Stephen Ross, the chairman and majority owner of The Related Companies, a global real estate development firm he founded in 1972 that has been and continues to be very active in Miami, and owner of the Miami Dolphins, discusses reopening and the state of commercial real estate projects like Hudson Yards in New York in elsewhere. This discussion concentrates a lot on New York, but the discussion, much of which is him expressing opinions about that (in his opinion) and how we should be opening up the economy, could apply in Miami or anywhere.

Video: How COVID-19 is Impacting Commercial Real Estate

In this video from Yahoo Finance, Doubleline Capital Portfolio Manager Morris Chen joins Julia La Roche and Zack Guzman of Yahoo Finance to discuss in some detail the latest commercial real estate outlook amid COVID-19. They talk about the variance in pain among various commercial real estate sectors as well as the offsetting positives of an extremely low interest rate environment. That the spread in cap rates to treasury rates has expanded, and what this might mean, is also discussed.

Miami Commercial Real Estate News October 28, 2020: Pics of Completed River Landing Development; 117 Acres Trade in Homestead; Projects Approved, Disapproved; More…

Photos Show the Massive $452 Million River Landing Project Now Complete

River Landing Shops & Residence, a massive mixed-use complex, is now open on the Miami River. It took nearly a decade to develop the project. Developer Urban-X Group first put the former Mahi Shrine Auditorium property where River Landing is located under contract in 2011. River Landing is a $452 million development with 2.2 million square feet…

$11.6M Sale of Former Newspaper Printing Facility in Metro Miami Arranged

Cushman & Wakefield has arranged the $11.6 million sale of the former Miami Herald Printing Facility in Doral. The three-story warehouse spans 118,993 square feet and features 15 dock-high positions, one grade-level ramp and clear heights from 10 feet to 46 feet. The property was built in 2013 and is situated at 3500 NW 89th Court, 14 miles west of downtown…

$23 Million Miramar Office Sale Brokered

Cushman & Wakefield has facilitated the $22.6 million sale of Miramar Tech Center, a 56,710-square-foot Class A office property in Miramar, Fla. Scott O’Donnell, Mike Ciadella, Dominic Montazemi, Greg Miller and Miguel Alcivar negotiated on behalf of the seller, United Data Technologies. The brokerage’s Jason Hochman secured a $13.6 million acquisition loan for…

Miami board again votes against a downtown Melo skyscraper

A Miami review board has unanimously recommended denial of plans for a skyscraper downtown from The Melo Group, advice the outgoing city planning director ignored for another Melo project that is now rising. The denial vote Oct. 21 is rare for the Urban Development Review Board, whose role is to advise the planning director. The latest Melo proposal…

Commercial Property Borrowing Cost Quarterly 2020 Q3: 5-Year Treasury Remains Naught-y

Yields on 5-year U.S. Treasury Notes continue to remain at lows reached as we began the era of COVID. As can be seen in the chart above, these rates, most closely tracked for commercial real estate financing cost, plummeted from what were already considered low levels to under 50 basis points (0.5%), barely hovering over zilch, where they have been since. Though…

Atlanta Fed: Beige Book Finds Slow Improvement but an Economy Still Lagging

A now-familiar pattern—economic growth picking up but still below pre-COVID levels—prevailed across the Southeast over the past several weeks. But two new factors joined the pandemic to hamstring commerce, as Hurricanes Laura and Sally disrupted energy production and transmission and damaged crops, farming infrastructure, and property across coastal…

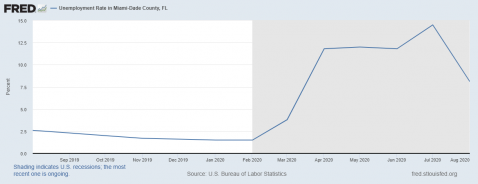

Chart: August Miami-Dade Unemployment Level Reaches Lowest Level Since March

From its peak of 14.5% reached in only the prior month, the unemployment rate in Miami-Dade county plummeted in August (8/1) to 8.1%, the lowest level since March when unemployment had jsut started to creep up but was still in low single digits (3.7%). The continuing effects of COVID-19 on employment, and thus the economy, in the Miami area continue can be…

Saks Fifth Avenue Lender Looks To Foreclose On Miami Store

The pandemic has pounded traditional retailers. Landlords and lenders involved with properties ranging from large malls to urban shopping areas are sizing up their options — and some are playing tough. Lenders to the Saks Fifth Avenue store at Miami’s Dadeland Mall are foreclosing on its owner, The Wall Street Journal reported. The owner defaulted in April…

South Florida by the numbers: 2020 presidential election and real estate

“South Florida by the numbers” is a web feature that catalogs the most notable, quirky and surprising real estate statistics. You may know that Election Day is Nov. 3. (With all kidding aside, however, will we know who is the winner by the next time this column is published?) Some pundits are predicting a close and heavily contested election, with the added…

Biscayne Boulevard residential tower with grocery wins OK

A large development bringing together more than 500 residential units and a major grocer has garnered a positive vote. Crescent Heights of America Inc. and its affiliated entities propose 2900 Biscayne, a 38-story mixed-use tower on land at 2900 Biscayne Blvd., and the city’s Urban Development Review Board unanimously recommended approval. The site is at 2900…

Poor hospitality: Hotel owners in big cities hit major tipping point

All of the lights in the Hilton Times Square have been pitch black for weeks — one of several ominous signs for hotel owners in New York and other large cities around the country. The owner of the 478-room property, just blocks away from Broadway and Bryant Park, disclosed plans to the state’s Labor Department last month to permanently shut its doors and lay off…

Supreme Court shift could favor rent law challengers

When landlord groups filed a federal lawsuit challenging New York’s rent law last year, they already had their eyes on the U.S. Supreme Court. Now, with the appointment of a sixth conservative judge, their case may have a better shot at being heard by the nation’s highest court. Amy Coney Barrett was sworn in Monday night as the 115th justice in the court’s history.

Miami-Miami Beach ferry service ‘at one-yard line’

Poseidon Ferry LLC, soon to offer daily waterborne commuter transportation between Miami and Miami Beach, will officially launch with an evening Music Cruise on Nov. 6, said CEO Johnathan Silva. The company’s core business, commuter service – still in the doldrums of permitting – should follow soon. “We’re at the one-yard line right now…”

Super Bowl economic impact touches down at $571 million

Fueled by shrinking supply and rising demand, Miami-Dade single-family home sales are close to a buying frenzy, with median sale prices increasing for 106 consecutive months and rising 15.2% in the year that ended Sept. 30, figures from the Miami Association of Realtors show. The average single-family home now sells for $435,000, September figures show. The hottest…

Cross-bay transit is vital, but blank-check deal is all wrong

Miami-Dade made a costly bet plopping down $8 million for designs of a multi-billion-dollar monorail in a deal with a global firm whose true interest is a mammoth gambling resort. The consortium that includes Malaysian casino mogul Genting aims to build a monorail linking Miami to Miami Beach and then operate it. But taxpayers would repay the group…

Life Time launches preleasing of $500M Coral Gables mixed-use multifamily project

Life Time launched preleasing of a major mixed-use multifamily development in Coral Gables that will include a 70,000-square-foot athletic resort and a 22,000-square-foot shared workspace component. Nolan Reynolds International is set to complete the $500 million, 1.2 million-square-foot project previously known as Gables Station. Life Time is…

Miami developer sued for running boat over Biscayne Bay swimmer’s leg

A Miami real estate developer is facing allegations that he ran over a swimmer with his boat in Biscayne Bay near Bay Harbor Islands, slicing her leg and causing permanent injuries. Theresa Murray filed suit in Miami-Dade Circuit Court Court on Monday, alleging that Irwin Tauber’s 41-foot boat’s three bladed stainless steel propellers sliced her leg and ankle…

Miami Developer Maimed Swimmer In Yachting Accident, Lawsuit Says

A Miami woman alleges that shopping center developer Irwin Elliott Tauber ran over her with his yacht in Miami’s Biscayne Bay in April, causing serious injury to her extremities. He also allegedly refused to render first aid. Tauber is the CEO of Taubco, which owns Causeway Square, an LA Fitness-anchored mixed-use building at the corner of Biscayne Boulevard…

Here are the most active players in the loan workouts space

Barneys’ former space on Madison Avenue was hanging by a thread. A $76 million balance on the building’s debt, which Ashkenazy Acquisition took out in 2010, was set to mature in July. And after Barneys filed for bankruptcy and shut down all of its stores this February, Ashkenazy was forced to tap the retailer’s letter of credit to make debt service payments…

Homestead Park of Commerce Sold for $35M to Copart USA

October 2020 – ComReal is proud to announce the sale of 117 acres within The Homestead Park of Commerce in South Dade and welcome Copart USA to the City of Homestead! The sales price was $34,746,716. Copart was represented by the ComReal team including Ed Redlich, Ron Redlich, Chris Spear, Edison Vasquez, Mort Fetterolf and Patrick McBride. The seller…

When the music stops: Guitar Center could file for bankruptcy

The music could stop at Guitar Center in the near future. The retailer is preparing for bankruptcy after missing a $45 million interest payment on its debt, the New York Times reported. The company has reached out to creditors to explore a plan where it could emerge from bankruptcy in 2021. The possibility of bankruptcy comes after Moody’s and S&P downgraded…

Does taxing the wealthy really drive them away?

This year’s spring housing market came a couple of months later than usual to the leafy suburbs of New Jersey. But it was worth the wait. Michele Kolsky-Assatly, a veteran agent with Coldwell Banker focused on Bergen County’s luxury market, has been busier than ever with the exodus of families from New York City. “They never want to be locked up in a high…

Macken wins approval for North Miami Beach townhomes

Macken Companies Principal Alan Macken and a rendering of the project North Miami Beach-based developer Macken Companies received site plan approval for a waterfront townhome community in the city’s Eastern Shores neighborhood. The company hopes to break ground on the 10-unit Koya Bay, along the Intracoastal Waterway at 4098 Northeast 167th…

Abandoned malls get new life as senior housing

As more malls and shopping centers close or see their anchor tenants fall into bankruptcy, they may be repurposed for a new use: senior housing. George and Pat Ritzinger are among the early beneficiaries of the trend: The couple moved to Folkestone, a retirement community in Wayzata, Minnesota, developed on land that formerly housed a shopping mall built…

Blackstone makes $1.2B deal with Brookfield for Simply Self Storage

Blackstone Group is buying Simply Self Storage from Brookfield Asset Management for about $1.2 billion, Bloomberg reported. Brookfield bought the storage company in 2016 and has more than doubled its footprint; it now has more than 8 million square feet of space across the U.S. It started seeking buyers for the company earlier this year. With this deal……

Jules Trump talks luxury towers and assembling in Sunny Isles Beach in TRD’s Coffee Talks

In excess-loving South Florida, there’s always room for more — more mansions on the waterfront, more luxury penthouses, and more Trump. TRD‘s latest episode of Coffee Talk includes just one Trump. Not Donald, not Eric or Don Jr., but one whose name South Florida industry experts know just as well — South African-born developer Jules Trump. Though he…

The metamorphosis of the metropolis

After years of sparring over its highest and best use, the fate of 5 World Trade Center was left to a competition. The Port Authority of New York and New Jersey and the Lower Manhattan Development Corp. last year announced what was effectively a truce: The agencies would consider both residential and commercial visions for the site. Among them were…

Covid pummeled shopping centers, but their parking lots are thriving

While many traditional streams of income for landlords have slowed or dried up due to the pandemic, one has proven to be a surprising earner: parking lots. Landlords of large parking lots and garages have been renting out those spaces for a variety of activities, including open-air retail, job fairs, polling stations and drive-through COVID-19 testing, the Wall Street…

Kendall Corners Florida Retail Shopping Center Gets a New Tenant, Aldi

Key Points Regarding the New Aldi Lease in Kendall Corners MMG acquired the Kendall Corners retail center in March 2017. The Kendall Corners’ original business plan included replacing Ashley Furniture with a grocer upon their lease expiration in 2020, as a means to incorporate more grocery-anchored retail centers to the portfolio. Ashley Furniture…

Active South Florida Lender Bank OZK’s lending up in third quarter

New York’s commercial real estate market has been pummeled by the pandemic, but one of its biggest condo construction lenders reported almost no write-downs in the third quarter. On its earnings call Friday, Arkansas-based Bank OZK reported that its net charge-off rate, or ratio of loans written-down to total loans originated, was 0.09 percent. That is well……

Do over: North Miami Beach to re-vote on Dezer’s plan to redevelop Intracoastal Mall

Dezer Development will return to the North Miami Beach commission for a re-vote on two ordinances tied to the contentious redevelopment of the Intracoastal Mall, despite securing approval earlier this week. In the Zoom commission meeting on Tuesday that ended after 2 a.m., two commissioners were absent for the vote. Still, the two ordinances passed…

MG3 buys former Miami Herald printing facility for $12M

Miguel Alcivar, Wayne Ramoski, Gian Rodriguez, Dominic Montazemi and Skylar Stein of Cushman & Wakefield MG3 Group, an Aventura-based private real estate company, bought the former Miami Herald printing facility in Doral for $11.6 million, a $2.3 million loss from its previous sale in 2016. Records… the three-story warehouse at 3500 Northwest 89th Court.

Eight stats tell the tale of Adam Neumann’s rise, fall, and return

Alfred CEO Marcela Sapone and Adam Neumann Adam Neumann is back. In his first venture since leaving WeWork last year, the eccentric and brash Israeli entrepreneur is investing $30 million in Alfred, a “future of living” startup that provides apartment services such as dog walking, maintenance and rent processing, according to Bloomberg. Neumann’s family…

At final presidential debate, talk of Opportunity Zones and “little tiny windows”

At Thursday’s presidential debate, there was less interrupting and more real-estate related discussion. The event marked the final faceoff between President Donald Trump and former Vice President Joe Biden before Election Day. Housing was only briefly acknowledged in the first debate, which devolved into more of a shouting match than polite discourse.

Gap Inc. will close 350 stores and exit malls entirely

Another big retailer is leaving struggling malls behind. Gap Inc. announced Thursday that it will close 350 of its stores —220 of its namesake Gap shops, and 130 Banana Republic outposts — by early 2024, ABC News reported. Eighty percent of its remaining stores will be in off-mall locations, according to ABC News. “We’ve been overly reliant on low-productivity…

South Florida industrial market shows signs of weakness in Q3

South Florida’s industrial market — believed to be resilient to coronavirus as demand for distribution space and cold storage grows with online shopping — did show some signs of weakness in the third quarter, according to a newly released report. In Palm Beach County, 350,000 square feet of industrial space was…

Sold! Online auto auctioneer pays $35M for Homestead land

Going … going … gone. A publicly traded provider of online car auctions paid $34.75 million for 117 acres of land in the Homestead Park of Commerce. Copart USA, founded in 1982 and based in Dallas, bought the land at Southeast 36th Avenue and Southwest 336th Street. The site includes a 32,453-square-foot Class A distribution warehouse, according to a…

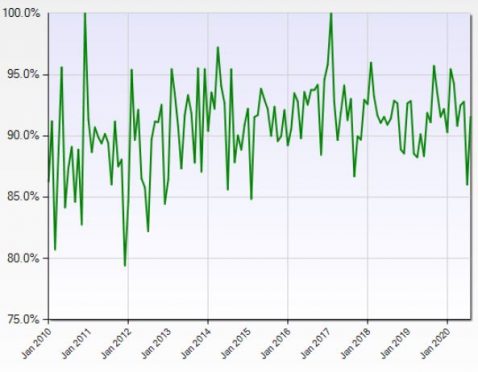

Rent collections in market-rate apartments stagnate in October

Rental payments for market-rate apartments are holding steady from September, but down slightly from last year. The National Multifamily Housing Council’s monthly payment tracker, which collects data on collections in 11.4 million market-rate units, found that 90.6 percent of those households paid some rent by Oct. 20. In 2019, about…

Miami board approves plans for Related, Crescent Heights towers and rejects Melo’s proposal

A city of Miami board rejected plans for Melo Group’s latest downtown Miami project, and approved plans for separate projects from Crescent Heights and the Related Group. On Wednesday, the Miami Urban Development Board unanimously approved Crescent Heights’ 38-story tower at 2900 Biscayne Boulevard and a 37-story mixed-use project at…

Sunny Isles mayor sells Hialeah warehouse for $13M

A company tied to the mayor of Sunny Isles Beach and a fellow South Florida real estate investor sold a 160,000-square-foot warehouse in Hialeah for $13.1 million. George “Bud” Scholl, elected mayor in 2014 and re-elected in 2018, and investor Steven M. Rhodes sold the industrial building at 1101 East 33rd Street, The Real Deal has learned. EverWest Real Estate…

Logistics Company Relocates. Inks New 93,000-SF Lease Deal

IFS Neutral Maritime, a consolidation, cargo and logistic company, inked a 7-year lease deal for 93,320 square feet at Turnpike Commerce Center (TCC) located at 1350-1400 NW 121st Avenue in Doral, with plans to occupy the building in its entirety in January 1, 2021. The deal closed October 7. Hector Catano, president of Cornerstone International Realty, represented the…

Midtown Capital Partners buys Miramar office center for $23M

A Miami real estate investment and asset management firm bought the Miramar headquarters of an information technology company for $22.6 million. Records show Midtown Capital Partners bought the Miramar Tech Center at 2900 Monarch Lakes Boulevard. A company affiliated with United Data Technologies, or UDT…

Commercial Property Borrowing Cost Quarterly 2020 Q3: 5-Year Treasury Remains Naught-y

Yields on 5-year U.S. Treasury Notes continue to remain at lows reached as we began the era of COVID. As can be seen in the chart above, these rates, most closely tracked for commercial real estate financing cost, plummeted from what were already considered low levels to under 50 basis points (0.5%), barely hovering over zilch, where they have been since. Though borrowing costs have not followed this point for point, they’re nonetheless lower.

This low interest rate environment is powerful for real estate as an asset class. There are of course ongoing concerns about vacancy rates and rent growth in a slower economy, but lower interest rates mean a lower cost of capital. Plus, real estate income becomes relatively more attractive to fixed income investments. Vacancy and rent growth effects remain unknown, but lower interest rates are known – now.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates.

Miami Commercial Real Estate News October 21, 2020: Feasibility Study Approved for Monorail to Miami Beach; Sunny Isles, Medley Warehouses Trade; Office Rents Set Record; More…

South Florida Q3 office rents hit record high, despite higher vacancies

Despite record high office vacancies across South Florida, average asking rates hit new highs Despite record office vacancy rates across South Florida, average asking rents hit new highs in the third quarter, according to a newly released report. Miami-Dade had the highest average asking rate, at $41.68 per square foot, according to the report from Colliers International…

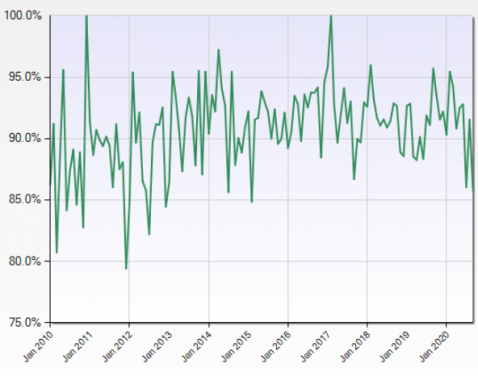

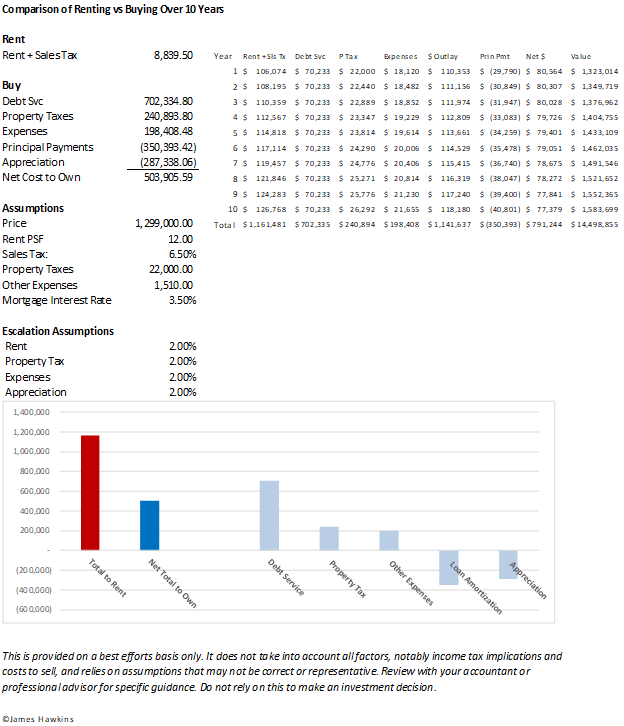

The sales to list price ratio as reported by the Miami MLS for improved commercial property in Miami-Dade County from $1 million to $10 million dipped in September. September’s recorded ratio of 86.3% is the lowest level recorded since February 2015’s 84.9% number. This follows a dip two months prior that, though a slightly better number was itself then the…

Here’s What Could Happen To The EB-5 Program In A New Administration

The EB-5 immigrant investor program, which has been used to fund major development projects throughout the United States, has been limping along for the past few years, and some have even predicted its demise after rules were tightened last summer. How might the program, which awards U.S. green cards and visas to foreigners who put a minimum of $900K into…

Sunny Isles mayor sells Hialeah warehouse for $13 million

A company tied to the mayor of Sunny Isles Beach and a fellow South Florida real estate investor sold a 160,000-square-foot warehouse in Hialeah for $13.1 million. George “Bud” Scholl, elected mayor in 2014 and re-elected in 2018, and investor Steven M. Rhodes sold the industrial building at 1101 East 33rd Street, The Real Deal has learned. EverWest Real Estate…

Honeywell warehouse in Medley sells for $8M

South Florida real estate investor Leo Ghitis sold a warehouse near Medley for $7.5 million. Ghitis sold the nearly 50,000-square-foot building at 9315 Northwest 112 Avenue on 3 acres of land inside Flagler Station Industrial Park, according to records. The price equates to about $152 a square foot. The buyers are entities that share an address with Midtown Capital…

Miami Beach based Starwood scores $265M refi for portfolio of InTown, Uptown hotels

Starwood Capital Group secured $265 million in refinancing for a portfolio of 58 extended-stay and midscale hotels nationwide, representing a fraction of all the hotels it owns and operates. Miami Beach-based Starwood hopes to execute the first lien mortgage about Oct. 28, according to a report from Kroll Bond Rating Agency. Starwood will use the funds to pay off existing…

Seritage sells Hialeah shopping center for $21M

Seritage sold a 108,000-square-foot shopping center formerly anchored by Kmart in Hialeah for $21 million. A Daytona Beach-based publicly traded real estate company, CTO Realty Growth, bought the shopping center at 1460 West 49th Street, records show. The company changed its name from Consolidated-Tomoka Land Co. to CTO in May. The sale equates to $194 psf…

Rental project in MiMo District launches leasing

The developer of the American Legion property in Miami’s MiMo District launched leasing of the first phase and plans to break ground on the second phase next year. Private equity firm Asia Capital Real Estate, also known as ACRE, and QuadReal Property Group, the real estate investment arm of the British Columbia public employees’ pension, completed the first phase…

In “Billion Dollar Loser,” WeWork’s “epic rise” and Adam Neumann’s quiet enablers

Real estate executives had their doubts about WeWork, but many weren’t willing to risk missing out on its success. They and others who kept their criticism to themselves helped enable and then felled the co-working giant once it became clear that its crash would be just as extraordinary as its ascent. “They couldn’t explain WeWork’s valuation, but they were fearful…

10,566 SF Office Sublease Negoitated at Brickell City Centre

Cresa has negotiated a 10,566-square-foot office sublease for Pillsbury Winthrop Shaw Pittman LLP (Pillsbury) in Miami’s Brickell City Centre. Pillsbury, which focuses on the technology and media, energy, financial services, and real estate and construction sectors, has occupied the space at 600 Brickell Ave. since 2017 and will now lease the space until at least…

Dezer’s mega development project gets key approval

A rendering of the project with developer Gil Dezer Dezer Development’s plan to redevelop the Intracoastal Mall property into a massive mixed-use project cleared another hurdle. North Miami Beach commissioners approved ordinances for the complex on second reading in a 3 to 2 vote early Wednesday morning. Two commissioners were not present for the…

Edgewater-Midtown tower residences win Miami’s backing

A mixed-use residential development is being proposed for the area where Edgewater meets Midtown in the City of Miami, and not far from Wynwood. Called 27 Edgewater, the planned 18-story building would rise at 2728 NE Second Ave. and be home to 108 dwellings. The project by developer 908 Group Holdings LLC was recently reviewed by the city’s…

Rents fall in cities around the world

Across the country, rents are tumbling. Sales have surged in the New York suburbs, and prices with them. But Manhattan apartments are the cheapest they’ve been since 2013. The number of listings have tripled from a year ago while the median rent has dropped 11 percent, according to Bloomberg. Expensive cities have taken the biggest hit. In San Francisco, the median…

Jorge Pérez steps down as president of Related Group, handing title to son Jon Paul

Jon Paul Pérez was named president of the Related Group, taking over from his father, Jorge Pérez. Jorge, who founded the Miami-based real estate giant in 1979, will stay on as chairman and CEO when Jon Paul takes over in November, according to a release. Billionaire developer Jorge Pérez, known as the Miami condo king, has spoken about his succession plan in the past.

Blackstone Move Solidifies Miami Mayor’s Vision For A Global City

The dream of Miami Mayor Francis Suarez to have the city turn into a global destination for talent and investment is coming to fruition. Blackstone, a private equity investment firm, has set its sights on opening a Miami outpost as the nation’s largest investment managers continue to migrate to South Florida. Its plans surfaced as the city is in…

PortMiami dredging may rest on economic future of cruise lines

PortMiami continues to plan for more dredging, pandemic or not. As the coronavirus has plagued both Miami and the rest of the nation, there has been an increased focus on cruise ship travel and economic recovery. Last year, Miami-Dade County commissioners authorized a three-year study. Now, after about a year and a half, US Army Corps of Engineers project…

Things To Consider When Leasing To A Medical Marijuana Dispensary

Some essential CRE steps when leasing to an essential business At the height of lockdowns and quarantines, it quickly became apparent that what was considered essential expanded far beyond first responders and hospital staff. Truck drivers working long shifts to get goods to supermarkets, and the employees stocking shelves with those products quickly rose to…

Can Proposed Seawalls Protect Miami From Storm Surges?

The Magic City could see walls become a permanent part of the downtown area if an Army Corps of Engineers plan comes to fruition Downtown Miami has one of the planet’s most spectacular coastlines, featuring buildings that seemingly jet from the ocean as you approach from the air or water. This beautiful location comes with…

Bus Rapid Transit has inside track in East-West Corridor

After nearly three decades of studies, local transportation decision-makers are set – again – to choose a mass transit upgrade for a 14-mile commuting route linking West Miami-Dade to Miami International Airport and downtown Miami. Today (10/22), the Miami-Dade Transportation Planning Organization Governing Board is to vote on a preferred transit mode for…

Sandor Scher: Set to bring hotel, condos, retail to Beach’s Ocean Terrace

For almost two decades, Sandor Scher’s Claro Development has advised on more than 100 projects in over 60 cities, adding nearly 2,500 hotel rooms in South Florida and, according to firm figures, delivering more than $750 million of hospitality, commercial and historic restoration development. His entrée into real estate came through a restaurant startup that over 6½…

Miami-Dade approves interim contract for monorail to Miami Beach

A rendering of the monorail Plans for a monorail between the city of Miami and Miami Beach took a step forward on Tuesday. In spite of calls for a deferral from Miami Beach, the Miami-Dade County Commission approved a contract of up to $14 million with Genting Group and Meridiam Infrastructure North America Corp. to study the feasibility of building…

The REInterview: Reeves Wiedeman on the manic rise and fall of Adam Neumann and WeWork

Dream no small dreams, for they have no power to move the hearts of men — or venture capitalists. Adam Neumann, the co-founder and former CEO of WeWork, certainly wasn’t guilty of small dreams. From being a broke émigré living rent-free in his sister’s apartment to building one of New York’s largest real estate companies to becoming the head of one of the…

Related, Crescent Heights and Melo Group seek approval for Miami projects

The Related Group, Crescent Heights and the Melo Group are seeking approval from the Miami Urban Development Review Board for projects in downtown Miami and Edgewater. Related and its partner, ROVR Development, led by Oscar Rodriguez and Ricardo Vadia, are proposing The District at 225 North Miami Avenue in downtown Miami. The 37-story…

Mezz lender forecloses on Ocean Drive hotel in South Beach

The pandemic brought especially bad timing for the owner of a South Beach hotel, which purchased it last year, embarked on a multimillion-dollar renovation, and ended up losing its investment. Leste Group and its partner, Moto Capital Group, last month foreclosed on the newly renovated Lord Balfour Hotel at 350 Ocean Drive, The Real Deal has learned. The,,,

Former Uber CEO Travis Kalanick cooks up a real estate empire

Uber co-founder and ex-CEO Travis Kalanick has quietly amassed a real estate empire over the past two years. Companies tied to Kalanick’s CloudKitchens, a startup that rents available space to food delivery businesses, have snapped up more than 40 properties across the country for more than $130 million, the Wall Street Journal reported. Kalanick’s…

AMC faces serious cash crunch despite theaters reopening

Movie theaters are reopening across the country, but that may not be enough to save some of the biggest cinema operators. AMC Entertainment Holdings, one of the world’s largest movie theater operators, said it could run out of cash by the end of the year if it can’t find additional sources of liquidity, Reuters reported. The company said…

Buying distressed debt to get the underlying property – a litigation due diligence checklist

It’s beyond the scope of this blog to predict where the commercial real estate market is heading, but there are those who have predicted a downturn. If that turns out to be right, there may be more loans than usual going into default. If you are considering buying a commercial note that is in default because you ultimately want to foreclose to buy the property…

New York’s CRE woes could spread nationwide: investors

Investors are betting that trouble in New York City’s commercial real estate market will spread nationwide. Prices for debt backed by hotels, restaurants and retail in New York City — among the hardest-hit sectors as the pandemic emptied out tourist destinations this year — have fallen and new loans have slowed…

Here’s what tenants are paying at Shops at Merrick Park

Brian Kingston and Merrick Park Nordstrom and Neiman Marcus may be closing stores across the country amid the pandemic, but at the Shops at Merrick Park in Coral Gables, the retailers appear to be in for the long haul. Brookfield Property REIT owns the roughly 850,000-square-foot property at 358 San Lorenzo Avenue, which consists of a three-story open-air…

Family foundation pays $5M for land in Miami Shores, plans private Jewish school

Jamie Rose Maniscalco and Daniel Ades with the property A family foundation paid $5.3 mil… The Ades Family Foundation, the philanthropic arm of Aventura-based Kawa Capital Management’s managing partner and chief investment officer Daniel Ades, bought the assemblage at 855, 975 and 995 Northwest 95th Street and at 900, 910 and 920 Northwest 96th Street.

Building up: Homebuilder confidence hits new highs

Homebuilders are feeling record levels of optimism, according to a new report. The National Association of Home Builders Housing Market Index reached 85 in October, seasonally adjusted, the highest reading in the monthly metric’s 35-year history. After experiencing a sharp decline in the spring, the NAHB index has been steadily rising — and…

How Does the Pandemic Recession Stack Up against the Great Depression?

Many observers have been comparing the COVID-19-induced recession with the Great Depression. An Economic Synopses essay published in August examined some key economic indicators during these contractions to consider their severity and duration. Group Vice President and Deputy Director of Research David Wheelock explained that the Great Depression…

Aventura office complex Optima inks new leases

Four companies signed leases for a total of 36,000 square feet at Optima, a three-building office complex in Aventura, including the first tenant of the complex’s 28-story tower that is still under construction. Blanca Commercial Real Estate, which brokered the deals, declined to disclose lease terms for space at the complex at 21500 Biscayne Boulevard.

Ransom Everglades sues developer Caroline Weiss over backyard boat dock

A pop-up private marina behind a commercial developer’s home in Coconut Grove is disrupting Ransom Everglades’ aquatic learning experiences, according to a recently filed lawsuit. The private school is suing Caroline Weiss, CEO of the Weiss Group of Companies, in Miami-Dade Circuit Court, in an attempt to stop her from allowing private boats from docking along…

State Of South Florida Commercial Real Estate Discussed

Paul Marko was recently appointed as principal of the South Florida Avison Young team, and he applied his 30 years of experience in office tenant representation, buyer broker services and portfolio administration to answer some questions about the South Florida and national commercial real estate markets.

“There’s a lot of money to be made”: IRS targets foreign real estate investors

The Internal Revenue Service is going after foreign real estate investors as part of a broader sweep to collect revenues amid the pandemic. In the past month, the Internal Revenue Service has announced two new audit campaigns targeting overseas investors who own or hold interests in U.S. property. The campaigns focus on foreign investors selling their interests…

Fontainebleau Miami Beach’s $1B loan exits special servicing

Miami-Dade County’s largest resort is no longer in special servicing. The $975 million commercial mortgage-backed securities loan for Jeffrey Soffer’s Fontainebleau Miami Beach returned to the master servicer on Sept. 23 following successful negotiations with lenders, according to Trepp data updated this week. The loan was transferred to the special servicer…

Unibail-Rodamco sues Express over $30 million in missed rent

Act of God? Mall operator Unibail-Rodamco-Westfield said its lease agreements with Express cover such events, and still require the retailer to pay the rent. Now Unibail is suing Express, saying the retailer owes $30 million in skipped rent across 27 locations throughout the U.S. Fourteen of those stores are in malls in California, according to the suit, filed in Los…

Mast Capital wins initial approval for shorter Mid-Miami Beach condo project

Developer Camilo Miguel Jr. won initial approval for a shorter, 85-foot tall version of his planned 4000 Alton Road condo project in mid-Miami Beach. The Miami Beach City Commission on Wednesday passed on first reading three ordinances that will enable Miguel’s Mast Capital to build an 85-foot tall building with as many as 216 units. The proposal will be heard once…

Miami Beach approves zoning change allowing for Aman tower

Miami Beach commissioners approved a zoning change that would allow billionaire developers Vlad Doronin and Len Blavatnik to build their Aman-branded tower. Commissioners Steven Meiner and Micky Steinberg voted against the Faena district overlay ordinance on second reading, which will allow the developers to build a 250-foot tall tower, up from the previously…

Chart: August Miami-Dade Unemployment Level Reaches Lowest Level Since March

From its peak of 14.5% reached in only the prior month, the unemployment rate in Miami-Dade county plummeted in August (8/1) to 8.1%, the lowest level since March when unemployment had jsut started to creep up but was still in low single digits (3.7%). The continuing effects of COVID-19 on employment, and thus the economy, in the Miami area continue can be seen, to be sure, but this is improvement, considerable. Though there is a new surge in infections, we seem to be figuring out how to navigate all this, thus hopefully any future effect will at least be muted.

Here’s hoping.

Miami Commercial Real Estate Sales to List Price Ratio Trails Off in September to Five Year Low ~ September 2020 MLS

The sales to list price ratio as reported by the Miami MLS for improved commercial property in Miami-Dade County from $1 million to $10 million dipped in September. September’s recorded ratio of 86.3% is the lowest level recorded since February 2015’s 84.9% number. This follows a dip two months prior that, though a slightly better number was itself then the lowest ratio since February 2015.

Though these three months may mean little to nothing, it is reasonable to assume there is a COVID effect on this ratio, with the sales to list prior ratio seeming to now be hanging in the high 80 percent rate versus low 90s prior, thus about 5% lower. Nonetheless, this ratio remains in the middle of where it has been in the past decade, as can be seen in the chart.

Miami Commercial Real Estate News October 14, 2020: Miami Beach Approves Zoning Mod for Aman Tower; County Approves Affordable Housing Projects; More…

Miami Beach approves zoning change allowing for Aman tower

Miami Beach commissioners approved a zoning change that would allow billionaire developers Vlad Doronin and Len Blavatnik to build their Aman-branded tower. Commissioners Steven Meiner and Micky Steinberg voted against the Faena district overlay ordinance on second reading, which will allow the developers to build a 250-foot tall tower, up from the previously…

Miami-Dade approves three affordable housing redevelopment projects for south Dade

Miami-Dade County approved short-term leases that will enable three developers — the Related Group, Centennial Management Corp. and Procida Development Group — to redevelop county-owned affordable housing projects in south Miami-Dade. Approving short-term, 11-month leases, during a commission meeting on Tuesday, was the first step…

Miami Beach raises red flags over county’s monorail push

Miami-Dade County officials may soon take the next step toward developing a “mass-transit solution” in Miami Beach, but city administrators have some concerns. According to a memo to be addressed by Miami Beach commissioners today (10/15), county commissioners will consider on Oct. 20 legislation that would approve a two-step interim agreement with a…

Residents Fight Developer’s Takeover Of Miami Beach Marina, Monty’s Raw Bar

Despite Miami Beach’s reputation for sun, sand and cocktails, there’s hardly any place in the city where visitors can enjoy a waterfront view and a single-digit-priced drink, because most of its 7.69 square miles have been taken over by upscale restaurants and hotels or private, luxury condos. At Monty’s Raw Bar, though, one can still sit under a thatched roof and get a…

How Wynwood Became ‘Absolutely The Coolest Neighborhood In The Country’

Jessica Goldman Srebnick, CEO of Goldman Properties, remembered how her developer father, the late Tony Goldman, led the revitalization of New York’s SoHo in the 1970s, Miami Beach in the 1990s and the Center City District of Philadelphia. “And we came to this little wonderful neighborhood called Wynwood in 2005,” she said during a Bisnow Wynwood webinar…

Federal Realty Defaults On $61 Million Loan Backed By Miami’s Shops At Sunset Place

Federal Realty Investment Trust is in default on a $61M mortgage backed by an outdoor mall in South Miami. The publicly traded real estate investment trust owns The Shops at Sunset Place in a joint venture, which last year announced a major redevelopment plan for the property, which has struggled with vacancies for years. This year, the coronavirus pandemic…

Coral Rock Scores $54 Million Loan for Hialeah Project

Coral Rock Development Group has secured $53.5 million in construction financing for the residential segment of Pura Vida Hialeah, a nine-acre mixed-use project in Hialeah, Fla. Principal Real Estate Investors acted as the lender. The residential development will comprise three eight-story towers offering a total of 260 units, ranging from studio to three-bedroom…

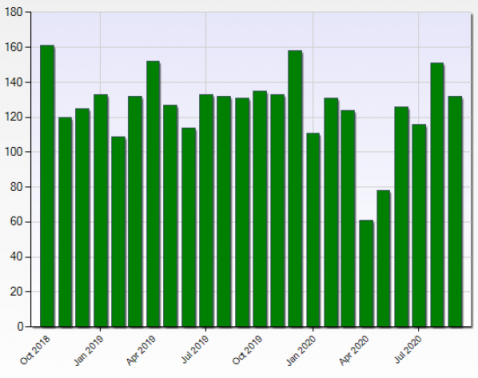

Chart: Another Strong Month for Miami-Dade Commercial Real Estate Sales ~ September 2020 MLS

Embedded above is the chart for the trailing two years, specifically the period from October 2018 to September 2020, of closed sales of Miami-Dade commercial property, both improved commercial property (with buildings) and vacant commercial land, recorded in the Miami MLS. September 2020 was, again, a strong month, only a bit off from sales in August, which had…

The Slow Drip Folly of Holding Highest and Best Use Maxed Out Vacant Land

Save me from the pain of witnessing foregone monetization. A vacant land owner, where the property that has seemingly topped out its HABU (highest and best use) potential, is forgoing potential income from reinvestment of potential sales proceeds (of the vacant land) for no apparent benefit. In other words, if HABU is topped out, there is not a higher value HABU to…

Last Chance for Miami Wilds Water Park?

Next week is the last chance for the current iteration of the Miami-Dade County Commission to vote on the controversial Miami Wilds water park — but the development is receiving more and more opposition from conservationists and politicians. The nonprofit Bat Conservation International recently released the results of a 2019 ecological survey that…

Industrial Development Site In Doral Sells For Record Price

Brokers negotiated the sale of Doral Center Development Land, a pristine parcel in highly sought-after Doral, Florida, located at 10751 Northwest 25th Street. The broker acting as exclusive representative sold the land, which totals 162,325 square feet (3.72 acres), for $6,000,000 or $37 per square foot. The Seller, REMS Group, and its principals are family friends of;;;

We Company reverts name back to WeWork

In a throwback to a more innocent time — before anyone knew Adam Neumann packed a cereal box full of marijuana onto his private jet — the WeCompany is changing its name back to WeWork. The move is an attempt to return the company to its office-sharing roots, according to an internal memo cited by Reuters. “We want to be strategic. We want to be innovative.

Hudson’s Bay, Simon Property Group hit with $846M foreclosure lawsuit

Wilmington Trust is suing a joint venture between Simon Property Group and Hudson’s Bay Company for allegedly failing to make mortgage payments. Ten Saks Fifth Avenue and 24 Lord & Taylor locations are named in the lawsuit, which was filed earlier this month in Miami-Dade County Circuit Court, the South Florida Business Journal reported. The lawsuit…

Deauville Beach Resort loses court battle tied to $400K judgment

The Deauville Beach Resort’s (6701 Collins Ave)management company and a Miami attorney engaged in a “sham” court petition to transfer assets so the firm could avoid paying a six-figure judgment, according to a recent ruling by Miami-Dade Judge Michael Hanzman. Hanzman dismissed a 2018 petition filed by lawyer Felix Caceres seeking an assignment for the…

New South Beach image and rules on drawing board

“Anything goes” might have once been a slogan for South Beach promoters, but Miami Beach commissioners agree that the area known as the Mixed Use Entertainment District needs a new image – and some ground rules. Hawking, lewd behavior, “quality of life” related offenses, misuse of vehicles such as scooters and loud noise are some of the issues they…

Highways nightmare stalls massive NW Miami-Dade American Dream Mall

Delays in the completion of freeway interchanges that will provide access to American Dream Miami, a mammoth entertainment and retail complex to rise in Northwest Miami-Dade, could push back the opening for about a year. “Our development agreement stipulates that the interchanges have to be in place before we can open, so we are tied to that,” said Miguel Diaz…

Quarter-billion dollar cruise industry bailout floated

As the US cruise industry enters its seventh month of inactivity due to Covid-19, Miami-Dade is eyeing a plan that could forgive more than a quarter-billion dollars that cruise lines would otherwise have paid PortMiami. A worst-case scenario in which cruise lines remain docked for two-plus years would see the port lose $271.5 million and be forced to…

Casino Giant Genting’s massive transit deal stalls bus terminal

Plans for a temporary bus terminal that would unlock a 3½-year-old joint development project are still on hold – and could possibly be canceled – as Miami-Dade considers a massive transit offering from Malaysian casino giant Genting. The makeshift station was to have served Metrobus riders while Genting subsidiary Resorts World Miami developed a new Omni…

Miami speeds to resolve Virginia Key Marina bid battle

With new players in the mix, the Miami City Commission has called for a special meeting next month to discuss the future of Virginia Key Marina. At last week’s virtual meeting, commissioners voted to hold a special meeting Nov. 16 to discuss, and potentially act on, the marina’s ongoing solicitation dispute. The city administration asked for the commission to defer the…

Downtown Miami observation wheel prepares to roll

While plans were originally to have its grand opening back in March, downtown Miami’s observation wheel will soon be up and running for Bayside Marketplace visitors, operators say. Towering 176 feet over downtown’s skyline, the new observation wheel might open at the end of this month, said Charlene Leavitt of Skyviews Miami, the tourist attraction…

Midtown Miami development site in foreclosure hits the market

3601 North Miami Avenue with Francisco Arocha The developer of the planned Triptych project that straddles the border between Midtown Miami and the Design District is listing the site for sale. HES Group, which is facing foreclosure from its lender, is looking to sell or find a joint venture partner for the 1-acre property at 3601 North Miami Avenue, said Francisco…

Here are the South Florida real estate players who donated to candidates in 2020

As the presidential election nears, The Real Deal examined top South Florida real estate players’ political donations this year, and found they largely skewed in one direction. A number of developers supported Republican candidates and causes, including Craig Robins, Stuart Miller and Russell Galbut. Related Group developer Jorge Pérez and real…

Spirit Halloween reawakens to cannibalize stores

Autumn is a time for falling leaves, pumpkin pie and Spirit Halloween reappearing to take up unoccupied space in strip malls and commercial corridors. This year, even as trick-or-treating becomes an unknown, there are more Spirit Halloween locations to go around. The company has opened more than 1,400 storefronts nationwide, an increase from last year,

Investors heat up cold storage market

Investors are increasingly turning to the cold storage sector, which showed surprising resilience through the first few months of the pandemic. Lineage Logistics, the world’s largest landlord of temperature-controlled storage, pulled in $1.6 billion in a fundraising round that ended last month, according to the Wall Street Journal. Americold Realty Trust, the only…

Dollar General launches new brand targeting affluent customers

Dollar General is launching a new brand aimed at higher-income earners — and keeping the focus away from the “dollar” in its name. The new brand, Popshelf, will still sell inexpensive products in its stores, with most items priced at $5 or less, the Wall Street Journal reported. But the stores will carry fewer Dollar General staples (like food) and more nonconsumable…

Fewer than half of holiday shoppers will hit the mall this year

In a typical year, the holidays are peak season for malls — but this isn’t a typical year, and shopping centers that have already been hurt by the pandemic will continue to feel the economic crunch in the leadup to the holiday shopping season. Only 45 percent of shoppers plan to visit a mall to do some or all of their holiday shopping, down from 64 percent last year…

Target-anchored mixed-use project planned for North Beach advances

Aria Mehrabi and renderings of the projects Part of Aria Mehrabi’s planned development for North Beach got the OK to move onto permitting this week. And Miami Beach officials will review more of his plans in November. The Miami Beach Design Review Board on Tuesday gave the green light to the planned 12-story tower with 170 residential units anchored by a 25,000…

Now Microsoft is joining work from home forever club

Microsoft is joining the ranks of Facebook, Twitter, Zillow and other companies that have developed permanent work from home options for their employees. The tech giant unveiled “hybrid workplace” guidance that permits employees to work from home for less than 50 percent of their working week, or receive manager approval for permanent remote…

Southland Mall’s troubled $65M CMBS loan for sale

A $65 million CMBS loan on Southland Mall in Cutler Bay is being shopped, after its former owner defaulted on it earlier this year. JLL is marketing the loan, which is tied to the 990,000-square-foot indoor mall at 20505 South Dixie Highway. The mall’s former owner, Investcorp, defaulted in April and handed the keys over to its CMBS lenders this summer. The mall is…

How the COVID-19 Economy Impacts Property Improvements & Customized Offices

The changing tenant-improvement landscape due to COVID-19 Before the COVID-19 pandemic, it was common for tenants in “Class A” buildings to ask for significant improvements to office space as a part of their real estate lease. In essence, this practice allows companies to obtain a highly-customized office as part of their agreement. The owners of…

Retail rent collection has nearly returned to pre-pandemic levels

While national chains still face financial woes, there are some signs of recovery within the retail sector — particularly in categories such as gyms and clothing stores. National retailers paid 86 percent of their September rent, according to the latest Datex Property Solutions report. That’s about 10 percent below what they paid in 2019, but slightly…

Blackstone to open office in South Florida

The Blackstone Group is planning to open an office in South Florida, as the region’s economic boosters work to attract financial and investment firms. The New York-based private equity giant plans to hire about 215 employees, most of whom will be back-office technology workers, according to Bloomberg. The news comes as the Miami-Dade County Commission…

Integra scores approval for waterfront workforce housing project in Florida Keys

Victor Ballestas and Wrecker’s Cay Integra Investments is moving forward with its plans to build Wrecker’s Cay Apartments, the largest workforce housing project to be built in the Florida Keys in more than 50 years. Miami-based Integra, led by developer Victor Ballestas, recently secured approval from Monroe County for the 280-unit development on Stock…

Doral DoubleTree owner sues architect for $4M, alleging design errors

The DoubleTree at 10250 Northwest 19th Street and Larry Beame (Credit: Google Maps) The owner of the 150-room DoubleTree in Doral sued the architect of the hotel, alleging design defects that cost millions of dollars in fixes and delays. Hospitality Doral LLC, which owns the six-story hotel at 10250 Northwest 19th Street in Doral, sued Beame Architectural…

Crust to Expand With Takeaway Concept

Klime and Anita Kovaceski are expanding into the carry-out business. The husband-wife team behind Crust will open a new takeout concept and market they’ve dubbed Crust2go. “We always had the idea for carry-out as a bigger component to Crust in the backburner,” Kovaceski tells New Times. “But COVID-19 has changed the way people eat and do things to the point…

Hollywood Publix with boat dock advances

Hollywood is another step closer to landing a rare Publix grocery store with a boat dock. The Hollywood Planning & Development Board approved plans and modifications for a 30,000-square-foot supermarket at 3100 South Ocean Drive during the board’s meeting Tuesday. The store still needs approval from the city commission. It would be the second Publix with…

Fort Lauderdale developers score $92M bridge loan for rental tower

4 West Las Olas Fort Lauderdale developers Scott Bodenweber and Tom Vogel scored $92 million in bridge financing for a newly completed apartment tower in downtown Fort Lauderdale. Benefit Street Partners Realty Trust, a New York-based mortgage real estate investment trust, provided senior debt of $76 million, while West Palm Beach-based…

Chart: Another Strong Month for Miami-Dade Commercial Real Estate Sales ~ September 2020 MLS

Embedded above is the chart for the trailing two years, specifically the period from October 2018 to September 2020, of closed sales of Miami-Dade commercial property, both improved commercial property (with buildings) and vacant commercial land, recorded in the Miami MLS. September 2020 was, again, a strong month, only a bit off from sales in August, which had one of the strongest months in the prior two years. As has been noted previously, overall commercial sales do not appear to be severely affected, though it is likely that you would see variance by commercial property type if you dug deeper. Of course, the Miami Multiple Listing Service (MLS) does not record all commercial real estate sales, and thus cannot be said to be fully representative of the asset class. Nonetheless, given that it is representative of commercial property sales recorded in MLS before versus now, it should be fairly reliable as a tool, though imperfect, to compare periods.

Miami Commercial Real Estate News October 7, 2020: Regal Cinemas Suspends Operations; Kendall Office Buildings Trade; More…

DHL signs 201,399 SF long-term renewal at Prologis Miami Commerce Center

Transwestern Real Estate Services (TRS) announces its South Florida industrial team has secured a long-term lease renewal for DHL Global Forwarding, which occupies the 201,399-square-foot Prologis Miami Commerce Center at 1801 NW 82nd Ave. Transwestern Managing Director Thomas Kresse negotiated the transaction on behalf of owner Prologis.

Doral DoubleTree owner sues architect for $4M, alleging design errors

The owner of the 150-room DoubleTree in Doral sued the architect of the hotel, alleging design defects that cost millions of dollars in fixes and delays. Hospitality Doral LLC, which owns the six-story hotel at 10250 Northwest 19th Street in Doral, sued Beame Architectural Partnership last week in Miami-Dade Circuit Court for $3.7 million. Though the hotel opened in///

Miami-Dade approves three affordable housing redevelopment projects for south Dade

Miami-Dade County approved short-term leases that will enable three developers — the Related Group, Centennial Management Corp. and Procida Development Group — to redevelop county-owned affordable housing projects in south Miami-Dade. Approving short-term, 11-month leases, during a commission meeting on Tuesday, was the first step of…

JV looks to buy up to $175M in distressed resi loans, with focus on NY, Miami

As an increasing number of borrowers skip their mortgage payments, opportunistic investors have been on the lookout for distressed loans sold off at discount prices. A new venture intends to acquire up to $175 million in delinquent loans on properties across the country, particularly in New York City and Miami. The funding will start with a commitment of $25…

Ruby Tuesday will close 185 restaurants

Yet another chain is seeking bankruptcy protection after the pandemic decimated its business. The restaurant chain Ruby Tuesday filed for chapter 11 bankruptcy Wednesday, introducing with it plans to close 185 locations, USA Today reports. The filing will leave the franchise with 236 operating restaurants. The company hopes to stay in business, saying in a…

Jungle Island hotel squeezes past a city board

The plan to construct a hotel in Jungle Island park on Watson Island moved forward last week after it met criticism from some members of Miami’s Urban Development Review Board. It took three tries to get a motion passed recommending approval, including several recommended changes. Jungle Island is operated by a private company at 1111 Parrot Jungle Trail, on…

As economy returns, Miami-Dade commissioners might stay away from county hall

Returning to County Hall won’t be simple for the Miami-Dade commissioners, as safety, capacity and cost obstacles could prolong virtual meetings even as the local economy reopens. “Our biggest challenge is [the] amount of space for elected officials at the dais,” Internal Service Director Tara Smith said during a special meeting on Covid-19 last week. “We can…”

Movie theaters welcome back public with private rentals

By creating safe environments for patrons, local movie theaters are slowly reopening and welcoming back the public with private screenings and facility rentals. An option that has always been offered, theater rentals are becoming the new way to enjoy the big-screen experience in a comfortable atmosphere among close friends and family members. “Since closing…”

Lester Sola: Pilots county’s airports toward $5 billion capital investment

When Lester Sola began working for Miami-Dade 28 years ago, his first post was in the county Aviation Department. Twenty-eight years and a variety of other county jobs later, he leads the department, overseeing the operations and growth of four general aviation airports and Miami International Airport (MIA), the county’s top economic engine, which together generate…

Pablo Cejas adds to downtown Coral Gables assemblage

Pablo Cejas, Bill Kerdyk, and 147 Alhambra Circle Coral Gables property owner and broker Bill Kerdyk Jr. sold a downtown office building on Alhambra Circle for $5.3 million. Kerdyk’s Alhambra Circle Investments LLC sold the 12,000-square-foot office building at 147 Alhambra Circle in Coral Gables to Pablo Cejas of Aquarius Capital, property records show.

Pinnacle scores $31M for south Miami-Dade senior affordable housing development

Pinnacle secured $30.8 million of financing to build an affordable housing development for seniors in south Miami-Dade County. Citibank provided $22.1 million through the purchase of 9 percent tax credits and also lent Pinnacle $4.3 million for the 112-unit rental project, Cannery Row at Redlands Crossing. Miami-Dade County also contributed a $3.5 million…

Hotels pivot to office space to stanch losses

Hotels across the country are pivoting to become offices as a way to survive the pandemic. In New York, the 607-room InterContinental Times Square was transformed into housing for doctors and nurses treating coronavirus patients in the spring. Then it started to offer rooms as offices. And now the hotel will offer office space on a suite-by-suite basis, according to the…

Airbnb slams door on Halloween-night rentals

Airbnb banned one-night rentals over the upcoming Halloween weekend in an effort to prevent parties — and thus, possible outbreaks of the coronavirus. The home-sharing company announced that it will bar one-night rentals on Oct. 30 and 31 to “protect our hosts and the communities they live in,” according to Business Insider. In order to rent a place over…

Tony Robbins buys West Palm Beach warehouse for production studio

A company tied to motivational speaker and author Tony Robbins bought a West Palm Beach warehouse with plans to build a production studio, The Real Deal has learned. The buyer, Ohio Resources LLC, tied to Anthony Robbins Companies, paid $4.4 million for the 28,000-square-foot warehouse at 2951 Electronics Way, according to a press release. A deed for the sale…

Fifth Wall targets $118M raise for European proptech fund

Fifth Wall, the venture capital firm that’s backed Opendoor, States Title and Industrious, is looking overseas for its next hit. The Los Angeles-based firm is currently raising a $118 million European fund to invest in proptech startups. Although the fund is not yet closed, investors so far include the real estate arm of BNP Paribas, the French bank; Pontos, a Finnish…

Menin plans major expansion of Bodega Taqueria

Jared Galbut, Bodega Taqueria Menin Hospitality is growing its Bodega brand. The company, led by Jared Galbut and Keith Menin, is planning to open Bodega Taquerias throughout the state and in South Florida, including a new location in North Beach and another at a new project under construction in downtown Miami, Galbut said. Overall, Menin’s goal is…

Black-owned firms to launch first affordable-housing REIT

Two of the largest minority-owned real estate investment firms in the country are teaming up to launch what they say is the first public real estate company dedicated to affordable housing. California-based investor Avanath Capital Management and San Francisco’s MacFarlane Partners filed paperwork with the U.S. Securities and Exchange Commission to…

Lights out: Regal Cinemas to suspend operations

Cineworld, the owner of the Regal Cinemas movie theater chain, will suspend operations at its locations across the United States, the Wall Street Journal reported. The announcement to temporarily close 500 theaters came after a wave of postponements of big-budget Hollywood movies, including the new James Bond film “No Time to Die.” “We are like a…”

Construction honcho pays $17M for Kendall office buildings

The head of a South Florida construction firm paid $16.8 million for a pair of adjacent office buildings in Miami’s Kendall neighborhood. Companies managed by Dan Azel of Andale Group bought the buildings at 8900 Southwest 107th Avenue and 10700 Southwest 88th Street, records show. The second building’s address is also noted as 10700 North Kendall Drive.

Most unemployment measures are declining… : …while long-term unemployment is still rising

Many of us follow the unemployment rate closely, even more so since the pandemic began. But there are many definitions of unemployment, which depend on how people are attached to the labor force. To learn more, see this earlier blog post and this conversational account of unemployment measures. Today’s FRED graph shows the recent evolution of 6 measures…

$2.2T House stimulus package would ban evictions for 12 months

Many renters in the U.S. are protected from evictions through the end of the year, and a stimulus package that passed in the house could extend those protections further. The U.S. House of Representatives approved a $2.2 trillion coronavirus relief package last week that includes a full-year ban on eviction foreclosure filings over nonpayment, according to Bloomberg…

Lincoln Road landlord seeks $32M following court victory over Walgreens

Richard Chera of Crown Acquisitions, 947 Lincoln Road rendering A company tied to New York City real estate mogul Richard Chera is looking to collect nearly $32 million from Walgreens after the pharmacy chain lost a civil lawsuit over a Lincoln Road store that never opened. On Sept. 22, Miami-Dade Circuit Judge William Thomas granted summary judgment…

CBD investor sells Hialeah Gardens development site for $5M

The head of a truck parts company acquired a development site at Shoma Commercial Park in Hialeah Gardens. Tundidor & Partners 13391 LLC, led by James Tundidor, sold the 3.7-acre site at 13391 West Okeechobee Road to Jaime Villamizar of Miami Star Truck Parts for $5.1 million. It comes with approved plans for a 39,500-square-foot building with a 25 bay retail…

Coral Rock lands construction loan on Hialeah project

Michael Wohl and a rendering of the project Coral Rock Development Group has snagged a $53.5 million construction loan for the 260-unit residential portion of its mixed-use project in Hialeah. Principal Real Estate Investors provided the debt, according to a release. The project, dubbed Pura Vida Hialeah, will consist of three eight-story buildings and about…

Leisure and hospitality gain 318K jobs in September as economic growth lags

The leisure and hospitality industry led employment gains in September with 318,000 jobs added to the economy, trouncing the industry’s August performance of 174,000 jobs. Food and beverage establishments accounted for more than half the industry’s growth last month, with 200,000 jobs returning last month. The U.S. economy added…

Housing demand sent construction spending up in August

Spending on construction, particularly in the housing sector, plowed ahead in August. Money flowing into construction projects ticked up to $1.4 trillion seasonally adjusted last month, a year-over-year increase of 2.5 percent, according to the Census Bureau’s monthly report on construction work done on new and existing structures across public and private sectors.

Designer-crafted floral-centric murals are headed to Miracle Mile

Contracts and planning details are being finalized for the installation of four art murals along Miracle Mile in Coral Gables. The fall economic development programming, which is aiming to debut mid-to-late November, is promised to bring a whole new pedestrian experience for visitors and residents. The city’s Economic Development Department is…

Here’s why President Trump loves depreciation

A day after the New York Times reported Donald Trump paid just $750 in federal income tax in 2016 and $750 again the following year, the president took to his favorite medium to deny the claims. “I paid many millions of dollars in taxes, but was entitled, like everyone else, to depreciation & tax credits,” Trump said on Twitter in response…

Fisher Island developer scores approval for residential projects on exclusive island

Heinrich Von Hanau Fisher Island developer Heinrich Von Hanau received approvals for two residential projects on the exclusive island. Miami-Dade County officials recently approved zoning changes to allow for a 57-unit, 10-story condominium building at 6 Fisher Island Drive and 12 single-family homes at 68 Fisher Island Drive. The new projects would bring the total…

PPP loan forgiveness to begin within the coming week: SBA

More than 96,000 requests for Paycheck Protection Program loan forgiveness have been submitted to the Small Business Administration since early August, but none were approved — but that’s about to change. The Treasury Department said that PPP requests will start to be approved and paid late this week or early next, the Wall Street Journal reported.

RedSky, JZ sell Wynwood assemblage at discount for $26M

A partnership between RedSky Capital and JZ Capital Partners sold an assemblage of land in Miami’s Wynwood neighborhood for $26 million, less than the price they paid four years ago. RedSky, a Brooklyn-based real estate company, and Manhattan-based investment firm JZ sold the development site to SV 2700 Owner LLC. The LLC shares an address…

Florida allows eviction moratorium to expire

Florida Gov. Ron DeSantis will allow the state’s ban on residential foreclosures and evictions to expire Oct. 1. DeSantis announced the ban, which only applied to the final action of foreclosures and evictions, would not be renewed, citing the Centers for Disease Control’s mandated federal eviction ban. The CDC’s order is in effect through the end of December…

JPMorgan wants to invest $700M building rentals in Sun Belt states

Wall Street landlords aren’t going anywhere — except maybe down South. The asset management arm of JPMorgan Chase wants to raise a $700 million fund focused on developing single-family and multifamily rental properties in Sun Belt cities, Bloomberg reported, citing an investor presentation. “Read Developers bet big on build-for-rent in these…”

Principal Real Estate Investors has provided a $53.5 million construction loan for the residential portion of Pura Vida Hialeah. The borrower, Coral Rock Development Group, is developing the property, which also features 40,000 square feet of adjacent retail space. The apartment community, dubbed The Residences at Pura Vida, will feature 260 units spanning…

Miami Beach Trying To Shed Hard-Partying Reputation, But Businesses Are Pushing Back

Miami Beach is a paradox. Before the coronavirus, it had seen a record number of tourists and booming prices for real estate. But it has also been suffering from a reputation for rowdy behavior — stoked by viral videos of a woman twerking on a cop’s ATV, a “stripper cat fight” and a brawl outside a club, with shots fired — that politicians say is concentrated around the…

Holding Highest and Best Use Maximized Vacant Land; Worth Forgoing Income?

A vacant land owner, where the property that has seemingly topped out its HABU (highest and best use) potential, is forgoing potential income from reinvestment of potential sales proceeds (of the vacant land) for no apparent benefit. In other words, if HABU is topped out, there is not a higher value HABU to come, thus there is no HABU upgrade benefit potential. In surely any reasonable modeling scenario that forgone income would accrue to more than the value of the land in around 15 years. Also, as time passes, there is always the risk that something will change in the market or specific to the location to cause prospective buyers of the property with its current HABU to evaporate, with the value being less to buyers for the next in line highest and best use.

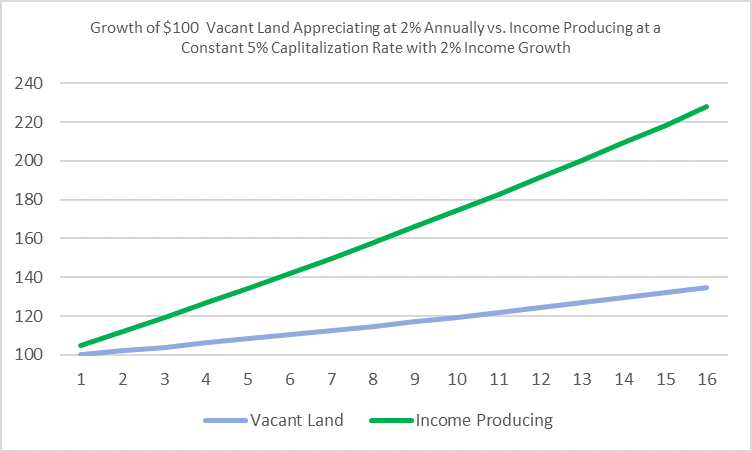

In the above chart two straightforward scenarios are illustrated:

Blue line – The blue line, shows the climbing of value vacant land with net operating income of $0, which is better than reality as in most cases vacant properties have net operating losses principally due to property taxes. As for the value accretion, here we are assuming the potential net operating income grows by 2% annually, and the the value moves in line with this potential income as would be expected over time and with other factors, cap rates a notable one, being constant.

Green line – This shows the same starting point, but here for developed property earning income at an initial cap rate of 5%, with net operating income growing by (the same as above) 2% annually, and with the cap rate remaining constant.

Which line would you prefer?

Alas, it may not be exactly as simple as that. Developed property over time may become obsolete, such that the value is only that of the land underneath it, or rent growth may become compromised such that the cap rate moves for the property. Regardless, given that with developed property you are earning and accumulating net operating income over time, such an owner will get so far ahead over time that there would in all probability be no contest between the two outcomes. Taxes also are not considered here. In any case, though one should speak with his or her accountant for guidance, under current tax law and assuming one took advantage of IRS Section 1031 to defer gains, I think most advisers would say the outcomes remain similarly disparate, as depreciation on improved property would largely offset taxable income on developed property.

You might ask; given this, why is there any undeveloped property?

I ask myself this all the time.

The truth is, the obvious HABU topped undeveloped properties are few and far between. Generally, these properties have been pursued, and owners have rationally arrived at a conclusion similar to the above. The math to get there may be somewhat different in path or assumptions, but it is so compelling few owners will resist in perpetuity. But there are exceptions. owners And, owners of properties for which HABU upgrades have increased values bask in their brilliance and thus are hard to reach with boring old “yeah but there’s no more” argument. This is reminiscent of an old Wall Street adage attributed to Humphrey Neill, the founder of the Contrary Opinion Forum; “Don’t confuse brains with a bull market.”

If you have a vacant piece of land with a market value of $3 million, you likely have a piece of land that could be monetized (rented) a bit more or less than $125,000 a year in this market, assuming it is land of interest to top quality credit tenants. The reason your land has the value it does is because of this potential income. Thus, by keeping the land vacant, an owner is only forgoing income that the property’s value could be garnering, income one could be earning if the property was sold and the proceeds were used to then purchase income generating property. Stated differently, there is opportunity cost – the loss of potential gain from other alternatives when one alternative is chosen – to holding on to undeveloped property.

This adds up over time. Bigly. These stories likely live in family legends, but only in their best PR form. There surely are countless family legends that ring like “your brilliant grandfather multiplied his money ten times on a piece of land” that should instead be “your grandfather multiplied his money 9 times in a ten year period on a piece of land, then stubbornly held on for the next twenty years as the property increased in value a mere 2% per year thereafter.

Granted, this isn’t the whole story. Sometimes there is the potential for a rapid change in the potential use of a property, particularly if a property is near a central business district. I would note, however, I’m not referring to properties like that. Also, vacant land doesn’t have zero income, it usually has either a net carrying cost, principally property taxes, or a small net operating income from pylon signage or other partial monetization. Also, in this chart above, I’ve not taken into account earnings from reinvestment of net operating income, which would make vacant land look even less appealing to hold.

Returning to Wall Street thinking as with the quoted adage above, an efficient market proponent would say that the above disparity, as significant as it is, is impossible. That person would be right, but wrong. The above underperformance of vacant land is not due to disparity of returns, but instead is due to the active choice of an owner ~ no decision is a decision. These owners are the equivalent of investors accepting less income, not less income with less risk, just less income.

Miami Commercial Real Estate News September 30, 2020: USAF Offers Miami-Dade New Airport Site; ShareMD Buys Medical Campus; Hialeah MF Sells; More…

Air Force offers county new airport site at Homestead

Miami-Dade is working on multiple deals to build out its general aviation airports and is “closer than ever” to an agreement for a new one at Homestead Air Reserve Base, Aviation Director Lester Sola said. Commissioners Oct. 6 are to decide whether to direct Mayor Carlos Giménez to “expeditiously” pursue a contract with the Air Force so that the county…

Miami Heat minority owner pays $20 million for Sweetwater Best Buy

As the Miami Heat eye a potential NBA championship, one of the team’s original partners has reason to celebrate early. Raanan Katz’s real estate company RK Centers paid $20.4 million for a 4.2-acre property leased to Best Buy at 10760 Northwest 17th Street in Sweetwater, near Dolphin Mall and Miami International Mall. The 46,000-square-foot building is home to…

On Eve Of NBA Finals, Miami Heat Player Scores Development Win

This week, Miami Heat forward Udonis Haslem will be trying to rack up victories against the Los Angeles Lakers in the NBA Finals. Last week, he scored a different sort of win: His company is moving forward with a $36M housing development. Haslem Housing Venture LLC… at 2035 North Miami Avenue. The proposal listed partners Haslem Housing Ventures and…

CTO Realty Growth Acquires Shopping Center in Metro Miami for $21 Million

CTO Realty Growth has acquired Westland Gateway, a 108,000-square-foot shopping center in Hialeah, for $21 million. Aldi, dd’s Discount, Ross Dress for Less and Bed Bath & Beyond occupy the property. Westland Gateway is located at 1460 W. 49th Street, 15 miles northwest of downtown Miami. Daytona Beach, Fla.-based CTO Realty purchased the asset through a 1031…