lauderdale for $16 million, according to a deed. An affiliate of Miami Heat co-owner…

Estate Cos. lands $93M construction loan for Lauderhill apartments

Robert Suris’ Estate Cos. has triggered construction of a 529-unit apartment complex in Lauderhill thanks to $93.2 million in financing from Synovus Bank. Known as Soleste Westgate, the seven-building complex will rise six stories on the site of a former Target store at 5451-5575 North University Drive and 7730 West Commercial Boulevard. The South Miami-based…

Related Fund Management, CP flip portion of Las Olas Square

501 East Las Olas Boulevard in Fort Lauderdale, FL with CP Group’s Partner Chris Eachus and Managing Partner Angelo Bianco and Macquarie’s CEO Shemara Wikramanayake: Less than five months after scooping up the Las Olas Square office and retail complex, Related Fund Management and CP Group flipped a portion of the property. Macquarie Group, based in…

BlackRock lands in West Palm Beach

Investment management behemoth BlackRock is heading to downtown West Palm Beach, marking a continuation of New York financial firms’ migration to South Florida. Larry Fink’s company subleased 5,000 square feet at the 360 Rosemary building, which was developed by Stephen Ross’ Related Companies, The Wall Street Journal…

Miami Commercial Real Estate News August 3, 2022: South Beach WeWork Location Sells for $37M, Little Haiti Retail for $17M; Citadel Takes 95K sf at 830 Brickell; More…

Industrial rents keep climbing, as vacancies drop in South Florida

Inflation? Recession? Pfft. South Florida’s industrial market hasn’t slowed down, as super low vacancy rates continue driving rents to new heights. In the second quarter, industrial landlords in Miami-Dade County increased asking rents by more than $1, compared to the same period last year, while Broward and Palm Beach industrial property owners jacked up the rate…

Ken Griffin’s Citadel leases at 830 Brickell office tower in Miami

Billionaire Ken Griffin inked a major lease for Citadel’s offices at 830 Brickell, less than two months after he announced moving the hedge fund to Miami from Chicago, with plans to build a new headquarters. Citadel took roughly 95,000 square feet in a long-term lease at the 55-story tower at 830 Brickell Plaza that is under construction, according to sources…

Jimmy’s Eastside Diner, featured in “Moonlight,” has a new owner

Italian restaurateur, real estate investor and soccer club owner Tonino Doino bought Jimmy’s Eastside Diner, which was featured in the 2016 film “Moonlight.” Doino, who owns the Lincoln Road restaurant Rosinella Italian Trattoria, paid about $4.3 million for the property at 7201 Biscayne Boulevard, according to the brokers involved in the deal and the…

Miami vs NYC: A developer’s guide

Don Peebles, in partnership with former Miami Beach Mayor Philip Levine and developer Scott Robins, wants to build a six-story office and apartment building on a city-owned parking lot: Ian Bruce Eichner took on two condominium projects last year. In Manhattan’s Murray Hill, he struck a deal to buy the Community Church of New York’s home. And in Bay…

Judge awards $5M to Israeli mogul in HFZ lawsuit over failed Shore Club project in Miami Beach

A judge awarded Israeli investor Benny Shabtai a $4.6 million judgment in his lawsuit against HFZ Capital Group over the failed Shore Club Miami Beach redevelopment. New York-based HFZ, led by Ziel Feldman, lost its ownership of the historic Shore Club when Monroe Capital foreclosed on the property. Monroe brought on Witkoff as its partner…

Hyatt Regency redevelopment to net $25 million for affordable housing

In November, voters in the City of Miami will determine the fate of a new plan to revive a crucial city-owned property in the heart of downtown. If approved, the sweeping development would bring three new towers to the riverfront, including a new hotel and an improved public walkway along the Miami River. Near the end of an exhaustive daylong meeting July 28…

Miami gives leaseholder 18 years to build on Coconut Grove bayfront

A formal restaurant that voters approved nine years ago for city-owned waterfront land got another nine years for completion in a unanimous Miami City Commission vote last week. The unnamed restaurant is to replace the Charthouse at 51 Charthouse Drive near city hall. The commission vote gave operators an OK to set up “temporary food…”

Chart Reflects Dearth of Industrial for Sale Listings in Miami-Dade

About any active commercial broker in Miami-Dade will tell you that there is all kinds of demand for industrial property, but none to buy. I can personally attest to this. This chart of properties noted as “industrial” in the Miami-Dade MLS and with an asking price of $1 to 5 million (mid-market industrial) illustrates this. The number of such active listings has only…

PortMiami Tunnel blazes trail to future

Some 120 feet below sea level the 42-foot-diameter PortMiami tunnel connects the mainland to Miami-Dade County’s second-greatest economic engine, supporting more than 334,000 jobs and contributing $42 billion annually. Since opening to traffic in 2014 after over four years in construction, it has become a gold standard for tunnels in Florida…

Golden Glades hub adding transit passengers

Most of the Metrobus routes serving the new Golden Glades Multimodal Transportation Facility that opened Jan. 24 have gained riders at a hub that also serves an express bus route and links in Tri-Rail and bus transit from Broward County. “This new transit facility is helping to bring more equity, accessibility, and innovation into our public transit system,” said…

Chart of Net Migration by State Shows Florida’s Population Growth at expense of California, New York

The map above shows each states net domestic migration from April 2020 to July of 2021. Florida and Texas had the most new residents, gaining around 200,000 each. New York and California suffered the largest losses. It appears that Arizona is benefiting from the exodus of people leaving California, as are Tennessee and the Carolinas form people leaving…

Citadel grabs Miami office space ahead of building its own tower

Ken Griffin’s Citadel is tying up deals for office space as it prepares to expand in Miami, where the firm is establishing its headquarters. Citadel has taken a floor at 200 South Biscayne Blvd., where it already has temporary offices, and leased roughly 90,000 square feet at 830 Brickell, an under-construction tower where Thoma Bravo and Microsoft Corp…

Z Capital loses attempt to assess Carillon condo owners in Miami Beach nearly $8M

Z Capital Group lost its attempt to levy a $7.7 million assessment on condominium unit owners at the Carillon Miami Wellness Resort. The outcome is the latest in the drawn out and still-ongoing legal battle, pitting the associations for the North, South and Central towers against Z Capital’s affiliate, Carillon Hotel. The oceanfront complex is at 6801 Collins Avenue…

All Florida Paper Signs 226,698 SF Industrial Lease in Metro Miami

All Florida Paper, a Hispanic-owned paper and sanitation products wholesaler, has signed a full-building, 226,698-square-foot industrial lease at Building D in Beacon Logistics Park in the Miami suburb of Hialeah. Jose Juncadella and Sebastian Juncadella of Fairchild Partners represented the landlord, Codina Partners, in the lease deal. Wayne Ramoski and…

Report: Apartments In Sun Belt Markets Set Up For ‘Significant Collapse Of Demand’

Rent growth is slowing considerably around the country, especially in some of the Sun Belt markets that were once scorching-hot, a new report shows. For the first time since 2020, 12 markets experienced a drop in asking rents over the course of a month, according to a report released Wednesday by CoStar-owned Apartments.com. The markets that…

Miami’s Office Pipeline Expands in Q2

By the end of the second quarter, Miami’s office pipeline reached 5.6 million square feet, according to CommercialEdge data. The metro’s under-construction stock represented 7.4 percent of its total office supply—the third largest rate in the country. Most gateway cities saw boosts to their pipelines during the second quarter, except Los Angeles and San…

Macken scores $16.5M construction loan for Koya Bay townhome development in North Miami Beach

Macken Companies scored a $16.5 million construction loan to complete a waterfront luxury townhouse development in its own backyard. The North Miami Beach-based developer secured the financing from LV Lending, according to a press release. The funds will go toward finishing Koya Bay, a collection of 10 four-story townhomes on the Intracoastal Waterway…

Ari Pearl JV pays $32M for Bay Harbor Islands condo complex

Developer Ari Pearl and investor Jonathan Leifer paid $32 million to acquire all of the units in an older Bay Harbor Islands condo complex on a waterfront property that they could redevelop. Nearly 30 individual owners at Bay Harbor Towers, at 10141 and 10143 East Bay Harbor Drive, sold their units to Pearl and Leifer, records show. Pearl’s PPG BHT Owner LLC…

Lease roundup: Cargo Management Group expands in Doral, All Florida Paper leases in Doral

Freight forwarding company Cargo Management Group opened additional operations in an industrial building in Doral. Cargo Management, based in Sweetwater, leased 49,986 square feet at 1325 Northwest 78th Avenue, according to a news release from the tenant’s broker. Andrew Fernandez of CBRE represented Cargo Management. Ana Rivera of JLL represented…

Hyatt, Gencom score Miami commission approval for James L. Knight Center referendum

Hyatt CEO Mark Hoplamazian and Gencom Founder and Principal Karim Alibhai with a rendering of the proposed three-tower development at 400 Southeast Second Avenue: Hyatt avoided a third strike at possible redevelopment of the James L. Knight Center site in downtown Miami. The Miami City Commission by a 4-1 margin on Thursday approved a…

Two major Miami projects – David Beckham’s soccer stadium, as well as Swire Properties and Stephen Ross’ One Brickell City Centre office tower – are a step closer to fruition. The Miami City Commission on Thursday gave preliminary approval to the Major League Soccer project’s designation as a Special Area Plan, as well as to items related to…

Crunch Fitness founder beefs up retail portfolio with $18M purchase in Little Haiti

Crunch Fitness and Big Move Properties’ Douglas Levine with 8200 Northeast Second Avenue and 201 Northeast 82nd Street: Douglas Levine, founder of Crunch Fitness, is pumping up his retail real estate holdings with a two-building, $17.8 million purchase in Miami’s Little Haiti. An entity managed by Levine, a real estate investor who also founded Miami-based…

NR Investments wants to build mixed-use complex in Miami’s Allapattah

NR Investments wants to develop a massive mixed-use complex on Miami’s General Services Administration site in Allapattah. Ron Gottesmann and Nir Shoshani’s development company filed a proposal for a 99-year lease and redevelopment of the city-owned 18-acre property at 1970 Northwest 13th Avenue and 1950 Northwest 12th Avenue, according to…

Madrid-Miami JV buys WeWork leased office building in South Beach for $37M

Azora Exan is jumping into Miami Beach’s office market with a $37 million purchase of a five-story building fully leased to WeWork. An affiliate of Azora Exan, a joint venture of Madrid-based Azora and Miami-based Exan Capital, bought the property at 429 Lenox Avenue in the city’s South of Fifth neighborhood, according to records. The partnership paid $461 per…

Related, partner pay $51M for Aventura mixed-use dev site

Related Group and a partner scooped up an Aventura office property for $51 million, with plans to develop a mixed-use project on the site’s parking lot. Coconut Grove-based Related and Aventura-based BH Group bought the 4.5-acre property at 2999 Northeast 191st Street that includes the Aventura View office building, according to the buyers’ news release. The seller…

Damac closes on acquisition of Surfside collapse site for $120M

Dubai developer Damac Properties closed on its $120 million acquisition of the site of the deadly Surfside condo collapse, The Real Deal has learned. The sale was recorded on Wednesday, according to the receiver’s notice, filed with Miami-Dade Circuit Court. The transfer of ownership marks a key milestone in litigation tied to the collapse…

Former low-income South Beach apartments hit market as possible hotel conversion

Jamestown is looking to cut off a slice of its Collins Avenue portfolio by listing a historic South Beach apartment building for sale. The Atlanta-based real estate investment firm, led by CEO and principal Matt Bronfman, retained Marcus & Millichap to market 727 Collins Apartments at 727 Collins Avenue in Miami Beach, according to an online listing. Jamestown…

Aimco adds to Flagler Village dev site set for 3M sf mixed-use project

845 Northeast Fifth Terrace and two other unaddressed lots in Fort Lauderdale with Aimco’s CEO Wes Powell: Aimco added another parcel to its Flagler Village development site slated for a 3 million-square-foot project. Denver-based Aimco, through an affiliate, scooped up 1.7 acres of parking lots on the southeast corner of Northeast Ninth Street…

Duncan Hillsley fattens up rental portfolio with $25M bulk condo purchase in Sunrise

Duncan Hillsley Capital bulked up its South Florida rental portfolio with a $25.1 million acquisition of 143 units at a Sunrise condominium complex. An affiliate of the Boca Raton-based real estate investment firm now owns a majority of Sunrise on the Green, a 238-unit garden-style condo complex at 4001 North University Drive, according to records. The…

Keiser University sells pair of Fort Lauderdale office properties for $58M

Keiser University sold a pair of Fort Lauderdale office properties to its owner, Everglades College, in two deals for a combined $57.6 million. In the bigger of the two deals, an affiliate of Keiser University sold the 111,542-square-foot office complex at 1900 West Commercial Boulevard for $30.4 million, according to records. Everglades College assumed an existing…

AvalonBay pays $295M for two Miramar complexes

From left: Rockpoint’s Bill Walton, AvalonBay Communities’ Benjamin W. Schall and Timothy J. Naughton, and The Altman Companies’ Seth Wise with 11385 SW 30th Ct and 2750 SW 113th Ln: AvalonBay Communities bought two Miramar apartment complexes for a combined $295 million. AvalonBay purchased Altís Miramar at 11385 Southwest 30th Court for…

Bridge Industrial nabs $28M construction loan for facility near Ft Lauderdale airport

Bridge Industrial is moving quickly on its project on the former Park ‘N Fly property in Dania Beach. It scored a $28 million construction loan less than two months after scooping up the site Windsor, Connecticut-based Talcott Resolution Life Insurance provided the financing for Bridge’s planned logistics facility at 2200 Northeast Seventh Avenue between Fort…

JV scores $87M construction loan for West Palm Beach office projects

Seven months after unveiling plans to develop a new office building and renovate an existing one in downtown West Palm Beach, a joint venture secured an $87 million construction loan for both projects. New York-based Acore Capital provided the financing to Brand Atlantic Real Estate Partners and Wheelock Street Capital, according to records. The funds will go…

Gatsby picks up Palm Beach Gardens mixed-use dev site for $17.5M

The Florida arm of Gatsby Enterprises is taking over a proposed office and retail project in Palm Beach Gardens after paying $17.5 million for a development site. Miami-based Gatsby FL, an affiliate of the New York-based real estate investment firm, bought a 7-acre site at 11200 RCA Center Drive from an entity managed by Palm Beach Gardens…

Developers of troubled West Palm resort project facing $61M foreclosure

The Banyan Cay Resort & Golf Club development is in deeper trouble, as a lender seeks to foreclose on the property after the alleged nonpayment of a $61 million construction loan. Dogged by four years of construction delays, the 150-room luxury hotel development’s partners allegedly failed to repay the loan by its July 1 maturity date, according to a July 16 lawsuit filed…

Chart Reflects Dearth of Industrial for Sale in Miami-Dade

About any active commercial broker in Miami-Dade will tell you that there is all kinds of demand for industrial property, but none to buy. I can personally attest to this. This chart of properties noted as “industrial” in the Miami-Dade MLS and with an asking price of $1 to 5 million (mid-market industrial) illustrates this. The number of such active listings has only been in a trough like this one other time in the prior decade.

Further, I don’t recall the industrial property market being as tight in 2017 as it is today. Thus, I wonder about the listings that make up the data behind this chart. It could be that there are more grossly unrealistic listings today – there are always some – than there were in 2017. After all, nothing requires a listing price to be based on reality. And, of late, anecdotally at least, there seems to be an uptick in sellers and their brokers listing properties well beyond a generous price. Playing off the age-old philosophical riddle; if a property worth $1 was listed for sale in the forest for $3, was it really listed?

Miami Commercial Real Estate News July 27, 2022: CBD Multifamily Trades for $184.5M, NMB Self-Storage for $26M; 2.6M sf Spec Industrial Planned for Doral; More…

Coral Gables commission gives Allen Morris another chance for Ponce Circle project

The Allen Morris Company has another chance to amend its plans for a controversial development near The Plaza megaproject in Coral Gables. The city commission voted to postpone a decision on two ordinances that would allow a change in the property’s zoning to commercial high-rise, as well as to vacate a public alleyway that separates the assemblage. Coral Gables…

Developers score $65M construction loan for Flagler Village apartments